With the aim to reduce the clearance time to just a few hours, the Reserve Bank of India (RBI) has announced a significant improvement in the cheque clearing process.

RBI Announces New Cheque Clearing System to Reduce Processing Time to Hours

Currently, the cheque processing can take approximately 2 to 3 days. This new process was revealed by the RBI governor during the Monetary Policy Committee meeting on August 8, 2024, is designed to benefit both payers and payees by accelerating the payment method.

As per the statement of the bank on the Developmental and Regulatory Policies, the Cheque Truncation System (CTS) now processes cheques with a clearing cycle that can extend up to two working days.

To enhance efficiency and reduce settlement risks, the RBI proposes transitioning CTS from batch processing to a continuous clearing model with ‘on-realization-settlement’. This means that the cheques shall be scanned, presented as well as processed on a continuous basis during the business hours, which shall shorten the clearing cycle from the current T+1 days to just few hours.

Detailed guidelines for this new process will be issued soon.

This change also aims to align the cheque clearing times more closely with the rapid transfer speeds provided by National Electronic Funds Transfer (NEFT) and Real-Time Gross Settlement (RTGS).

NEFT transactions are available year-round, processed in batches through 48 half-hourly slots, and have no maximum limit on daily transfers.

RTGS allows for immediate transfers of large amounts any time of day.

On the other hand, Immediate Payment Service (IMPS) operates 24/7, including bank holidays, enabling instant transfers of amounts up to Rs. 2 lakhs.

New Continuous Clearing System to Expedite Cheque Processing to Same Day

As per the existing system, CTS clears cheques in batches and can take the time up to 2 working days. However, it is with the new continuous clearing system that the time of clearing of the cheque shall reduce to the same day that it is presented.

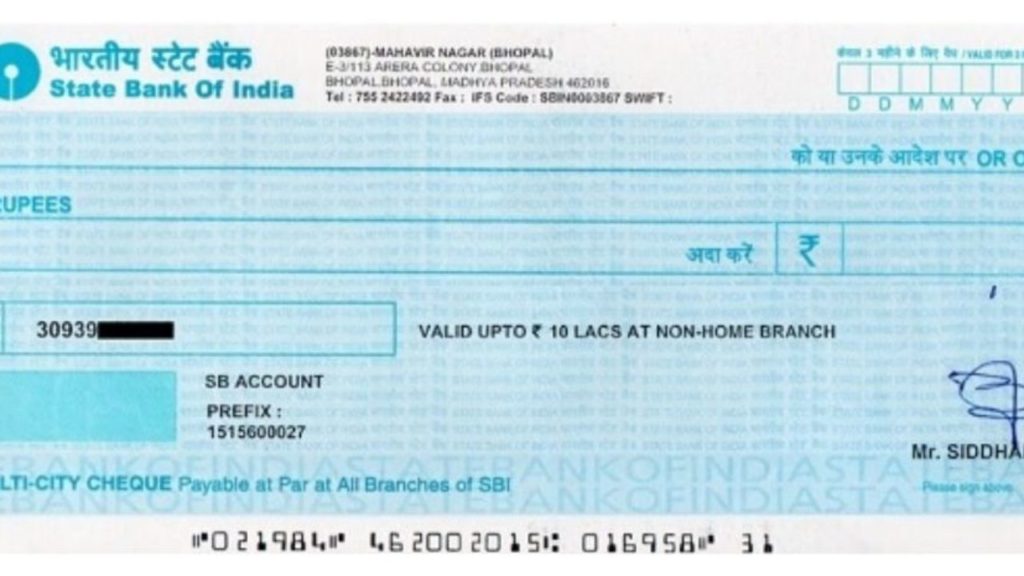

Reducing the processing time and costs, cheque truncation involves halting the physical cheque and sending an electronic image instead.

With this, there shall be no need to have the physical cheque movement across branches, further enhancing efficiency. The Positive Pay System (PPS) further improves security by preventing cheque fraud, with banks encouraged to offer this for cheques of Rs. 50,000 and above.

In the case a customer needs to view the physical cheque, banks can provide the images, upon request, the physical cheque from the presenting bank, which may involve a fee. Presenting banks must retain physical cheques for ten years to comply with legal requirements.