Unlimited UPI Transactions No More? PhonePe, Google Pay Can Impose Restrictions On UPI Usage

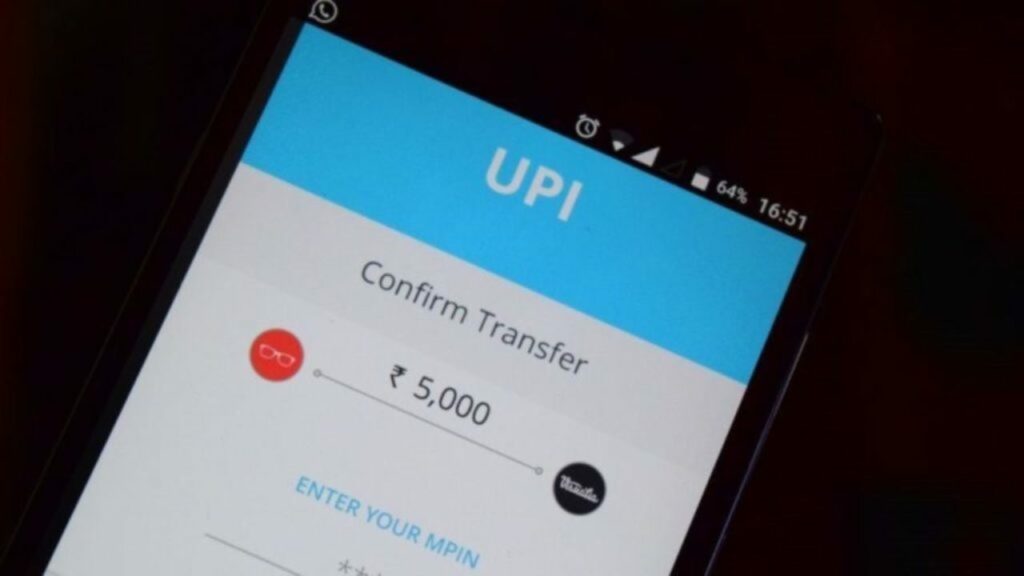

Payment apps which offer UPI services, payments like Google Pay, PhonePe, and others could soon set limits on transactions.

Contents

The matter under consideration

This means users will no longer have the freedom to make unlimited payments through such apps.

The National Payments Corporation of India (NPCI), which operates UPI, is in talks with the RBI to implement the market cap deadline of 30%.

When it comes into force the rule will limit the volume of UPI transactions to 30% per app.

NPCI is exploring all possibilities and no call has been taken on extending the deadline of December 31.

Deadline extension sought by everyone

It has received requests from stakeholders and may decide on how to go about the implementation (or deferral) of UPI market cap guidelines by the end of this month.

The report comes on the back of industry stakeholders and leading UPI players such as PhonePe and Google Pay holding talks with the NPCI to delay the implementation of the move.

PhonePe has already put in a formal request to defer the December 31 deadline by at least three years.

Other players have reportedly sought an extension of five years.

November-end decision expected

NPCI is likely to reach a final decision on the issue by the end of November after examining representations and consulting the RBI.

It is noteworthy that the NPCI was, at one point, considering deferring the implementation since nearly INR 10 Lakh Cr worth of UPI transactions are processed every month.

Background

The market cap plan, dubbed the Third Party Applications (TPAP) guidelines, was notified in November 2020.

The aim was to limit the duopoly within the UPI ecosystem and provide a level playing field to other UPI players.

The NPCI gave all payment players two years to comply with the new rules, i.e., limit their customer onboarding and reduce their market cap.

If they failed to do so, they would face payment failures upon reaching the 30% threshold.

Top players

Currently, PhonePe holds nearly 50% share in the UPI market, while Google Pay holds nearly 35% share.

In the event that the TPAP guidelines get implemented in 2023, a UPI app would not be allowed to onboard new customers on breaching the 30% mark.

Further, the respective UPI app will have to inform users that it has exceeded the 30% limit and will only be available when the NPCI allows.

Other matters to ponder

The NPCI has yet to come out with a detailed SOP.

But there are still questions regarding monitoring transaction volume, disruption in user experience and the benefits of the restrictions that still have to be answered.

PayTm issues clarification

PayTm has shared that it supports and welcomes the proposed implementation of NPCI’s UPI market cap.

With this, the UPI ecosystem in India will see further growth in a democratized manner, encouraging wider participation and ending the market concentration risk, the company stated.

Not a TPAP

PPBL, which owns Paytm UPI, is NPCI certified PSP (Payment Service Provider) and Issuer Bank for UPI transactions, and not a Third Party Application Provider (TPAP).

Thereby it won’t come under the purview of NPCI’s market cap.

The Bank is an Issuer and PSP Bank in itself along with being an acquirer of UPI transactions on its own platform, and serves the customer end-to-end in a transaction.

PayTm Payments Bank issues statement

A Paytm Payments Bank Spokesperson said, “We believe the proposed implementation of UPI market capping will be hugely beneficial for the UPI ecosystem.

This move by the NPCI will bolster the growth of digital payments and democratize it for the citizens, ending market concentration risk.

With this, UPI will become even more accessible and enable further digital adoption.”

Make payments even without PayTm account

The Bank is now enabling users to make transactions across all UPI payment apps with just the mobile number, and even if it is not registered with Paytm.

With this, users can receive and send money instantly to any mobile number with a registered UPI ID across platforms using the Paytm app.

This further deepens Unified Payments Interface (UPI) interoperability and roots for the adoption of mobile payments.

Comments are closed, but trackbacks and pingbacks are open.