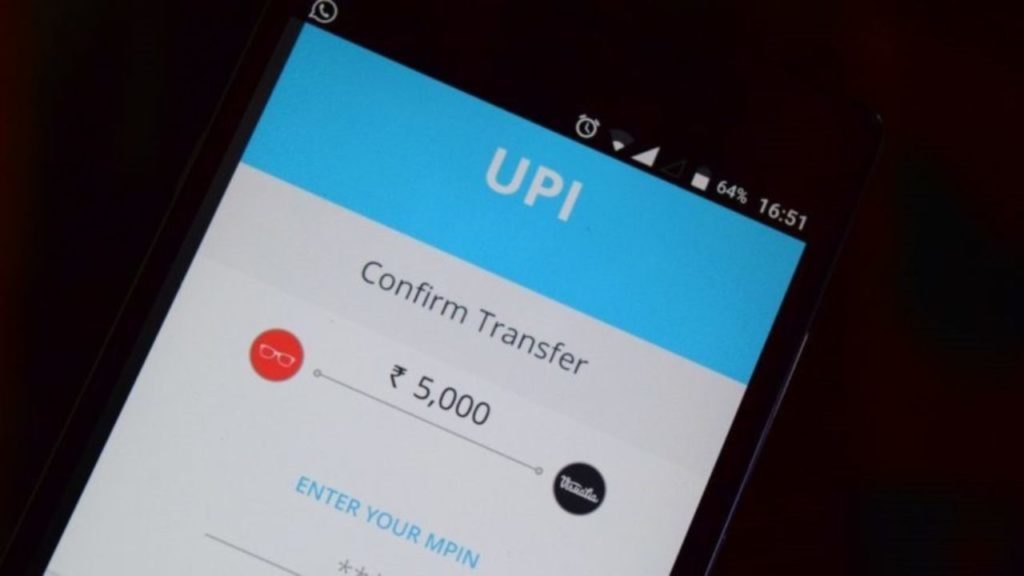

The latest official data showed that consumers are not too keen to use debit cards, with homegrown instant payment system Unified Payments Interface, or UPI, emerging as the most preferred payment method.

Indians Pick UPI Payments Over Debit Cards

It has spread its wings in such a way that for every Rs 100 spent on debit cards, consumers spent over Rs 1,900 via UPI in the year ended 31 March 2023.

Similarly, the aggregate debit card transactions by value stood at Rs 7.2 trillion in FY23, while the same for UPI was at Rs 139.2 trillion, as per the debit card usage data sourced from the Reserve Bank of India’s (RBI) 30 May annual report.

At the same time the UPI transaction data is sourced from the National Payments Corp. of India (NPCI) which is known to be the umbrella body for payment systems.

Notably, the debit card transaction volumes have been declining over the past few years.

It has reached from 4 billion in FY21 and 3.9 billion in FY22 to 3.4 billion in FY23.

When it comes to UPI transactions, its volume in FY23 was at 83.8 billion, according to NPCI.

Sources say that the ease of making payments has led to greater popularity of the NPCI-run platform.

Contrary to that, the use of debit cards has steadily declined, albeit for different reasons.

How Did This Happen?

It is mostly about the convenience of not having to carry their wallets to make a payment in case of consumers.

On the other hand, merchants use UPI because of the zero merchant discount rate (MDR) fees.

During the pandemic, customers were compelled to use contactless payment methods and, since UPI aided such transactions, people got familiarized with it and subsequently adopted it en masse, according to the Industry insiders.

The partner, Grant Thornton Bharat, Rohan Lakhaiyar said, “Merchants prefer UPI payments since they do not have to deploy expensive PoS [point of sale] machines for accepting payments. A simple QR print acts as an acceptance device, and, accordingly, UPI acceptance has become ubiquitous across the merchant ecosystem, fuelling a virtuous cycle for UPI payments.”

In fact, UPI payments are free for merchants, whereas debit cards have inherent fees ranging from 0.5% to 0.9%, due to which merchants also nudge customers to UPI, Lakhaiyar said.

In addition to that the settlement of transactions is immediate UPI payment whereas for debit cards it happens the following day.

Convenience And Accessibility

The chief executive, domestic, at JP Morgan-backed payment solutions firm In-Solutions Global, Anup Nayar said, “The shift from debit cards to UPI in India can be attributed to the convenience, accessibility, zero fees for account setup and annual maintenance, and multi-app support.”

Besides this, with UPI, users can transact directly using smartphones, eliminating the need for physical cards, Nayar added.

The ease of use and the propensity of consumers to use their mobile devices for a lot more activities than just communicating is behind this massive adoption of UPI, as per the information provided by some executives.