The Government of India has launched a national campaign to bring informal economic activities under the Goods and Services Tax (GST) framework.

The Ministry of Finance has instructed the Central Board of Indirect Taxes and Customs (CBIC) to mobilize its field offices for this outreach effort.

Government of India Launches National Campaign To Bring Informal Economic Activities

The goal is to expand the tax base and reduce tax evasion by integrating unregistered businesses into the formal GST system.

Official sources stated, “The government’s objective is two-fold: bring unregistered businesses into the tax net and reduce the reliance on cash-based, unaccounted transactions.”

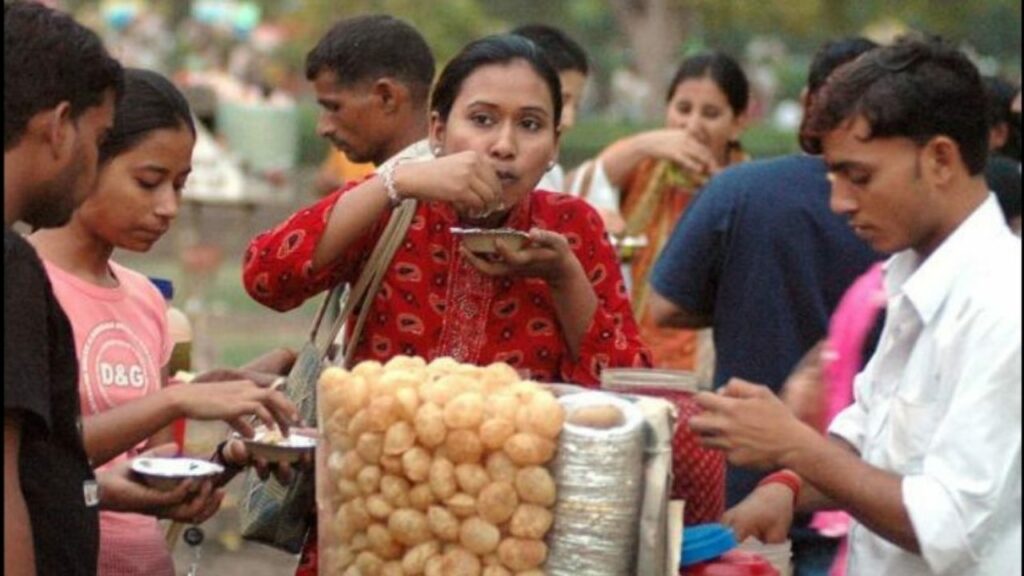

The drive includes analyzing cash-heavy sectors, targeting dense commercial areas, and identifying unregistered food vendors, local shops, and small service providers.

Officials emphasized the initiative will focus on building trust with small businesses rather than being intrusive.

A senior official said, “More registrations mean more oversight, but also better compliance, smoother trade, and potentially lower rates for all in the future.”

The strategy is based on the principle that a wider tax base reduces the per-person tax burden and allows for rate rationalization over time.

In April 2025, India recorded its highest-ever monthly GST collection, reaching ₹2.36 lakh crore, marking a 12.6% year-on-year increase.

The record collections were largely driven by the inclusion of new taxpayers, with over 2.5 million new GST registrations added in FY25.

The total number of registered GST taxpayers has now reached 15 million.

Domestic GST collections grew by more than 9%, reflecting steady consumption and production, with growth in both rural and urban areas.

The expanded taxpayer base significantly boosted state-level tax compliance and revenue dynamics.

UP, Maharashtra Among Top Contributors in GST Registrations

Uttar Pradesh leads in terms of the total number of GST registrations, now exceeding 1 million.

Maharashtra is the top contributor to overall GST collections due to its strong industrial and services base.

Other states with over 1 million registered GST entities include Gujarat, Karnataka, and Tamil Nadu.

India’s informal sector still constitutes approximately 45–50% of employment and a significant portion of its economy.

Experts say this initiative could lead to structural improvements, such as better productivity, access to credit, and enhanced worker security.

Officials noted that the GST system’s digital trail could become a valuable tool for long-term policy formulation.

They added, “The reason for the highest ever GST revenues is two-fold — growth in the economy and better compliance of taxpayers.”

Increased formalization could also attract foreign direct investment (FDI), enhance India’s ease of doing business, and improve investor confidence.

CNBC-TV18 contacted the Ministry of Finance for comment, but received no official response.

Nonetheless, it is evident that India is accelerating efforts to formalize its economy, with GST registration playing a central role in that strategy.