Mobile Subscribers numbers in India fall again, now at 908 mln!

To be honest, I had not anticipated fall in mobile subscriber numbers atleast for next couple of years, but it is happening. In July 2012 mobile subscribers witnessed a major fall of over 20 million primarily due to Reliance.

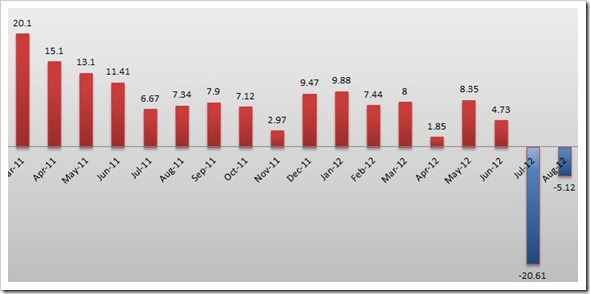

According to TRAI report for month of August 2012, India witnessed another fall of more than 5 million subscribers. The reduction of mobile subscribers came from Uninor, Bharti, Idea, Vodafone, Videocon and MTNL. Here is the historical chart of mobile subscriber growth in India.

Highlights of Telecom Subscription Data [August 2012]

– Total Indian mobile subscriber numbers fell by 5.13 million in August 2012 reducing the total tally to 908.36 mln.

– Urban India witnessed a fall of 3.77 mln subscribers as compared to Rural India fall of 1.36 mln. Rural monthly growth rate was –0.41% as compared to urban growth rate of just -0.65%.

– Urban Teledensity stands at 155.83 as compared to rural density of 39.35

– Urban mobile subscriber share stands at 63.32% as compared 36.68% rural subscribers

– 5.61 million new Mobile portability requests were made in month of August 2012 taking the total tally of MNP requests since launch to 64.92 mln

– Out of total 908.36 million, 701.87 mln were active mobile subscribers in month of July 2012 (Peak VLR data).

– 1.4 lakh new Broadband subscribers were added in month of July taking total tally to 1.48 crore.

– Delhi (233.45) has over 3 times the teledensity as compared to the National average (77.28). Lowest teledensity was registered in Bihar (47.00)

– Wireline Subscriber base stands at 31.21 million.

– India’s total telecom subscriber base (wireless+wireline) has fallen to 939.57 mln.

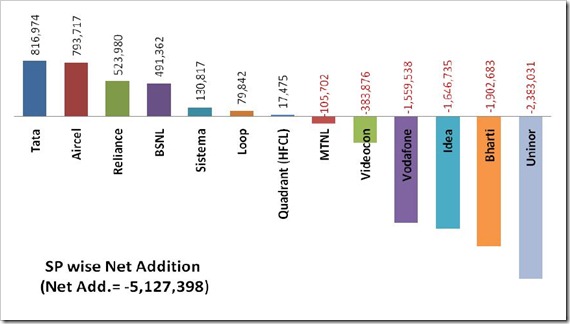

Operator wise Mobile Subscriber additions [Aug 2012]

After lackluster 6-9 months, Tata managed to top the charts with addition of over 816k subscribers followed by Aircel (793k) and Reliance (523k). Uninor was the biggest looser in month of Aug where they lost close to 2.4 million subscribers, while Bharti Airtel who have been consistently doing well also lost 1.9 mln subscribers. Idea (1.65m), Vodafone (1.56m), Videocon (0.38m) and MTNL (0.1m) all of them witnessed negative growth.

The dip in subscriber count in last few months for various telecom operators can be attributed to cleansing of non-operating numbers. Any sim card that is inactive for over 3 months gets deactivated, and that number shows up on the charts. However, instead of doing it phased manner, the operators seem to have reported it in one month and hence this fall.

Although on charts close to 26 million subscribers have been lost, in reality it is just the reporting of numbers that have been corrected, so in longer run, I think this is a good for reporting the right active numbers. The active numbers which last year were in 60% have now risen close to 80%, which is definitely a very good sign!

Operator wise Total Market Share [July 12]

Bharti still is the leader by a large margin with 20.58% market share followed by Vodafone (16.88%) and Reliance (14.82). After Reliance witnessed a steep fall in July 2012, it has conceded its 2nd position to Vodafone who are now ahead by over 2 percentage points. Idea (12.77%) and BSNL (10.93%) round off the top 5 telecom operators in India.

![Operator wise Total Market Share [sug 12] Operator wise Total Market Share [sug 12]](https://trak.in/wp-content/uploads/2012/10/Operator-wise-Total-Market-Share-sug-12_thumb.jpg)

When Reliance introduces CDMA and GSM many of the people are confused and which is not suitable to India and most of the connections are captured in starting of Reliance due to revolution in Introduction offer and reach to people in very short time. Reliance is older company and which started from yarn but many of them are known from Mobile Phone only..Because it is the only first business in Reliance which B2C and others are B2B for them..So it reaches very faster to people. Mobile phones are some what saturated and it is available very commonly..But yet to cover nearly 35% in India. Still huge market is open for Mobile Operators.