Five years ago in 2017, Bhavik Koladiya along with Shashvat Nakrani started the fintech company BharatPe.

However, the firm has been mired in controversy since January 2022 leading to some top-level exits including Koladiya himself who left in August last year.

He has now sued BharatPe and former co-founder Ashneer Grover over a share dispute.

Removed as co-founder

In July 2017, co-founders Koladiya and Nakrani had started BharatPe and incorporated it in March 2018.

Koladiya was the face of his company until June 2018, when Grover became the third co-founder.

The shareholding structure then was such that Grover had 32 per cent equity, Nakrani held 25.5 per cent and Koladiya was the largest shareholder with a 42.5 per cent stake.

However, in December 2018 just before Sequoia became an investor, Koladiya’s name disappeared from the founders’ list “owing to discomfort on the part of large institutional investors to have a person with a jail term in the US.”

Letting go of shares

It was then that Grover took over and Koladiya continued to remain as a ‘consultant’.

The founders and other stakeholders decided to reduce Koladiya’s public involvement with the firm.

This meant Koladiya transferring his shares to Grover, Nakrani, Nakrani’s father Mansukhbhai Mohanbhai Nakrani and some angel investors.

He had sold Grover his 1,600 shares whose total value was around ₹ 88 lakh but no money was paid to him.

He said the shares have now gone up to over 16,000 and it should not be owed to Grover anymore.

Legal troubles in US

Koladiya held a majority stake in his company but had to exit the cap table due to a past conviction for credit card fraud in the US.

He had served a jail term in the US for running a grocery store and accepting digital payments without a license.

This violated identity theft and mail fraud laws in the US, and he ended up getting arrested and jailed.

After a 22 month-long trial he was charged a fine and deported back to India in 2015.

According to the people in the know, Koladiya’s involvement in BharatPe would have hurt fundraising chances so he had to step down and relinquish his shares.

Court hearing

Now he wants to get his shares in the company back.

In an application, he requested a temporary injunction restraining Grover from creating any third party rights in the shares.

The Delhi High Court presided over the matter on 18 January and issued summons to Grover.

Justice Prateek Jalan noted Grover’s counsel’s submission that he will file a reply to the suit and not create any third party rights to the 16,110 shares in question.

As the court asked why Mr Koladiya gave away his shares, senior advocate Mukul Rohatgi, appearing for Mr Koladiya, said he is a gullible person.

Further hearing

“Defendant no. 1 (Grover) is bound down to this statement and is directed to file an undertaking in this regard within a week from today. Reply to the application be filed in four weeks and rejoinder in two weeks thereafter,” the high court said.

It listed the suit for further hearing on March 16.

Grover’s counsel alleged that the documents shown to the court were false and fabricated and that his wife had paid ₹ 8 crore to Koladiya’s wife.

Shares sold not pledged

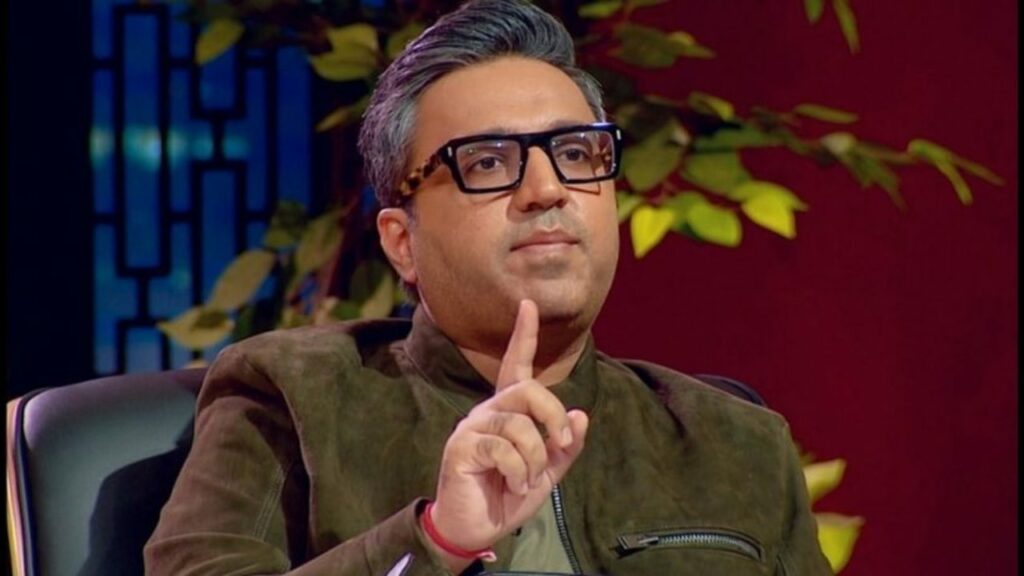

The former Shark Tank India judge Grover had said multiple times that Koladiya had sold his shares to him and other buyers.

Koladiya argued that he had triggered an agreement signed with Nakrani and Grover in 2018 to get his ‘pledged shares’ of BharatPe.

According to Koladiya, Nakrani had stuck to the deal following which he was expected to become a shareholder of BharatPe but Grover had not reverted.

As of today, Grover holds shares worth over Rs 1,000 crore for Koladiya.