Income Taxes paid by Indians [Overview, Numbers & Graphs]

Do you know how many Indians pay Taxes and how much?

You would be surprised with some of the numbers. According to the report released by Indian Finance Ministry, estimated number of taxpayers for financial year 2011-12 stands at just 3.24 Crore people. That means, less than 3 people in 100 pay taxes

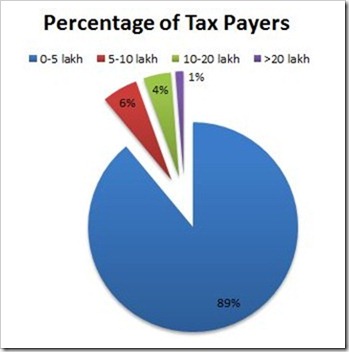

Out of these 3.25 Crore people, 89% pay taxes in the tax slab of 0 – 5 Lakh rupees, while on the other end of spectrum, only 1.3% of all tax payers have income about 20 Lakh!

Number of Tax Payers in India & their Slabs

| Slab | Number (in lakhs) | Percentage of taxpayers |

| 0-5 lakh | 288.44 | 89.00% |

| 5-10 lakh | 17.88 | 5.50% |

| 10-20 lakh | 13.78 | 4.30% |

| >20 lakh | 4.06 | 1.30% |

The graph clearly shows the inequality in the earnings of Indian people – Imagine, in a country of 120+ crore people, only 4 lakh people earn above 20 lakh rupees a month.

Now, if you consider that many cheat when it comes to taxes, even then the numbers are so skewed that it is mind-boggling.

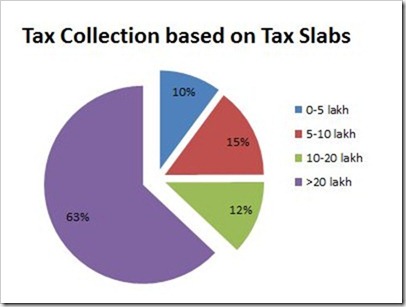

This next graph will show you further how much wealth is concentrated amongst only a miniscule few!

Tax Collection by Tax Slabs

| Slab | (Rs. in crore) | Percentage of tax collected |

| 0-5 lakh | 15,010 | 10.10% |

| 5-10 lakh | 21,976 | 14.80% |

| 10-20 lakh | 17,858 | 12.10% |

| >20 lakh | 93,229 | 63.00% |

The biggest surprise for me was – although, only 1.3% of all tax-payers earn more than 20 lakhs in India, they account for a whooping 63% of all the taxes collected by Indian Government. So 4.6 lakh Indians pay a total of 93,229 crore rupees of tax. That comes to an average of roughly 23 lakh per person!

Although, I was aware of this situation to a certain extent, after looking at the numbers in the report, I was taken aback by amount of inequality we have in India!

Would love to hear your comments on this!

[Via]

The percent of people avoiding taxes (but under surveillance) seems to be only 4% as per the data. Apart from agricultural income which is not taxed, incomes of political parties are not taxed. Also, large scale money transfers abroad under double taxation avoidance treaties cause reduced IT collection.

The data by GOI shows absurdly low figures on Gini coefficient and that prompts successive FMs to think that the middle class is the culprit in tax evasion. It is high time the Government corrects this opinion about the middle class whereas this classs is surviving on loans.

The table is in today’s ‘LPG to be dearer for the rich” news item. From the table it is clear that tax collected in the 0-5 L category is little and will be good riddance if abolished. IT must be based on “Per Capita Income” i.e., income taking into consideration that of a person only divided by the number of dependents on that income Based on this the tax slabs need to be appropriately revised From Redifmail (8-2013)-highet IT is in Arubaa south Carribean island-59%. others-JAPAN 50%, UK, China,Germany,Australia 45%, South Africa 40%, INDIA 30%! in the hiiher tax slabs increase surcharge 1% of IT for every 5L, increase in income to compensate for the0-5 l cut off and save the staff and equipment for better purpose.

There is no doubt that actual tax payers are definately 1/3 of the population . This means atleast 2/3 of the earning population do not pay tax.

You can see high value cars owned by many, first class travellers , high value residential buildings for social status but they dont figure in tax payers list. Hence Govt should come out with PAN cards of different colours based on the avg income tax paid by the individual ( Eg : Tax paid 5Lac – 10Lac , 20 – 50 Lac , 50 Lac and above )and this should reflect the social status as a tax payer. There should be incentive linked to this status. Eg : Special entry lines at air port , railway stations , seat booking qouta’s , priorities in bank , government departments , police stations , public transport etc Any additional incentive is welcome.

Now common man can notice rich persons but not in tax payer queue ! Thus many rich people especially businessmen,politicians etc will get exposed as they have to stand in different queue. Hence these guys will try to get into higher tax slabs to maimntain thier social status.

sir i need to know that how does the government charge the middle class people ?

In a country like India where people are savings minded won’t pay such high slab of income tax the government should consider bring in down the tax rate in line with the prevailing bank interest rate ie maximum to about 10 % and all the perquiesties may be abolished this will centainly increase the tax base to a considerable level so that there won’t be any revenue loss to the government.

Since tax collection from the 89% of total number of income tax payers amounts to meager 10% of total collection, the government needs to concentrate on self- employed and business people whose income is above 5 lacs to ensure better tax compliance. In fact, the persons in the tax bracket of 0-5 lacs may be exempted from reviews of taxable income as the expenses on collection from them may be far more than the collection itself. We all know that the black money normally is invested in property, shares, gold and other high value items. Keeping a tab over them can make better tax realization.

Supposing that all tax payers pay 25% of the tax assessed for this year pay, as advance tax for the next year, how much will the Govt get as additional tax revenue per year in advance?

In the next year, the assesse must be allowed to deduct 30% from the assessed tax amount for the subsequent year as incentive for paying 25% in advance.

The Govt gets revenue in advance, may be directed towards accelerating development.

Percentages may be worked out .

Is this a weird idea?

It’s pretty meaningful statistics.Thank you for sharing!!

Could you kindly share the source of he data, I am looking for the same parameters for 2013.?

I think there’s a mistake in the article. The first sentence under the first pie chart where it says “only 4 lakh people earn above 20 lakh rupees a month.” I think that is supposed to be per annum. It would be great if the columnist would confirm that because I sounds wrong to me but I could be wrong too.

Hey nagarjuna thats not true about what are you thinking man you are a rich of this country and the 97% are poorer than you this is of because you don’t know the real facts of our country according to indian income tax law there is no income tax on farming and our more than 70% of our population is in farming so they have to pay nothing as income tax but this do not prove that you are richer and rest are poorer than you brother

I was just telling my colleagues today 15thmarch2013 that we inthe incomegroup of Rs.5 lakhs apprx. are in the top 10% of the country’s population of 120 crores; now i correct my thinking that the Rs.5 lakh plus people form the top 3% of the country. that means 97% of my countrymen are poorer than us in terms of income. i belong to the top 3%. my dear brothers and sisters!

Another good data could be how many of them are for service and how many of them are business man / industrialist

This is an interesting article bringing to the fore that IT could without much loss be abolished for the under Rs.5,00,000/-pa class Their total contribution is only in terms of numbers of tax payers

Now that corruptorates are coming into agricultural sector, “industrial agriculture”, needs be taxed. Probably we can look at a new paradigm of taxation analogous to per capita income – per capita IT rather than an individual, and load factor on tax assessee. These need study and expansion

we need youngstars to rule the country.but our people will accept that they know who do all the 420 thing.but they vote for him. bcoz of the people India is under developed country.

wen India going to be a corruption free country.

I already brainstormed on this matter few years ago when I was in Pune that India is progressing by the contribution of the working/salaried classes. Just imagine, if all kirana walas, local shops, diamond merachants in Guj and many business mans and shopowners in India start giving their taxes honestly (even pay half of taxes) like salaried classes, the government need separate ministry to handle tax amount from IT department as the government khajana will overload with the money. These people earns hefty amount but pays taxes in peanuts and even not pay saying no goods sold or profit made.

And to add on above, we do not need to bring black money from Switzerland, I believe that we have enough black money in stashed in India itself that need to be unearthed.

shooking ,but not abnormal burocrates and polititions are either their partner or helpers.

so shocking…

Ya Shocking,,,,!

Unfortinately the people who pay the highest taxes also manage to get more than disproportionate of the assets. They are owners of vast properties, factories etc. where they have aquired land at a pittance. Some have been given land on the understanding that they will construct houses/employ for a large number of poor people, but they have cheated the people with connivance of our politicos and babus. A case in point is Hiranandani Constructions who was given a vast tract of land in Powai at some Rs. 40/acre to build flats for the PBL guys but instead built palatial flats and sold each for 1.5-2 crores plus. Educated and who we thought upright people bought these flats, in fact the flat papers were made such as if they were multiple flats to fulfil the Govt. requirement of area of the flat. people like Chairman of L & T have also purchased flats here. What do you call these people….

1. 89% of people fall in the income class of 0-5L and contribute just 10.1% of the collection

2. 4% of the people pay in the >20L category and contribute 63% of the collection. Why not leave this 1. group altogether from the tax policy , increase a certain % tax in the 3 other slabs to off set the loss and the entire tax machinery could be shrunk and deployed for more useful purposes ?

The reason I think would be because of industrialization-bringing in new companies and they employ many people for lower salary.The govt. should improve GDP by promoting local investors and industrialists to aim higher and make many Indians become entrepreneurs.I think that might be a solution…

My comment is in response to the commen to Mr. Vishnu.

The above statistics only show the brake up of different ways of compiling and presenting data.

We can not draw a conclusion from the graphs as to how much tax is avaded by above 20 lakh slab group.

In fact there is lot of scope to collect tax from 0-5 lakh group.

This group comprise of mostly small businessmen, traders, kirana who has vast scope to hide their income.

If you take higher bracket (for example) Mukhesh Ambani wont hide few million from tax men.The fear of it getting exposed and the loss of PR value make him pay sincerely.

Just my two paisa:)

Nice posting. But one request that have a upload file regarding Income Tax Article with file attach option, so the article will be most effective. Some kinds of think which is spread with an example, but here is no option link to attach the file. I hope in future the Moderator may guess the point.

Deepak Shenoy at Capital Mind (http://capitalmind.in/2012/04/only-406k-taxpayers-earn-over-20-lakhs-dtc-report/) has the exact same analysis and the same graphs. His post showed up earlier than your post in my feed. Coincidence?

No… It is not coincidence… I happened to see this before my post… was planning to write something on the same.

Although, I have not picked up either the graph or table from his post, I do have to say that I took the idea from that post. And hence I have given him the “via” link at the end of the post…

I actually forgot to put it while publishing the post…

Thanks for responding. I love your blog and known you to cite your sources, which I really like. So I was wondering what happened here.

woah…then just imagine the amount of tax collected if the all the >20 lac guys paped up their taxes!