Now Link PAN With Aadhaar With A Simple SMS; But Does It Work?

Income Tax Department has now made the linking of your PAN Card with Aadhaar even more simpler. Now, all it takes is just an SMS to link it.

Here is how you can do it right away:

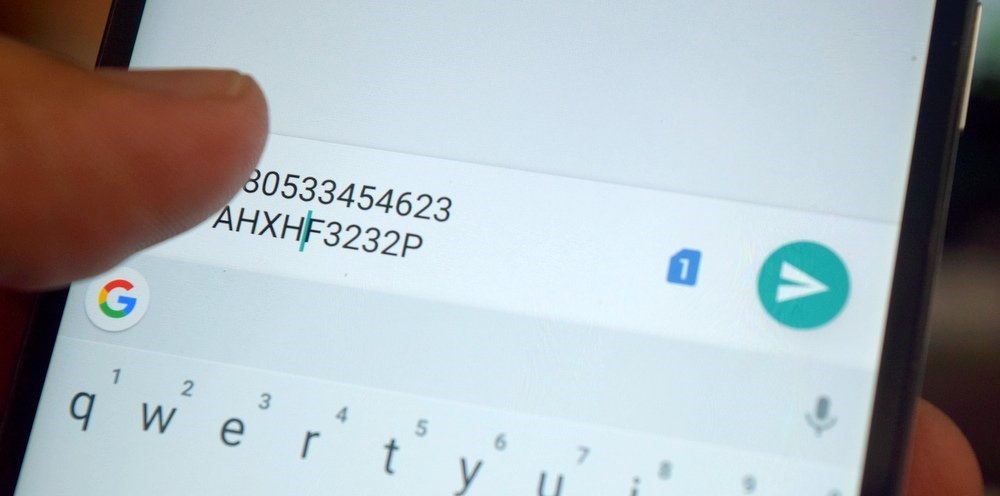

Step 1: Send an SMS to either 567678 or 56161 from your registered mobile number

Step 2: Mention your PAN and Aadhaar number in that message

And, you are done.

This is the easiest, and simplest method devised by the IT Dept. to link your PAN with Aadhaar till date.

They have advertised this message based method across all leading newspapers and magazines as well.

But.. Where Is The Format?

Ironically, in the advertisements, and in the related news covered by mainstream media, IT Dept. has not mentioned any particular format to send that SMS to 567678 or 56161.

In the absence of any format, how will the system work, and attach the relevant numbers to the relevant fields? Should Aadhaar number be mentioned first or the PAN Card number?

Should the name be mentioned?

What if I use any other number?

As the time of writing, we didn’t have any answers to these questions.

Alternate Methods To Link Aadhaar With PAN Card

- Early this month, IT Dept. had launched a dedicated portal to link Aadhaar with PAN Card, wherein only three boxes were provided to update: PAN Number, Aadhaar and Name.

- After some issues arose, wherein the name on the Aadhaar and PAN were not matching, and linking was getting rejected due to this reason. In order to overcome this problem, IT Dept. released an OTP based method. An official said, “In case the taxpayer is unable to link PAN with Aadhaar because of discrepancy in name, we are advising them to log into the Aadhaar website, request for a name change and upload a scanned copy of PAN card as supported proof. This is the simplest way to update name in Aadhaar and only the registered mobile number has to be functional,”

In case you wish to update your mobile number on the Aadhaar card, then you will be required to visit https://ssup.uidai.gov.in/web/guest/update, and subsequently update the new mobile number, which would be authenticated using OTP.

However, the question whether Aadhaar-PAN linking is still relevant or not is still an issue. A journalist had written a blog, wherein she claimed that bank officials are denying this news that linking Aadhaar-PAN linkage is compulsory by law.

We will keep you updated.

You can also check out our video in this regards (in Hindi) that explains the whole process. Do make sure you subscribe to our channel for more such videos.