Most of the start-ups as well as established companies in internet space primarily targets US audience. This is understandable as US Online Advertising market stands at a whopping USD 24 billion and is at least four times bigger than the second largest market that of UK.

In developing countries, it’s a rarity if an internet company gets funded, and most of the start-up visionaries here are not very bullish when it comes to internet space.

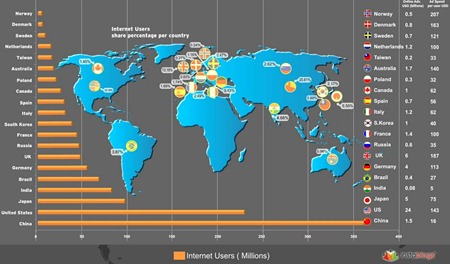

Countries like China, Brazil or India might lead in number of internet users with around 33% of total online traffic, but their online advertising market is less than USD 2 billion. Though China has some exceptional online players but nothing close to US.

Europe has a mature market in terms of internet penetration with Norway, Sweden, Netherlands, and Denmark having more than 85% penetration.

Online advertising spend has already taken over TV ad spend in UK and Denmark. Owning to the mature market (higher online penetration) ad spend per person in Europe is quiet healthy. Marketers in Europe are not shy to experiment with online properties.

Yahoo, AOL, Microsoft and other large players have already explored Europe and have decent revenue coming out of Europe. Many young internet start-ups emerging from Europe have made big globally.

European start-ups are at advantage of having a decent domestic online market letting them establish themselves here first and then becoming more aggressive when taking on a global audience (primarily US). Skype, Bebo, Netvibes, Joost are some of the start-ups having roots in Europe.

So let’s analyze two key components; ad spend per person and internet penetration rate.

India’s online spend per person stands at shameful USD 5 and that of Norway is USD 207.

That means an online content portal operating in India can bring in 40 times more revenue if it’s to be run in Norway. Of course there are many other factors involved like cost of operation is comparatively less in India, number of online users are small in Norway etc but my point is making money in Norway for an internet start-up is easier than in India.

The other factor is internet penetration rate. Internet penetration rate is defined as the percentage of Internet users divided by populations for each country. An Internet user is defined as being over 16 years old and uses the Internet on a regular or occasional basis in businesses and homes. Higher the penetration, mature is the market. Marketers are at ease as they can target a larger audience.

Online Media companies which started in US or have targeted US can easily expand globally by exploring some of these markets with higher internet penetration and ad spend per person.

Many successful content sites like Engadget, Techcrunch, Asylum are already having their presence in local versions. Most of these sites started targeting the US ad pie, but riding their brand presence have emerged as strong players in various local markets.

Ankit, I might be off with the CPM but the fact remains that with the cost per impression model doesn’t work for startups or individual advertisers.

Indian market size in terms on internet population might look large but the penetration and ad spend per user is among the lowest. Marketers are not clear about how to run successful campaigns.

HT and other media sites receives most of the traffic from search engines, making bounce rates on these sites extremely high. So advertisers choose instead to spend their money with Google, where consumers linger.

1lakh for 10K impressions converts into $200 CPM, which sounds really high. I highly doubt that. Normal rates for Indian media houses vary from $2-$4 CPM prime spots.

Ankit, I think ad-spend is probably more related to the returns a business derives from advertising in a particular media- higher the returns, future spend will also be probably higher. I think market maturity, both at the corporate and consumer level, usage of internet by SME’s, individual entrepreneurs etc., to be more relevant barometer for ad-spend as against simply internet penetration.

More than anything else, I think contextual advertising, meaning where the web user is looking for a product or information and he sees relevant advertising, he is more likely to click on it. This will translate into traffic and may be even sales for the advertiser. However, just banner advertising on a website and paying the website tonnes of dollars for impressions will amount to ad-spend but does not accrue any value to the advertiser and so future ad-spend might be trimmed.

Some time ago I discussed with a start up about their advertising plan and they mentioned Google adsense and not banner ads on HindustanTimes (HT) or the like. When I inquired the reason, the founder simply stated that he had to pay something like Rs.1 lakh for may 10K impressions, which due to to the traffic on HT, would run out in less than 1 day. So, can a start-up so much cash for hardly any advertising? This probably applies to SME’s as well. With a similar budget the companies can get continued exposure through low-cost avenues over a period of time.

(From my points I don’t whether I am supporting or contradicting your arguments! Need my caffeine refill :-))

I know very little of the internet advertising business…but I seriously thought CPC (Cost-per-click) works out to be a win-win than CPM/I. CPM/I is wayy too expensive for any company, forget a start-up on a traffic-intensive website.

Some startups I talk to in the US do implement a cost-per-click model.

Any pointers why the Indian market has migrated to CPM/I than a CPC?

CPC and CPM are like kms and miles. Both can be converted into the other metrics. The difference is for CPC based campaigns you calculate eCPM (effective CPM) while eCPC for the other.

The market dominates the CPM or eCPM no matter you pay in terms of CPC, CPM, monthly tenancy or any other metric.