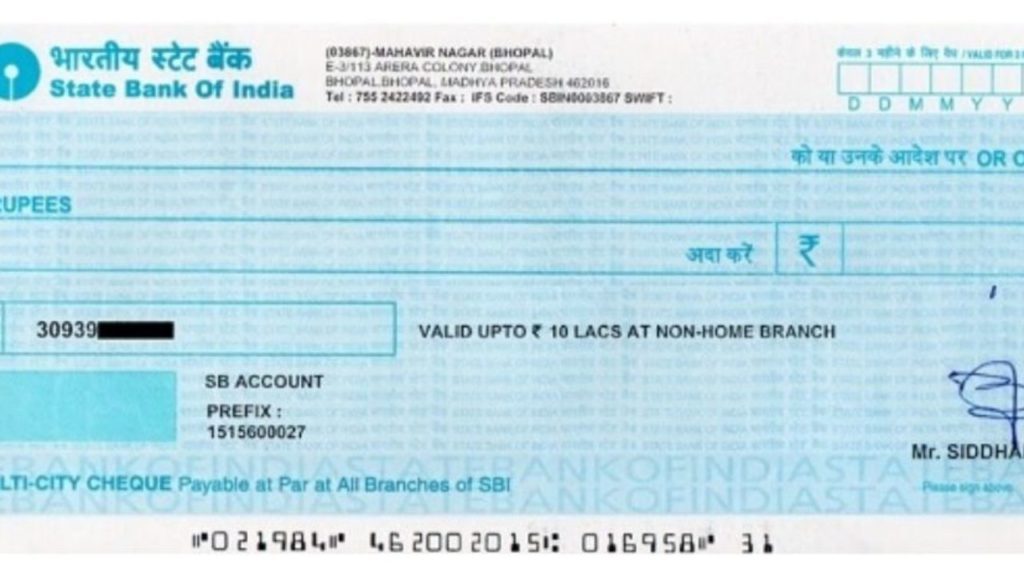

Starting October 4, India’s cheque clearing process will operate in a continuous, near real-time manner, significantly reducing the time taken for funds to reflect in accounts. The RBI’s move replaces the existing batch-based model with hourly settlements, marking a major step towards faster, more efficient banking operations.

How the New System Works

Cheques deposited between 10 a.m. and 4 p.m. will be instantly scanned and sent for clearing. Settlements between banks will occur every hour starting at 11 a.m. The paying bank must confirm payment by 7 p.m., failing which the cheque will be auto-approved — ensuring quicker fund availability.

Benefits for Customers and Businesses

- Faster access to funds: Money will now be credited within hours instead of 1–2 business days.

- Improved cash flow: Businesses will receive payments faster, enhancing liquidity.

- Nationwide uniformity: Clearing speed will be consistent across India.

- Better transparency: Real-time status tracking of cheque clearance.

How Cheque Clearing Evolved

- Pre-1980s: Manual processing took up to a week.

- MICR & CTS: Reduced clearing time to 1–3 days.

- T+1 Model: Nationwide clearing in one day.

- Now: Continuous clearing cuts it to just hours.

Phased Rollout Plan

- Phase 1 (Oct 4, 2025 – Jan 2, 2026): Banks must confirm by 7 p.m.

- Phase 2 (From Jan 3, 2026): Response window will shrink to just three hours.

Nationwide Implementation

The new system will cover all bank branches under RBI’s three grids — Delhi, Mumbai, and Chennai — ensuring uniform adoption across the country. A special trial clearing on October 3 will test systems for a seamless transition.

This overhaul marks a transformative shift in India’s payment landscape, bringing cheque transactions in line with the speed and convenience of modern digital payments.