Paytm Beats Google Pay, PhonePe In UPI Transactions; BHIM App Is Out Of The Race Now

Cashless India is no longer a distant dream!

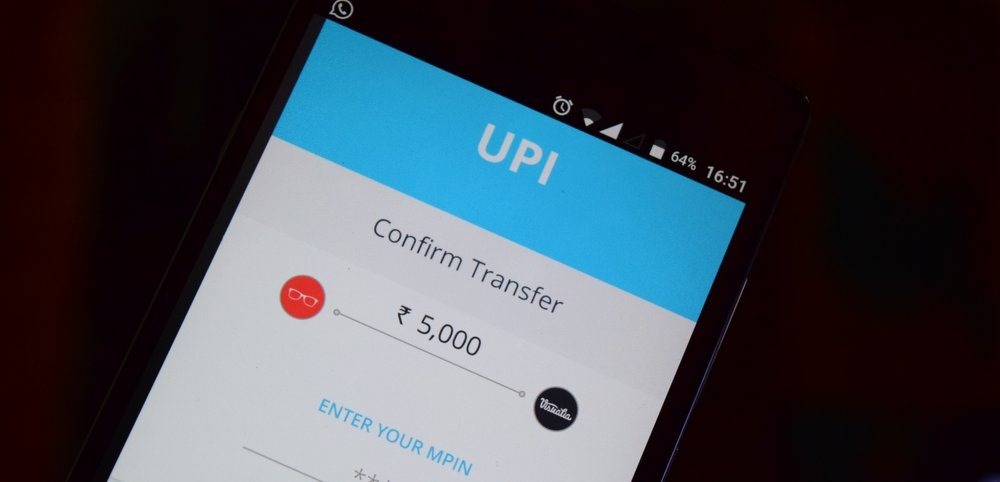

UPI, Unified Payments Interface is what is causing all the rage now in the banking world. In a surprisingly short while, UPI has managed to top the charts and seems quite future-proof. And the most used platform for UPI payments is Paytm, followed by Google Pay and PhonePe.

UPI also recorded a huge record of Rs. 75000 Crore transactions and Paytm has previously topped the list of UPI payment platforms and still manages to be #1. The competition is fierce and all three platforms are neck and neck and fighting for the position.

2 million UPI Payments For Cab Rides!

In January, Paytm’s numbers were more than 221 million transactions whereas PhonePe and Google Pay were at about 220 million transactions. Additionally, PhonePe crossed 225 million transactions, but not specifically to UPI, but on all payment modes. They announced a total transaction amount if Rs. 30000 Crore in January.

In November 2018, Paytm reached the 100 crore mark for the first time ever.

In total, UPI has clocked around 670 million transactions in December which went up to 672 million transactions in January. Also, P2P (peer to peer) transactions have seen a boost and continue to be scale heights. A senior banker revealed in secrecy that the total number of merchant transactions has not crossed 100-120 million per month.

He said, “However, merchant payments are growing as non-bank entities are pushing those transactions. Even the number of UPI payments for cab rides is recording almost 2 million per month, growing at a considerable pace.”

The Downfall of BHIM?

BHIM, the app promoted by the Government of India, is slowly winding down, with lesser numbers than the past few months. As per NPCI, National Payments Corporation of India, the transactions occurring on BHIM were 14 million, which was around 18 million in December 2018.

The average amount per transaction on BHIM is about Rs. 4436 only and not much has changed in this amount for the last three months.

But, even though the numbers have gone down, there are reports that show that the funds settled through BHIM is the highest in all the UPI platforms. This proves that BHIM is being used by people by choice and not because of the enticing offers the app grants.

Jio money, too, will soon compete as Reliance Jio has announced that UPI will be incorporated in the newly launched Jio Money app.

Will India become cashless soon? Share your opinions with us in the comments section!

Comments are closed, but trackbacks and pingbacks are open.