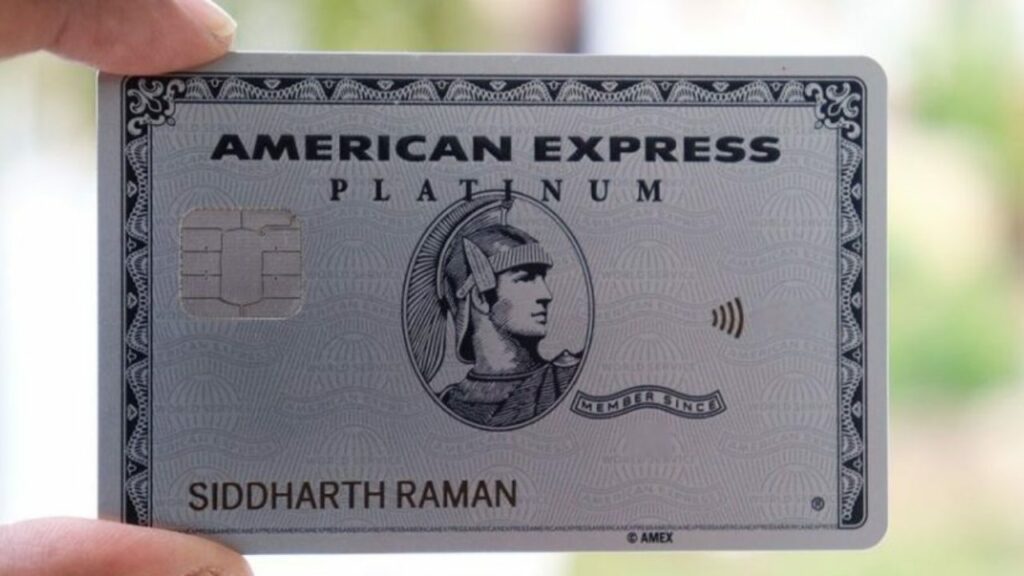

American Express Allowed To On-Board New Credit Card Customers In India; RBI Lifts Ban

RBI has lifted restrictions imposed on American Express Banking Corp after the latter demonstrated satisfactory compliance to RBI rules.

The restrictions were imposed based on an order dated April 23, 2021 in accordance with RBI circular dated April 6, 2018 on Storage of Payment System Data.

Contents

Requirements

They were barred from onboarding of new domestic customers onto its card network from May 01, 2021 for non-compliance with the RBI circular on Storage of Payment System Data.

Per that circular, all payment system providers had to ensure that within six months the entire data (full end-to-end transaction details / information collected / carried / processed as part of the message / payment instruction) relating to payment systems operated by them is stored in a system only in India.

They also had to report compliance to RBI and submit a Board-approved System Audit Report (SAR) conducted by a CERT-In empanelled auditor within the timelines specified therein.

Mastercard

In a similar action, on June 16 this year, the RBI had lifted the restrictions imposed on Mastercard citing improvement compliance.

As per the restrictions they were barred from on-boarding new domestic customers (debit, credit or prepaid) onto its card network from July 22, 2021.

They were punished for non-compliance with the RBI’s 2018 circular on Storage of Payment System Data.

On April 6, 2018, the RBI said that it had observed that not all system providers stored payments data in India.

Data storage rules

Such systems were also highly technology dependent which necessitated the adoption of best-in-class safety and security measures on a continuous basis.

System providers must ensure that all data related to payment systems operated by them are stored in a system only in India.

This data should include complete end-to-end transaction details and information collected, carried and processed as part of the message and payment instructions.

For the foreign leg of transactions, if any, the data can also be stored in the foreign country, if required.

Amex’s response

Sanjay Khanna, Interim CEO and COO, American Express Banking Corp, India welcomed RBI’s move to allow them to onboard new customers effective immediately.

He said that India is a key strategic market for the company and that the central bank’s decision is the “result of our significant local investments in technology, infrastructure, and resources.”

“American Express’ ability to deliver best-in-class value and customer experiences will enable us to meet the increasing demand for premium products and services and grow our business in India,” he added.

[…] Each topic is well researched from multiple sources and written with focus on detail. Prev Post American Express Allowed To On-Board New Credit Card Customers In India; RBI Lifts BanNext Post Apple Employees Revolt Against 3-Day Work From Office Rule Imposed by Management! Apple […]