Regulatory Nod for Paytm

In a significant development for digital payments in India, Paytm, a prominent player in the fintech industry, has recently obtained approval from the National Payments Corporation of India (NPCI) to operate as a third-party application provider (TPAP) for Unified Payments Interface (UPI) services. This regulatory nod marks a pivotal moment for Paytm, allowing the platform to expand its offerings and enhance user experience by integrating UPI functionality.

The approval from NPCI grants Paytm the authority to facilitate UPI transactions, enabling users to make payments, transfer funds, and engage in various financial transactions seamlessly through the Paytm app. This move underscores Paytm’s commitment to innovation and its efforts to provide comprehensive financial solutions to its vast user base across India.

Partnerships with Leading Banks

To support its UPI services, Paytm has partnered with four leading banks in India, namely Axis Bank, HDFC Bank, State Bank of India, and YES Bank. These partner banks, acting as Payment System Providers (PSPs), will collaborate with Paytm to ensure the smooth functioning of UPI transactions on the platform. Leveraging the extensive banking infrastructure and expertise of its partners, Paytm aims to deliver a seamless and secure payment experience to its users.

The involvement of these established banking institutions reinforces the credibility and reliability of Paytm’s UPI services, instilling confidence among users and merchants alike. By forging strategic partnerships with leading banks, Paytm demonstrates its commitment to fostering collaboration within the financial ecosystem to drive digital transformation and financial inclusion in India.

Impact on Customers

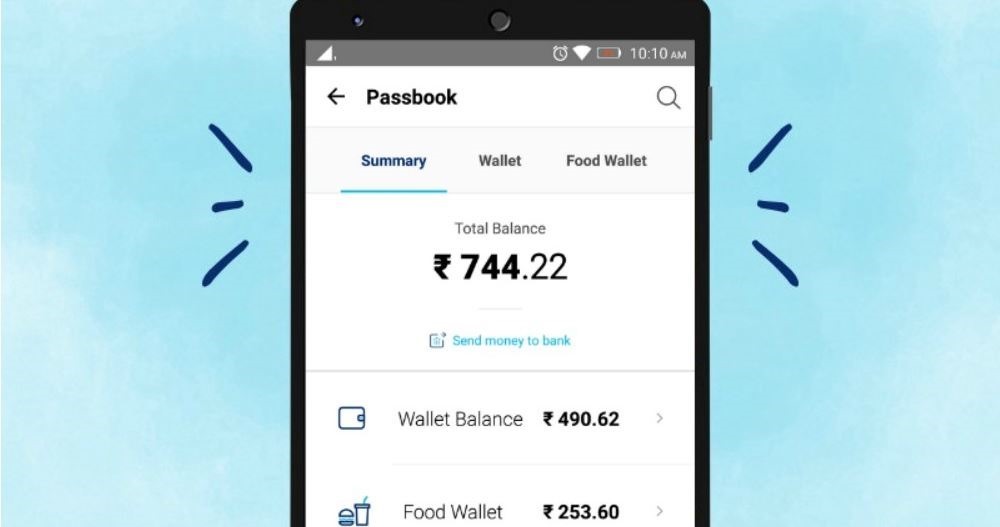

For Paytm users, the approval as a third-party UPI app translates into uninterrupted access to UPI-based payment services through the Paytm app. Users can continue to leverage the convenience and efficiency of UPI for making payments, transferring money, and managing their finances seamlessly. With YES Bank serving as the merchant acquiring bank for Paytm, existing users and merchants can carry out UPI transactions and AutoPay mandates without any disruption.

The seamless transition to a third-party UPI app ensures continuity and reliability in digital transactions, further enhancing the value proposition of the Paytm platform for its users. By providing a frictionless payment experience, Paytm aims to empower individuals and businesses to embrace digital payments as a preferred mode of financial transactions.

Paytm Payments Bank Deadline

The approval as a third-party UPI app comes at a crucial juncture for Paytm, as certain services of Paytm Payments Bank Ltd (PPBL) are slated to cease after March 15, 2024. The Reserve Bank of India (RBI) imposed restrictions on PPBL on January 31, 2024, citing persistent non-compliance and supervisory concerns. Following the RBI’s directives, PPBL has been barred from accepting fresh deposits or top-ups post the specified deadline.

Amidst these regulatory challenges, the approval to operate as a third-party UPI app provides a ray of hope for Paytm to navigate through the evolving regulatory landscape and continue offering innovative financial solutions to its customers. By diversifying its offerings and strengthening its position in the digital payments ecosystem, Paytm remains committed to driving financial inclusion and digital empowerment across India.