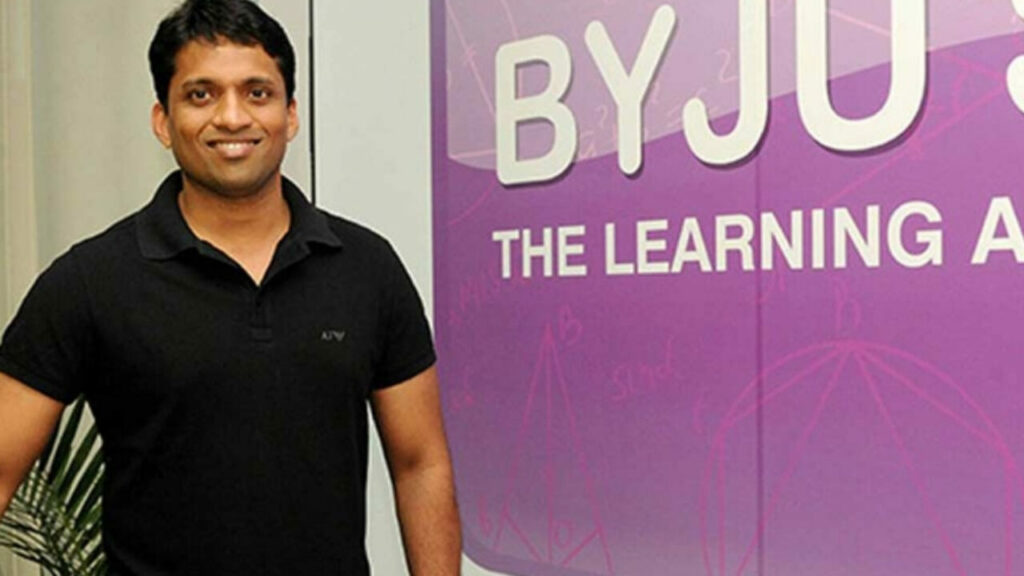

Byju Raveendran, the founder of Byju’s, a prominent edtech unicorn, has called for a meeting with senior management to update them on the company’s business and liquidity situation.

The meeting, anticipated to take place on December 5, is expected to provide clarity on Byju’s current financial position.

Byju Raveendran Calls For a Meeting With Senior Management

Sources reveal that Byju’s requires a cash infusion of 500-600 crore by March to settle pending employee dues, vendor payments, tax obligations, and commitments to the Board of Control for Cricket in India (BCCI).

Byju is reportedly confident about addressing this liquidity requirement through asset sales and potential pledging of his holdings in Aakash or Think and Learn.

The company has faced financial challenges, leading Byju to borrow from family, friends, and other entrepreneurs in recent months to meet salary and vendor payment obligations. Byju’s monthly shortfall is estimated at Rs 60-70 crore, despite successfully reducing its overall costs.

While its wage bill has decreased from over Rs 300 crore a year ago to Rs 130 crore, the company is actively exploring avenues to raise funds, including selling some of its acquired assets.

Byju’s To Sell Assets to Generate Funds

At its peak during the edtech boom in 2020-2021, Byju’s aggressively raised funds and acquired numerous companies. However, the company is now relying on selling these assets to generate funds and sustain its core edtech business in India.

The anticipated sale of assets, particularly the Epic sale, is expected to address the company’s older liabilities, amounting to less than 100 million. Byju Raveendran, the founder, is reportedly confident in navigating the liquidity crunch without the immediate need for investor support.

These developments unfold against the backdrop of Byju’s recent struggles, including alleged accounting irregularities, mis-selling of courses, and mass layoffs. The company has undergone significant changes, with early investor Ranjan Pai injecting capital, the establishment of an advisory council, and the elevation of Arjun Mohan as CEO.

Byju’s is also exploring divestment options for assets like Great Learning and Epic. The upcoming annual general meeting on December 20 is expected to address various matters, including approving audited financials, the appointment of statutory auditors, and remuneration discussions.