What is Triggering the Wave of Mergers & Acquisitions in the Indian Internet Space?

The Indian Internet story in India which is just over a decade old has unfolded itself beyond anyone’s imagination. It kick started in 2004 with eBay starting its operations in India by acquiring Baazee.com (India’s largest online auction portal). It was given further impetus by Flipkart and Snapdeal in 2007. And, soon the Indian Internet space was inundated with startups in niches like travel and hotel bookings, food and grocery delivery, furniture and home decor, mobile and tech accessories, jewellery, car rental, analytics, etc.

Since then, in a period of 10-12 years, India has established itself as the most promising Internet market in the world. It has attracted global venture capital from all parts of the world including the Silicon Valley, China and South Africa. India’s ecommerce sales are expected to reach US $120 billion by 2020 from US $30 billion in 2016, and its ecommerce market is expected to reach US$ 220 billion in terms of gross merchandise value (GMV) and 530 million shoppers by 2025.

With such positive forecasts, entrepreneurs and investors would be thinking of huge initial public offerings and a profitable exit. Yet, that is not the case.

Contents [hide]

Investor confidence is at an all-time low

2015 and 2016 have been watershed years for the Internet companies in India. In the past one year, these companies have put up a very dismal performance – multi-billion dollar losses and laying off of thousands of employees. And, nothing to show for it.

A crisis of confidence is bubbling in the market. Four years ago, we saw investors rushing into internet companies, and we now see the same people pulling back. The steady downpour of funds into startups has turned into a small trickle.

According to a report by PWC, unlike 2015, this year VC investment has been hesitant. The first quarter of 2016 saw us $152 million in 83 early stage deals as compared to USD $303 million in 101 deals in the first quarter of 2015. In the fourth quarter of 2015, it was USD $ 284 million in 100 deals.

The wave of consolidation has begun

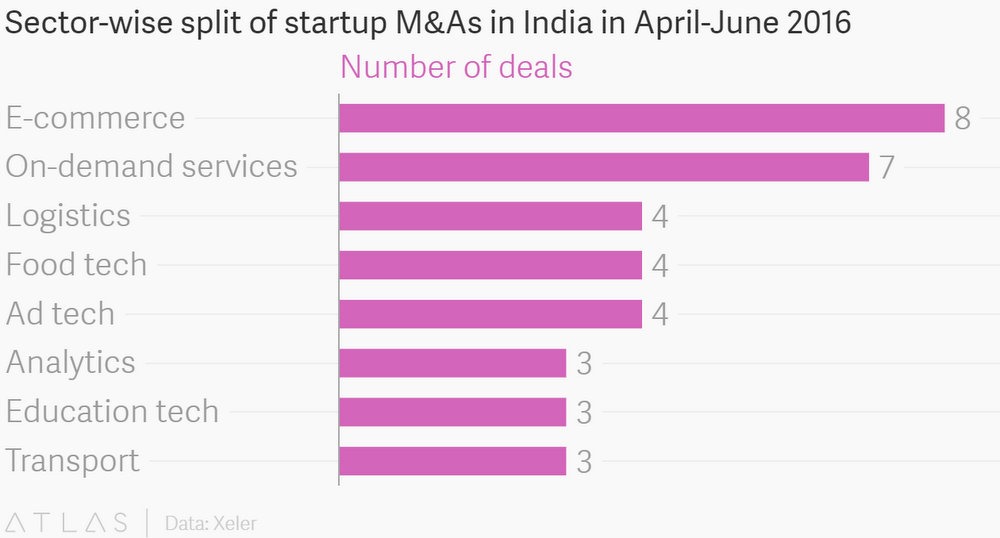

In the last couple of years, India has witnessed a series of mergers and acquisitions in the internet space. Jabong was bought by Flipkart owned Myntra, Titan picked up CaratLane, Mahindra acquired BabyOye, Future Group took over the online furniture and home furnishings store FabFurnish.com, Ola Cabs bought TaxiForSure, PayU acquired Citrus Pay and Paytm got consumer behaviour prediction and recommendation platform Shifu, among the prominent deals that took place this year.

And, the latest deal to make the news is Nasper-backed MakeMyTrip and Ibibo merger. In a deal pegged at $1.8 billion, Makemytrip has acquired rival Ibibo that is considered to be the biggest acquisition in India’s online travel space. Instead of fighting against each other, now the newly-merged entity can fight smaller companies like Booking.com, Expedia and Cleartrip in the rapidly growing Indian travel market, and can also stand against well-funded startups like OYO Rooms and Stayzilla in the budget hotel and homestay segments. The merged entity is now expected to dominate the space with an overall market share of between 50% and 60% hardly leaving any room for competition.

The reasons behind consolidations

There are various reasons why we are seeing a spate of consolidation in the Indian internet space, and financial crunch is only one of them.

The funding climate is drying out, and securing follow-on financing has become tougher. Investors are becoming selective with their finance and which companies to invest in. This spells doom for smaller startups. They know they won’t be able to raise funds as before, and hence have opened themselves to acquisitions.

While most of the acquisitions in the Internet space have been largely due to the inability of companies to raise additional capital, they also take place due to a company’s inability to weed out a potential competitor or when the common investors demand it. For example, Ola bought TaxiForSure (and killed it) in order to buy out a local competitor while in the case of Letsbuy acquisition, Tiger Global, a common investor for both Flipkart and Letsbuy is said to have forced the merger.

Paytm, an online wallet, that also runs online marketplaces for products and local services made several acquisitions and strategic investments to complement its services or add new segments. It bought Shifu to offer more personalized user experience to its customer; Near.in – a hyperlocal service provider; Jugnoo – a mobile app for on demand auto rickshaw service; and Little – a platform that helps users find deals at nearby businesses.

Also, some sectors especially food-tech, online grocery delivery firms, home services and logistics are overcrowded with many players without any real differentiation. In the quest to emerge at the top, many of these firms exhausted their resources, and had nowhere to go. No wonder PepperTap folded and TinyOwl has shut shop.

Technology companies in search of new ideas, innovation, trained professionals and strategic market share are on the lookout for acquisitions. There is an intense competitive environment where many large startups or tech companies are in the race to acquire other businesses before they are picked up by their competitors.

Expect more consolidation in the future

Mergers and acquisitions generate cost efficiency, get more competitive benefits and enhance the revenue in the form of market gains. A lot of startups emerge every year, but many of them do not have the scale to be profitable. They will be looking for consolidation in order to remain sustainable.

The trend is here to stay; there will be more strategic alliances and consolidation in the Indian Internet space in the coming years.

[This article has been contributed Arvind Yadav, Principal at Aurum Equity Partners LLP]