Tata Group has begun preliminary deliberations around hiving off its promising battery manufacturing division – Agratas Energy Storage Solutions – into an independent company as part of a strategic rejig of its green energy portfolio.

According to sources privy to ongoing discussions, Tata is evaluating such a spinoff to help Agratas raise external capital more freely and chart its own high-growth journey. An eventual domestic IPO of the unit could garner a valuation of $5-10 billion.

Agratas Eyes Funding to Fuel Capacity Growth

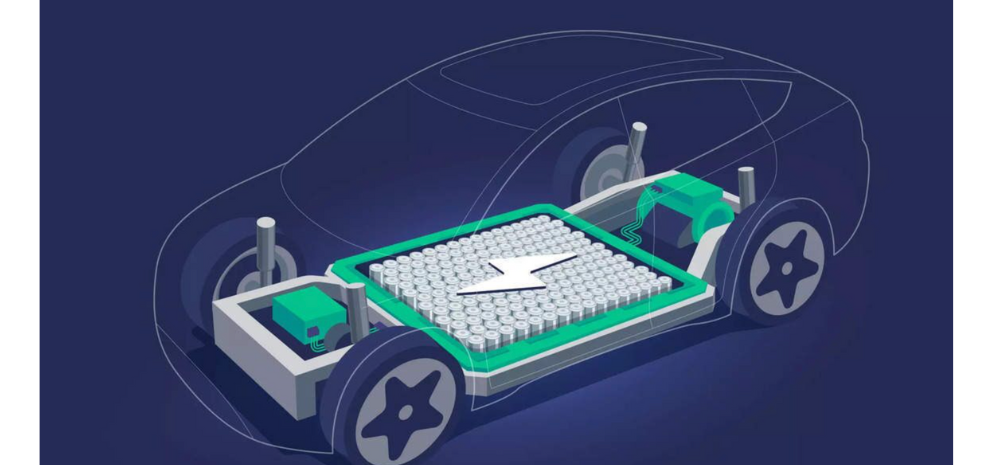

Agratas requires sizable investments to develop manufacturing hubs to produce batteries at scale for electric vehicles and renewable energy storage. As part of Tata, fundraising options remain limited. But as a standalone unit, Agratas would have more flexibility.

In fact, the company is already in discussions with banks to secure $500 million in green loans for factory expansion. Share sales later through an IPO could further propel growth. Tata however hasn’t made a final call yet on the spinoff.

Leveraging Leadership Across EVs, Batteries Tata has rapidly emerged as a dominant player in India’s EV ecosystem, with Tata Motors regaining its spot as the most valuable domestic automaker driven by its early leadership in electric cars and SUVs.

Alongside, Agratas has also built commanding market share supplying batteries for EVs and energy storage. Hence Tata feels the time may be ripe to let its battery arm chart its own journey to fully capture India’s electrification upside. If the spinoff fructifies, an IPO too would ride the sentiment.