India’s Super Rich Heavily Investing In Global Real Estate; Their Count To Double In 5yrs

As per the recent wealth report created by London based real estate consultants Knight Frank, India’s high net worth individuals (UHNWI) are heavily investing in real estate in other countries; and their numbers have grown 166% in the last 10 years. Almost 50% of all India’s UHNWI have foreign real estate in their portfolios, which is highest in the world. At 42%, Australia’s UHNWI come second followed by Russia.

As per Samantak Das, chief economist and director, research, Knight Frank India, a quarter of all India’s UHNWI are buying global real estate which has nothing to do with investments; and almost 87% are purchasing foreign properties for purely investment purposes.

As per Wikipedia, an Ultra High Net Worth Individual is a person having net worth of atleast $30 million (Rs 180 crore) or more; and a High Net Worth Individual is a person having net worth of atleast $1 million (Rs 6 crore)

Real Estate Prices Are Increasing

Due to this increased diversification of investment portfolios across the globe; wherein UHNWI from Asia and Latin America are purchasing prime real estate in USA and Europe, the overall prices of real estate is increasing at an alarming rate.

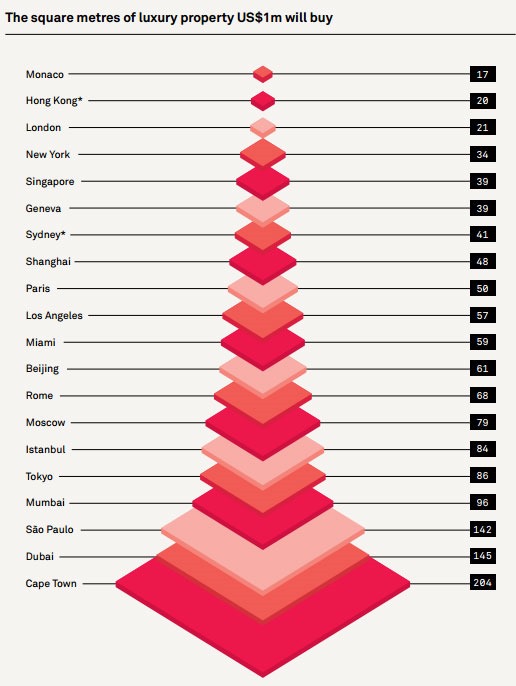

For $1 million (Rs 6 crore), these are the real estate which you can now purchase:

- Monaco: 181.9 square feet

- Hong Kong: 241 square feet

- London: 224.7 square feet

- Singapore: 417.30 square feet

- Sydney: 438.7 square feet

- Shanghai: 513.7 square feet

- Paris: 535 square feet

- Moscow: 845.3 square feet

- Mumbai: 1033 square feet

Globally, on an average, 23% of the total assets of an UHNWI is invested in property at their place of residence, and the rest is distributed in other investments.

Due to the increase cross-country real estate purchases, the price of real estate increased by 2% globally. New York’s high end real estate prices grew at the fastest rate at 18.8% between December 2013 to December 2014; followed by Aspen (Colorado), Bali, Istanbul and Abu Dhabi where high end real estate grew between 14.7 to 16%.

Real estate prices in San Francisco, Dublin, Cape Town, Muscat and Los Angeles grew around 10% annually.

India’s Billionaire Increase

As per the Knight Frank report, there are 68 US Dollar Billionaires (Rs 6200 crore) in India right now, which will increase to 136 in the next 10 years. This will make us the country with 4th highest number of billionaires in the world.

Overall, if we add up Non Resident Indians, then are total of 90 billionaires, having net worth of $294 billion, compared to 56 billionaires last year having net worth of $191.5 billion. Mumbai has the highest number of billionaires in India, followed by New Delhi and Hyderabad.

In Asia, Vietnam registered 200% increase in billionaire count, followed by 125% increase in Indonesia and 114% in Kazakhstan.

Some other interesting facts from the report:

- Total number of Ultra High Net Worth Individuals in the World: 172,850

- Total assets owned by these Ultra rich: $20.8 trillion

- Estimated commercial real estate investments by private individuals, globally: $153 billion

- City which witnessed maximum investments by UHNWI: London

- Top Asian country with maximum UHNWI investment: Hong Kong

- Number of UHNWI in Singapore: 1752 (maximum in the world!)

You can access the full report here.

[…] is the bad situation that the super-rich of India are now investing in real estate of foreign market, compared to Indian […]