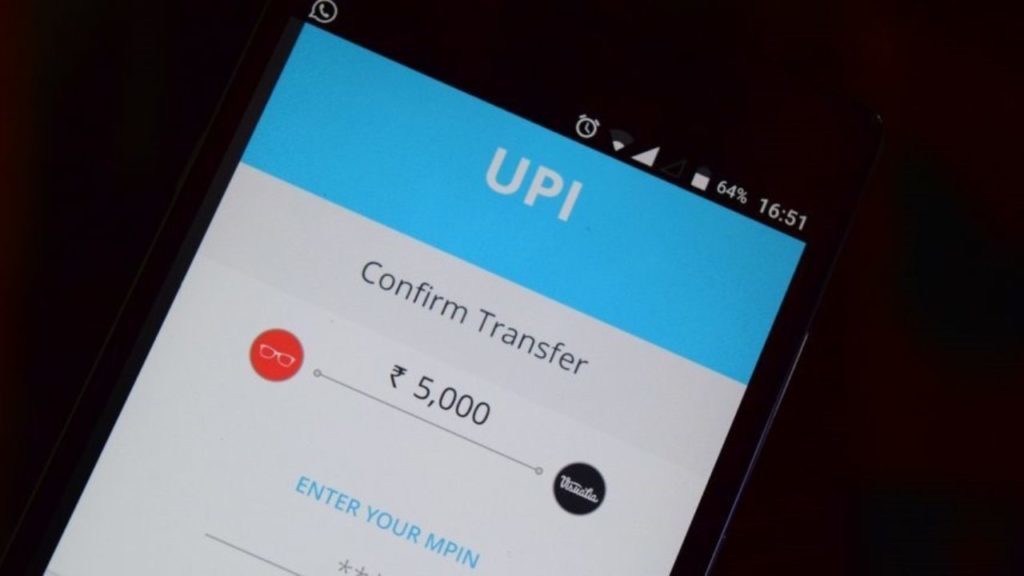

This Govt Bank Has Highest UPI Failure Rate Of 12%; 3% Of All UPI Transactions Fail In India

Online payments, especially UPI transactions, have noted a drastic increase in the past few months, as people refrain from exchanging notes due to the possible spread of COVID-19 disease.

But this has also resulted in a spike in the failure rate of the UPI transactions, as revealed to us by data from the National Payments Corporation of India (NPCI).

Read on to find out which bank has the highest UPI failure rate right here.

More Than 3% Failure Rates In UPI Transactions; These Banks Record Highest Technical Failure

The data by the NPCI also shows that in the month of September, the UPI platform has noted more than 3% failure rates from 10 of the top 30 banks.

Of the above 10 banks, 9 are owned by the state.

The bank to record the highest failure rate is the United Bank of India, with a technical decline at 12.4%, followed by Canara Bank at 5.9% and the State Bank of India at 5.3%, all in the month of September.

In July, the technical decline rates for most of the top thirty banks was less than 1%, as confirmed by the data by NPCI.

Outdated Digital Infrastructure To Be Blamed For Transaction Failures

The sudden spike in the increase of transaction failures and the piling of credit reversal has alarmed several banks, and the blame is pointed to outdated digital infrastructure, leading to the inability to deal with the spike in the volume of payment.

A senior banker said, “Every UPI transaction hits the banks’ core banking system (CBS). The tricky part is that in the UPI architecture, every transaction is clocked twice, once by remitting banks and then by receiving banks. This can lead to a pile-up of credit reversal failures especially as nobody anticipated UPI volumes to double in such a short span.”

He also said that every UPI transaction ever conducted impacts the banks’ core banking system (CBS).

As we all know, the digital transactions had breached the 1 billion mark way back in June with UPI recording as much as 1.8 billion transactions in September, which were worth Rs 3.6 lakh crore.

Comments are closed, but trackbacks and pingbacks are open.