Paytm has definitely seen better days; however, customers of the bank need not worry. Regulators won’t affect 80–85% of Paytm wallet users, according to RBI Governor Shaktikanta Das.

Following the RBI’s ruling against Paytm Payments Bank Ltd., remaining users are advised to link their apps to other banks.

Paytm Customers Need Not Worry: RBI Governor Shaktikanta Das

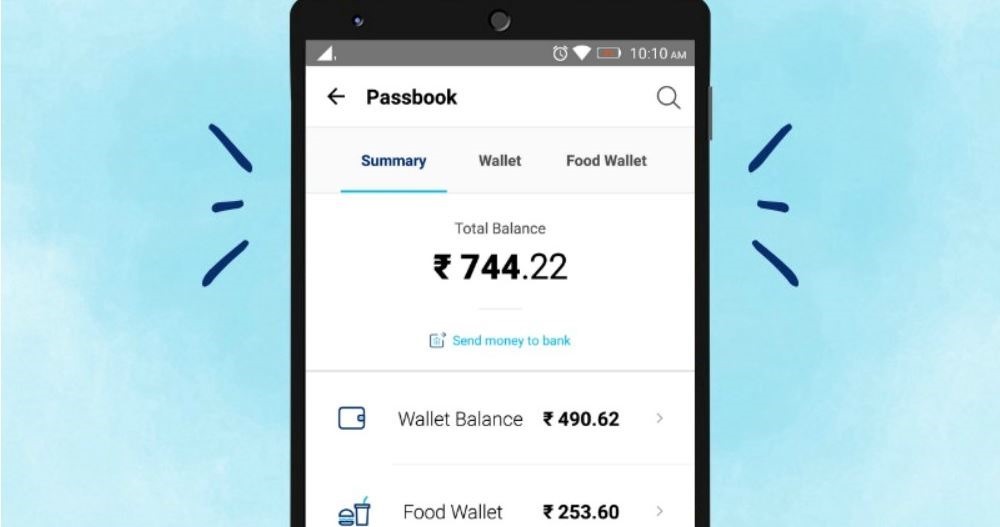

Due to RBI’s ruling, PPBL is unable to accept credit transactions, deposits, or account top-ups.

Users are allowed to link their wallets to other banks until March 15; there are no longer any planned extensions. Das emphasizes support for financial technology innovation by clarifying that RBI’s action was against PPBL rather than Fintech companies.

Governor Das stated in an interview that RBI fully supports fintech and promotes its expansion. Das explains regulatory compliance by drawing a comparison between driving a Ferrari and adhering to traffic laws.

Given RBI’s no objection position, NPCI will soon make a decision regarding the license for the Paytm payment app as confirmed by Das.

He said, “So far, as RBI is concerned, we have informed them that we have no objection if NPCI considers the Paytm payment app to continue because our action was against the Paytm payment bank. The app is with the NPCI…NPCI will take a call…I think they should be taking a call shortly.”

Paytm Non-Executive Chairman Stepping Down

Paytm Payments Bank Limited’s part-time non-executive chairman Vijay Shekhar Sharma is also stepping down. The bank’s board was reorganized, and two retired IAS officers, Ashok Kumar Garg, and Srinivasan Sridhar were inducted.

Das has also remarked on economic expansion and projects a GDP of about 8% for the current year.

Growth of 7% is anticipated for the upcoming fiscal year. The most recent inflation figure, 5.1%, is 110 basis points above the 4% target. Das says the inflation trend is going down.

The RBI concentrated on sustainably hitting the 4% inflation target. Regulations emphasize how crucial compliance is to the fintech industry. Most Paytm wallet users received assurances about service continuation.

Paytm Payments Bank modifies its organizational structure in reaction to legislative actions. The current and upcoming fiscal years are expected to see growth, indicating that the economic outlook is still favorable.

The Reserve Bank of India (RBI) is considering an unprecedented move to revoke the banking license of Paytm Payments Bank ahead of its scheduled winding down operations on March 15th.

If it proceeds, this will mark the first time in over 20 years that the RBI has canceled a bank’s license.