Mukesh Ambani, the visionary behind some of India’s most transformative ventures, is once again set to redefine an industry—this time, banking. Jio Financial Services, a subsidiary of Reliance Industries, has quietly launched an innovative mobile app that promises to bring all essential banking services directly to users’ smartphones, eliminating the need for physical bank branches.

The Jio Finance App: A Comprehensive Financial Hub

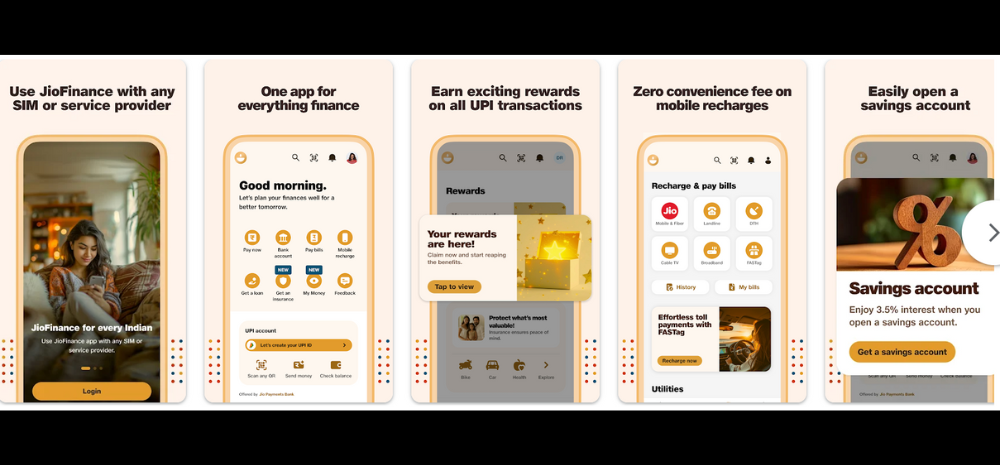

The newly launched Jio Finance App is designed to be a one-stop solution for all financial needs. From UPI payments and bill settlements to securing home loans and insurance, this app offers a wide range of services that can be accessed with just a few taps on a mobile device. With over 10 lakh downloads already, the app is quickly gaining traction, signaling its potential to become a dominant force in the financial sector.

Disruption on the Horizon

Much like Reliance Jio’s entry into the telecom industry, which forced established players like Airtel and Vodafone to rethink their strategies, the Jio Finance App is poised to disrupt the financial sector. Traditional banks, fintech platforms such as Paytm and PhonePe, and even credit card companies are closely monitoring this development, as the app’s full-scale launch could make traditional banking methods obsolete.

The Future of Banking in India

The implications of this app’s success are enormous. As it moves beyond its pilot phase, the Jio Finance App is expected to offer a smooth, seamless experience for users, addressing any initial glitches and bugs. With comprehensive financial services available on a mobile platform, the concept of banking is set to undergo a radical transformation in India. As we checked, they are offering 3.5% on money deposits, via Jio Payments Bank.

Ambani’s Market Dominance

Mukesh Ambani has once again demonstrated that when Reliance enters a market, it doesn’t just compete—it dominates. The Jio Finance App is not just another entry into the digital finance space; it’s a potential game-changer that could reshape how Indians manage their finances, pushing the industry towards a future where mobile banking becomes the norm.

Conclusion

As the Jio Financial Services app continues to roll out, it holds the promise of revolutionizing banking in India. With its potential to disrupt traditional banking models and reshape the financial landscape, Mukesh Ambani’s latest venture reaffirms Reliance Industries’ ability to lead and transform entire sectors. The future of banking in India may very well lie in the palm of your hand.