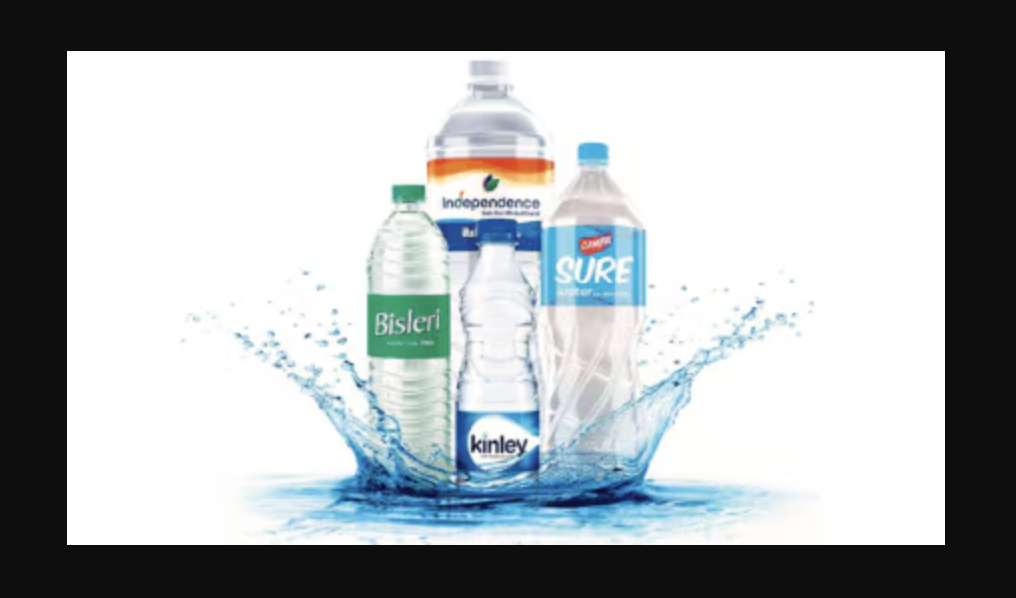

Reliance Consumer Products Limited (RCPL), the FMCG arm of Reliance Industries, is making waves in the bottled water industry with the launch of “SURE” mineral water — a high-quality, budget-friendly alternative priced 20-30% lower than market leaders. The move marks Reliance’s strategic expansion beyond beverages like Campa Cola into daily essentials, targeting the rapidly growing ₹30,000 crore packaged water market.

Purity Meets Affordability: SURE’s Product Lineup

“SURE” water is designed to deliver safe, mineral-enriched hydration at competitive prices. Each bottle undergoes reverse osmosis and UV purification to meet BIS standards while retaining essential minerals for health and taste. Packaged in eco-friendly PET bottles, it caters to households, offices, and on-the-go users alike.

Key product variants:

| Variant | Capacity | Price (₹) | Discount vs. Peers |

|---|---|---|---|

| Small Bottle | 250ml | 5 | 20-30% (vs. Bisleri ₹7) |

| Medium Bottle | 500ml | 10 | 20-30% (vs. Kinley ₹13) |

| Large Bottle | 1L | 20 | 20-30% (vs. Aquafina ₹25) |

| Jar | 20L | 80 | Bulk savings |

Available across Reliance Retail, JioMart, and Reliance Smart, SURE promises reliable hydration at unmatched value.

Guwahati Plant: The Engine Behind Expansion

The February 2025 launch coincides with the inauguration of RCPL’s state-of-the-art 6 lakh sq. ft. bottling plant in Guwahati, built in partnership with Jericho Foods & Beverages LLP.

Key highlights:

- Capacity: 18 crore liters annually for water, 10 crore liters for soft drinks.

- Product Range: SURE, Independence water, Campa Cola, Campa Orange, Campa Lemon, and Power Up.

- Job Creation: Over 200 local jobs in Assam.

- Technology: High-speed 583 BPM water line and eco-conscious bottling processes.

This facility strengthens Reliance’s supply chain in the Northeast, enabling rapid distribution and pan-India scalability.

Market Strategy: Disrupting an Established Sector

India’s bottled water market, dominated by Bisleri (25% share), is ripe for disruption. Reliance is entering aggressively with a price-leadership model, focusing on urban and semi-urban consumers seeking affordability without compromising quality.

Strategic Advantages:

- Pricing Power: 20–30% cheaper than rivals.

- Distribution Strength: Access to 18,000+ Reliance Retail outlets.

- Regional Focus: Northeast-first rollout before nationwide expansion.

- Brand Synergy: Complements Campa’s beverage portfolio and leverages RCPL’s FMCG momentum.

Analysts believe this approach could challenge existing players and help Reliance capture 5–10% market share by FY26.

Challenges Ahead: Sustainability and Competition

While pricing is a strong differentiator, Reliance must address environmental concerns around PET waste and ensure authentic mineral sourcing. Additionally, competitors like Bisleri and Aquafina may counter with discount campaigns and loyalty programs.

Conclusion: A Bold Bet on Value Hydration

With “SURE,” Reliance is not just selling water — it’s building a strategic foothold in a high-demand essential category. By combining affordability, purity, and vast distribution, RCPL aims to make premium hydration accessible to every Indian. If successful, SURE could not only quench consumer demand but also redefine competition in the bottled water industry.