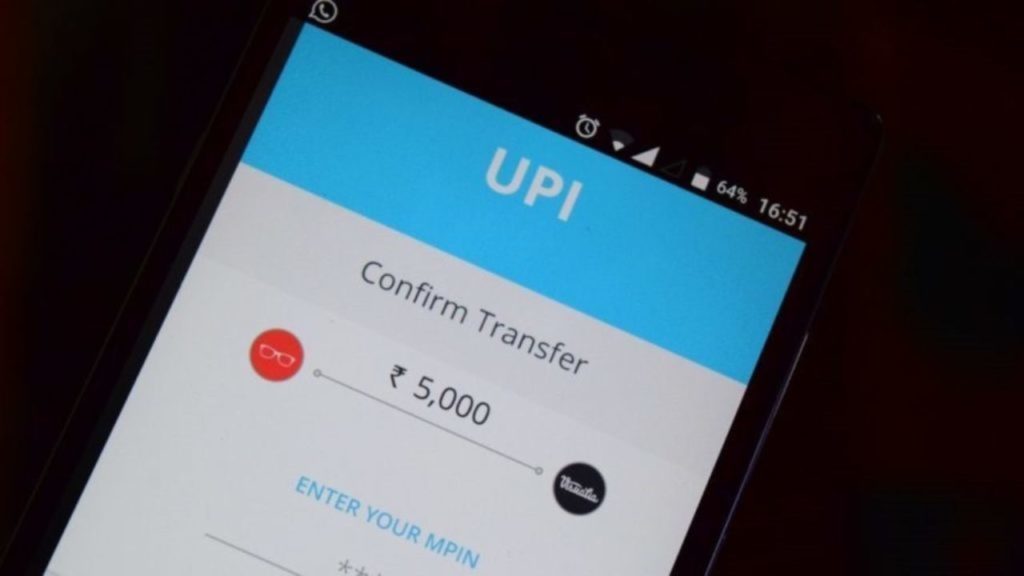

Google Pay, PhonePe, Paytm Wants To End SMS-Alerts For Financial Transactions; App Notifications Are Enough?

Major fintech companies such as Google Pay and Paytm have requested the government to allow in-app alerts in lieu of mandated SMS notifications for banking transactions.

Contents

Industry-Wide Request

They have cited higher cost as well as security risks as reasons behind the change.

The industry has proposed that customers be given the option of choosing both or either options for a smooth transition to the new system.

Nasscom wrote the petition, representing the fintech industry to the RBI to consider allowing app-based notifications for banking transactions.

Higher Costs Of SMS Alerts

At present, the RBI requires banks to send only SMS alerts for each transaction with the cost borne by the banks and financial services firms.

The industry lobby said that SMS charges are estimated at ?0.12 per message while the cost of an ‘In-App notification’ is pegged at ? 0.001.

It further said that India recorded digital payment transactions worth Rs 8,734 crore in the financial year 2022.

The cost of SMS -based notifications would therefore have added up to approximately Rs 1048 crore.

In contrast, in-app notifications would have cost about Rs 8.8 crore.

Proposal

Nasscom’s public policy vice president Ashish Aggarwal said that the RBI wants to ensure that a customer is aware of activities in their transaction account.

Hence, the focus should be on secure and efficient access to information instead of limiting the method of information transmission or storage.

Nasscom has suggested that customers be allowed to choose either or both SMS and ‘In-App notifications’ for small volume transactions of up to ?10,000.

For transactions higher than ?10,000, both SMS and ‘In-App notifications’ may be mandatory and later the thresholds may be increased.

SMS More Prone To Fraud

Apart from cost savings there are security benefits since there are fewer chances of frauds with in-app notifications as it is linked to a user’s behaviour on the app.

SMS alerts are also commonly used by fraudsters and that there is no mechanism in place to authenticate and determine the authenticity of such SMSes.

Further, in-app notifications get triggered in real time and customers get notified as soon as a transaction is done.

In-App Notifications More Secure

The failure rates for SMS-based notifications are also allegedly higher.

But ‘In-App notifications’ may have a higher success rate since they serve as direct communication between the bank and customer.

Since only RBI regulated entities are allowed to send ‘In-App notifications’, it helps reduce the risk of malicious messages defrauding customers, since no third party will be able to send ‘In-app notifications’.

Comments are closed, but trackbacks and pingbacks are open.