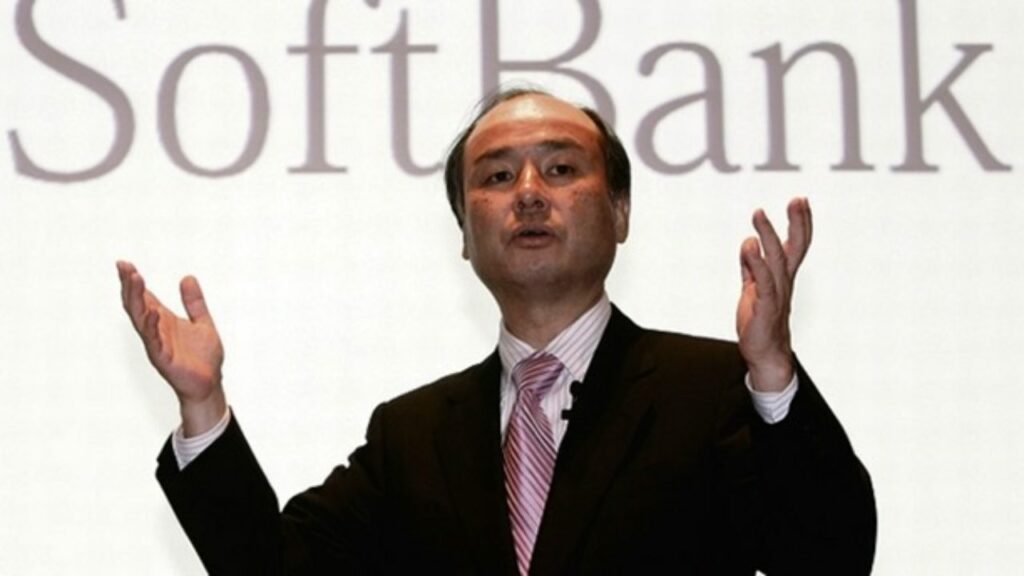

This year, SoftBank Group Corp which is one of the prolific private tech market investors in India has cut its investments in the country by more than 84 percent, reportedly.

Extremely Selective In Capital Deployment

Just a year ago, this investment firm turned extremely selective in capital deployment amid macroeconomic headwinds.

So far, the conglomerate has backed nearly a fifth of India’s over 100 unicorns by investing nearly $500 million into Indian startups this year.

Although this amount is very much down from over $3.2 billion it invested in the whole of 2021, as per the sources.

This year SoftBank has participated in only about six deals which is much lower compared to 17 in 2021.

Besides this, the invested amount is also significantly less than the previous six years’ average of $1.875 billion, reportedly.

Huge Drop In Investment

The data shows that the average check size has also dropped to $83.3 million in the first 11 months of this year compared to over $185 million in the whole of 2021.

SoftBank has invested more than $11.2 billion in Indian companies since 2017 with its Vision Fund investment units.

The investment company has invested more than $4.1 billion during 2017 and that too across just three deals.

Over the years, SoftBank has invested close to $15 billion through its Vision Fund investment units, sources said.

During 2021, the firm has participated in at least three rounds of more than $500 million.

Which includes Flipkart’s $3.6 billion round, Eruditus’s $650 million round and Meesho’s $645 million round.

Apart from thes, the Japanese conglomerate has also participated in Unacademy’s $440 million funding round and Swiggy’s $451 million round, as per the data compiled by data intelligence platform Venture Intelligence (VI).

But pictures changed during 2022 as the firm has not participated in a single round of more than $500 million.

So far, its largest round happened with Polygon’s $450 million fundraise which happened in February this year.

Besides this, the conglomerate has also invested in three rounds ranging from $100-$303 million.

When it comes to exit, SoftBank has made four exits this year which is notably the most for the Japanese investment conglomerate in the past eight years.

Before this SoftBank had sold shares only in three of its portfolio companies before 2022, as per VI data.

Its two of the three exits happened last year with Paytm’s parent One97 Communications and Policybazaar’s parent PB Fintech.

It continued this year when SoftBank sold shares in logistics unicorn Delhivery, another portfolio company of the Japanese investment conglomerate that got listed in May.

The company has garnered $6 billion through exits in Indian startups as of date.