OnDot’s Card Control App Helps Manage Every Aspect Of Your Credit / Debit Card From A Smartphone

OnDot Systems is an one-of-a-kind service for credit card users and providers which lets you stay in complete control of your card with your smartphone.

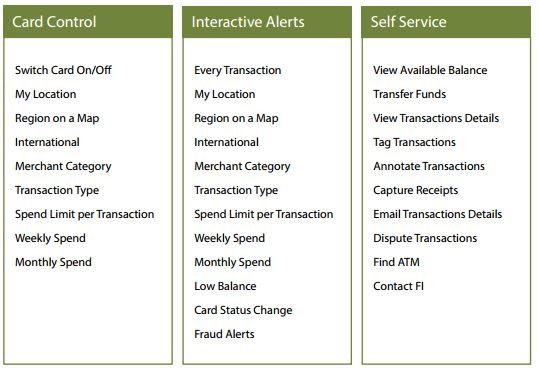

The startup has showcased its app CardControl which allows credit card users to switch their cards On and Off their cards among other things like setting up payment thresholds, restricting transactions to geographical locations or merchants etc.

The startup also offers credit card providers and banks an API to integrate similar services or offers them to provide the CardControl app to their users.

See this video that explains how OnDot’s CardControl can help you manage your credit card from your smartphone.

The app can also throw notifications on every kind of transactions made with the card. One interesting feature is “Around Me” which if turned on, will only allow transactions with the card if your phone is around.

You can also enable/disable type of transactions. Parents worried about their kids spending more money on app stores will be mostly benefited by this. They can just disable online payments or can set a limit to the type of spending. You can also customize your son’s spending with the credit card to grocery stores, gas spending and restaurants.

The most interesting part is that you do not need to use any extra hardware or different card for it. The service works fine with the existing cards and all you need is install an app on your smartphone. You can mail OnDot systems to see if your card provider or bank uses this facility.

The startup has 70 employees and many in India. It is headquartered in San Jose and is founded by Indian American entrepreneur, Bharghavan Vaduvur, who earlier founded Meru Networks, a wireless networking company.

The company has been in a dormant mode for three years building and testing their product and building necessary ties in the market. It also raised $18 million in funding to further boost its product.

The company has so far signed deals with four major credit card processors who provides card services to 10000 banks. The known revenue model is charging a licensing fee from the banks per user they offer the services to.

Lone Star Bank in Texas an early adopters of the service, has reported a 60% drop in their losses annually due to card frauds.

There is no doubt that with CardControl app, you do not have