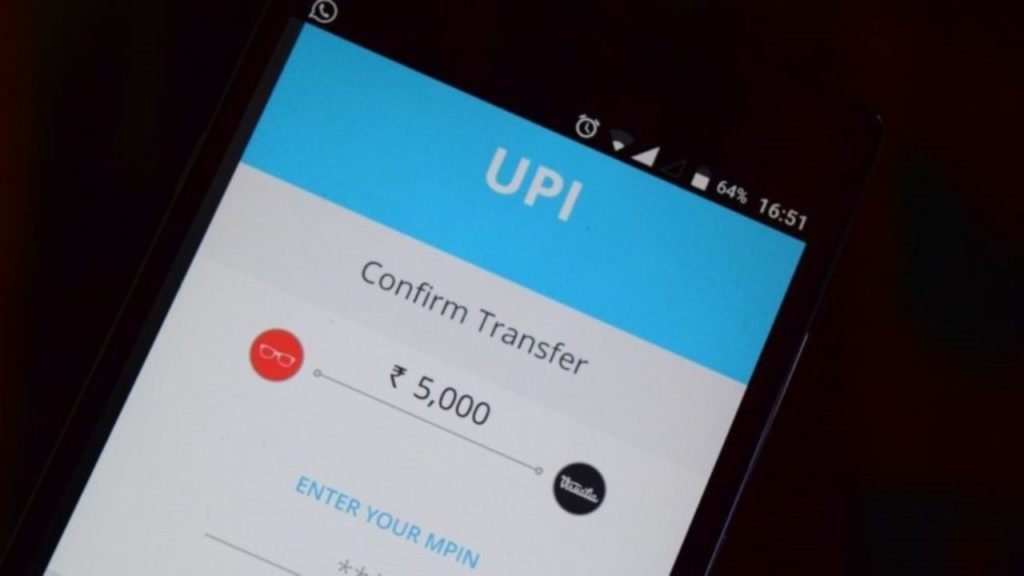

NPCI is organizing strategic talks with fintech companies in an effort to balance out Google Pay’s and PhonePe’s dominance in the UPI mobile payment system.

Concerns over market concentration are raised by the fact that PhonePe and Google Pay combined account for around 86% of UPI transactions by volume.

NPCI In Talks With Fintech Company To Balance Out Google Pay and PhonePe’s Dominance

The representatives of CRED, FamPay, Amazon, and other major fintech companies will meet with NPCI officials to discuss strategies for growing UPI transactions on their apps.

The favored method for online transactions in India, UPI, is a partnership of Indian banks that conducts over 10 billion transactions every month. The combined market share of PhonePe and Google Pay has grown to almost 86%, with Walmart controlling more than three-quarters of PhonePe.

The Reserve Bank of India’s restrictions on Paytm Payments Bank caused the third-biggest UPI participant, Paytm, to see a drop in market share to 9.1%. In the UPI ecosystem, the NPCI advises capping individual enterprises’ market share at 30%; however, the deadline for compliance has been extended until December 2024.

The market share cap presents a special issue, according to NPCI, since it lacks a technical means of enforcement.

RBI’s Regulatory Action

RBI took regulatory action after expressing dissatisfaction with NPCI regarding the expanding duopoly in the payments industry.

The NPCI is urging fintech companies to provide user incentives, while RBI is contemplating an incentive scheme to level the playing field for up-and-coming UPI providers.

The intention behind these incentives is to lessen the dominance of PhonePe and Google Pay and encourage the adoption of alternative apps for UPI transactions. This strategy is in line with the suggestion of a parliamentary commission to assist local fintech companies that can offer substitutes for Google Pay and PhonePe.

The regulatory environment pertaining to UPI transactions is being examined and may be changed to address concerns about market concentration. In order to allay worries and encourage competition in the UPI ecosystem, the RBI and NPCI are collaborating.

The NPCI and fintech firms’ talks are a proactive step in the direction of creating a more varied and competitive payment landscape in India. Through user incentives and strategic collaborations, emerging UPI companies can increase their market share.

Companies now have extra time to modify their operations and plans thanks to the market share cap deadline extension. The NPCI’s support of market share ceilings is indicative of its dedication to preserving an equitable and competitive climate within the UPI ecosystem.

To shape the future of digital payments in India, authorities, industry players, and fintech firms must work together. The objective of incentive-driven programs is to encourage the usage of alternative UPI apps by users, hence promoting a more equitable allocation of market share.