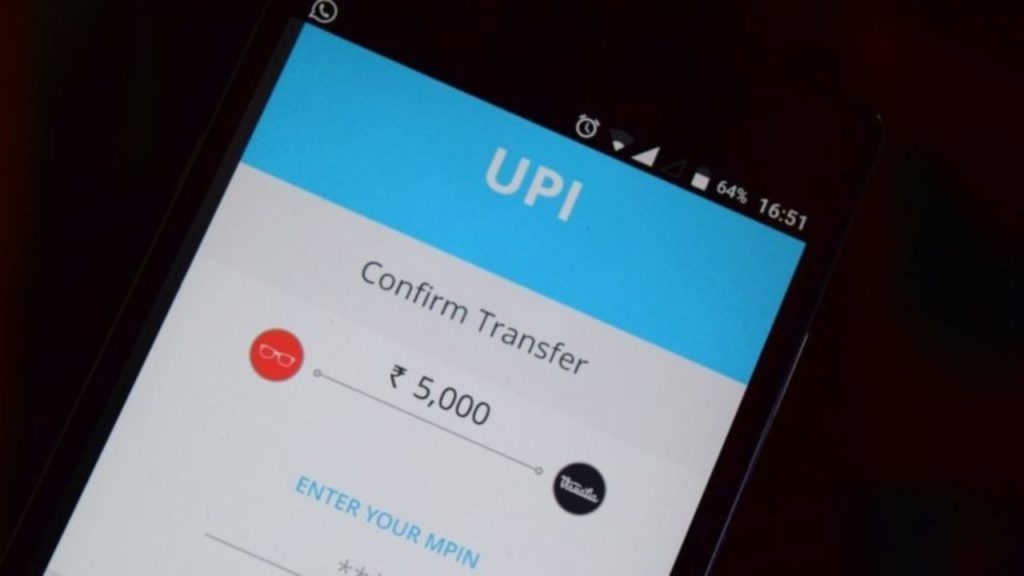

The UPI Lite will now be integrated with the e-mandate framework as announced by the Reserve Bank of India (RBI).

How Does This Help?

The move is expected to help in auto-replenishment of UPI Lite balances.

According to the Governor Shaktikanta Das, this integration will enhance the ease of making small-value digital payments.

RBI said, “The UPI Lite facility currently allows a customer to load his UPI Lite wallet upto Rs 2000 and make payments upto Rs 500 from the wallet. In order to enable the customers to use the UPI Lite seamlessly, and based on the feedback received from various stakeholders, it is proposed to bring UPI Lite within the ambit of the e-mandate framework by introducing an auto-replenishment facility for loading the UPI Lite wallet by the customer, if the balance goes below a threshold amount set by him/her. Since the funds remain with the customer (funds move from his/her account to wallet), the requirement of additional authentication or pre-debit notification is proposed to be dispensed with.”

“This integration makes it easy for UPI Lite customers as he/she does not have to do the steps of authorisation and authentication. It will load the wallet automatically as long as the balance is available in his/her account for e-mandate payments,” said V. Balasubramanian, CEO, Financial Software and Systems (FSS).

Auto-fill Feature For Ensuring Sufficient Funds

Further, the auto-replenishment feature will ensure that your UPI Lite wallet always has sufficient funds thereby helping you conduct payments even if you forget to reload your UPI Lite wallet, said Vinayak Goyal, the Executive Director of AGS Transact Technologies.

Adding, “The key feature of UPI Lite is the ability to make small payments up to Rs 500 without a UPI PIN, making it a faster and preferred payment option for day-to-day transactions such as small value retail purchases. The auto-replenishment feature will ensure that your UPI Lite wallet always has sufficient funds, saving time and effort, and providing an uninterrupted payment experience.”

To encourage wider adoption of UPI Lite, it is now proposed to bring it under the e-mandate framework by introducing a facility for customers to automatically replenish their UPI Lite wallets if the balance goes below the threshold limit set by them, said Governor Shaktikanta Das during the RBI MPC meeting.

Besides this, it will also enhance the ease of making small value digital payments.

“The framework for processing of UPI e-Mandate for recurring transactions, has been issued by the RBI on January 10, 2020. This currently enables recurring payments with fixed periodicity such as daily, weekly, monthly, etc,” said Mehul Mistry, the Global Head-Strategy, Digital Financial Services and Partnerships, Wibmo which is a PayU Company while Explaining how the auto-replenishment feature works.

Further adding, “The integration of UPI Lite with the e-mandate framework will bring convenience to customers, enabling them to make person to person (P2P) and person to merchant (P2M) payments up to Rs 500 per transaction frictionlessly without a UPI PIN. Additionally, the UPI Lite wallet can be auto-replenished from the underlying Savings Account or RuPay Credit Card.”