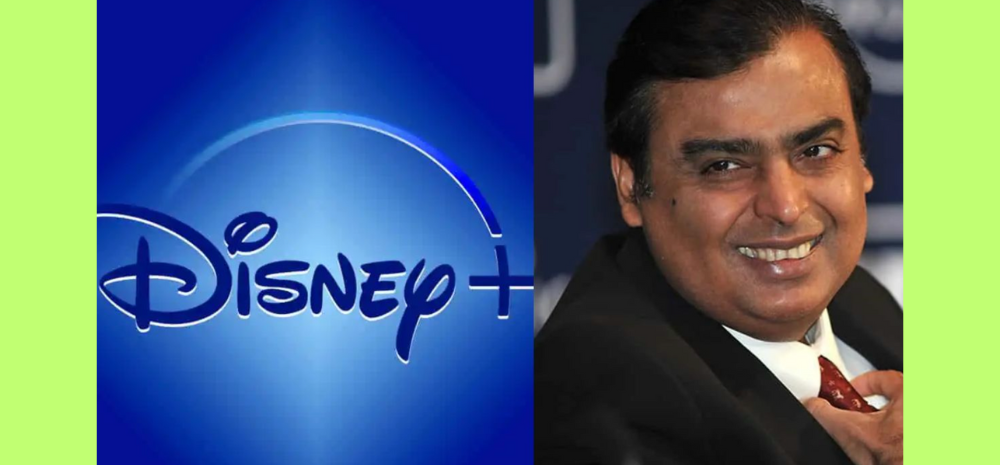

Billionaire Mukesh Ambani-owned Reliance Industries is reportedly acquiring 51-54% controlling stake in Disney’s India operations, for around $3.5 billion in enterprise valuation amid their tentative merger agreement. This marks a sharp drop from Disney India’s peak estimated valuation of $15 billion earlier fueled by ambitious localization plans.

The deal consolidation currently underway intends forming India’s largest media services powerhouse across TV broadcasting, OTT platforms and cricket rights. Reliance eyes boosting breadth, reach and pricing leverage domestically through Disney’s deep content catalogue integration.

40% Stake for Disney in New Entity

While Reliance becomes majority Indian owner, Disney will hold 40% share in the combined entity as it cedes ground adjusting for headwinds facing its Hotstar streaming service. Sony Pictures too abandoned separate $10 billion merger plans with Zee Entertainment last week minus adequate government assurances.

Nonetheless, market concentration risks mean anti-trust hurdles persist despite Disney India’s enterprise value shrinking over 60% now. Binding definitive documents are anticipated only by February-end although top management alignment is advanced. Operations overhaul and synergy extraction remain gradual post-formal consolidation.