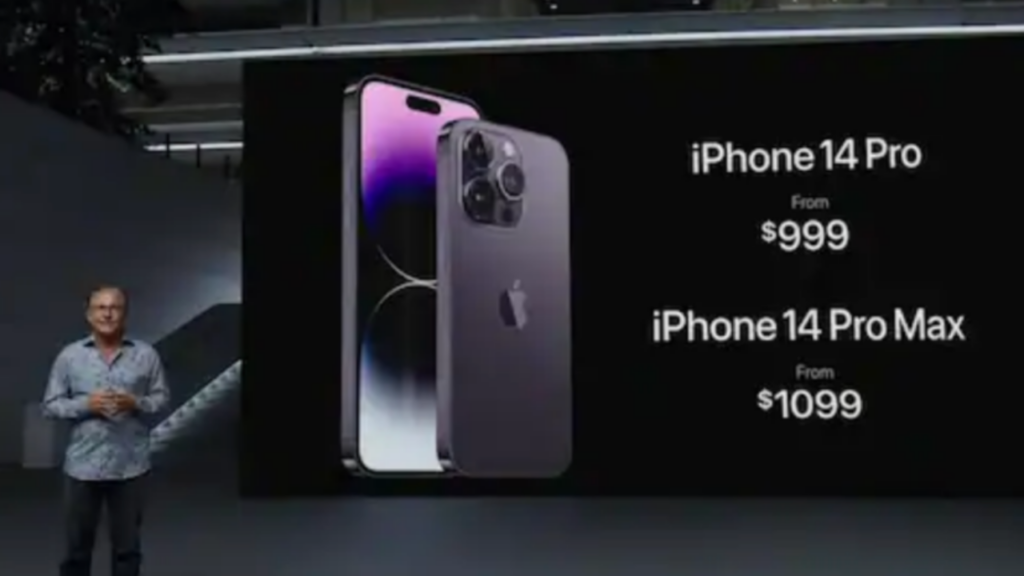

Per Canalys’s latest report, from Apple’s iPhone lineup the iPhone 14 Pro Max was the company’s best-selling flagship, followed by the iPhone 14 Pro, iPhone 14, and iPhone 13.

Apple at the top

Its overall iPhone lineup also topped the premium segment during Q1 2023.

The report also reveals that the most powerful and most expensive device in Apple’s catalog is the most popular in the world as well.

The device in question is of course the iPhone 14 Pro Max which is not only the most popular iPhone in the world but also the most popular premium smartphone.

Others on the list

The iPhone 13, introduced in 2021, claimed the fourth position on the list.

Samsung’s Galaxy S23 Ultra managed to secure the fifth spot, making it the best-selling Android flagship in the market.

The iPhone 14 Plus rounded out the top six, indicating that all devices from the iPhone 14 series made it to the list of the best-selling flagships in the first quarter of 2023.

In total, Apple had seven iPhones on the list, while Samsung had six devices.

High-end smartphones’ healthy growth

According to Canalys, the high-end smartphones (above $500) have “bucked the trend”.

31% of all shipments between January and March 2023 were of premium devices that are over $500 MSRP, the highest in the last five years

While the overall smartphone market declined 13.3% on a yearly basis this particular segment outperformed with a growth of 4.7% YoY.

Also, almost one-third of the total smartphones sold in Q1 2023 were high-end smartphones.

Top performing Android

The best-selling Android flagship for Q1 was the Samsung Galaxy S23 Ultra.

Other popular flagships from Samsung included the S23, S23 Plus, Galaxy Z Flip 4, S22, and S21 FE 5G.

The Top 15 is primarily occupied by Samsung and Apple devices which makes sense given the far wider availability of their premium devices.

For example, Google is selling the Pixel 7 series in 17 countries; Oppo is keeping the Find N2 to China, while Honor is still trying to catch up and was late to the party with an April launch of the Magic5 Pro.

Among Chinese smartphone manufacturers, only Xiaomi’s Xiaomi 13 and Huawei’s Mate 50 managed to secure a position as best-selling flagships.

Market forecast

This April Canalys suggested that the market does remain challenging with marginal declines for 2023.

Canalys Research Analyst Lucas Zhong said, “Shipments will stabilise around the levels from 2022 as we move into the middle of 2023.

Decline rates will start to improve soon, although this is more connected to the stark contrast between 2022 and 2023 shrinking.

Canalys expects the smartphone market will gain momentum in the second half of the year as channel inventories reach healthier levels.”