In 2020, Reliance Industries had announced that it had become net-debt free after raising Rs 1.68 lakh crore via rights issue and investments.

Largest corporate loan

Major conglomerates including competitor Adani have been prepaying loans to address debt concerns among investors.

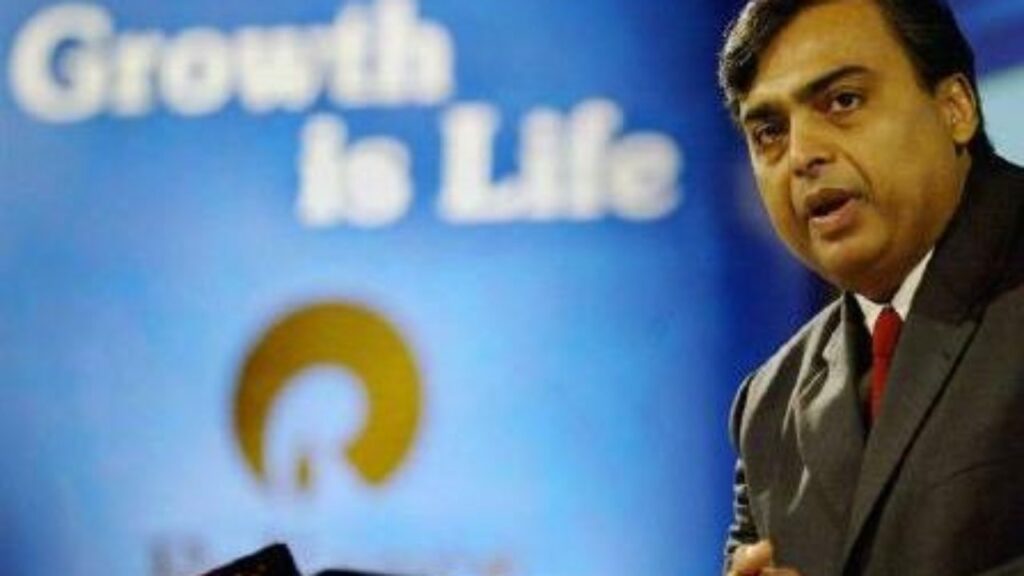

In the latest development, Mukesh Ambani’s firm has raised the largest loan in India’s corporate history, by borrowing $5 billion from multiple banks.

Lenders in line to invest

The company secured the debt through back to back approvals and raised $3 billion from 55 banks, and its subsidiary Jio bagged $2 billion from 18 lenders.

Both loans come with the same terms, and will boost the expansion of 5G coverage in India along with Reliance’s capital expenditure.

Back on top

Chairman Mukesh Ambani has once again become Asia’s wealthiest man after Gautam Adani’s tumble.

He is also the only Indian among the world’s top 10 billionaires and the richest sports franchise owner.

Apart from capturing India’s telecom sector with Jio, the company is also looking to aggressively expand Reliance Retail.