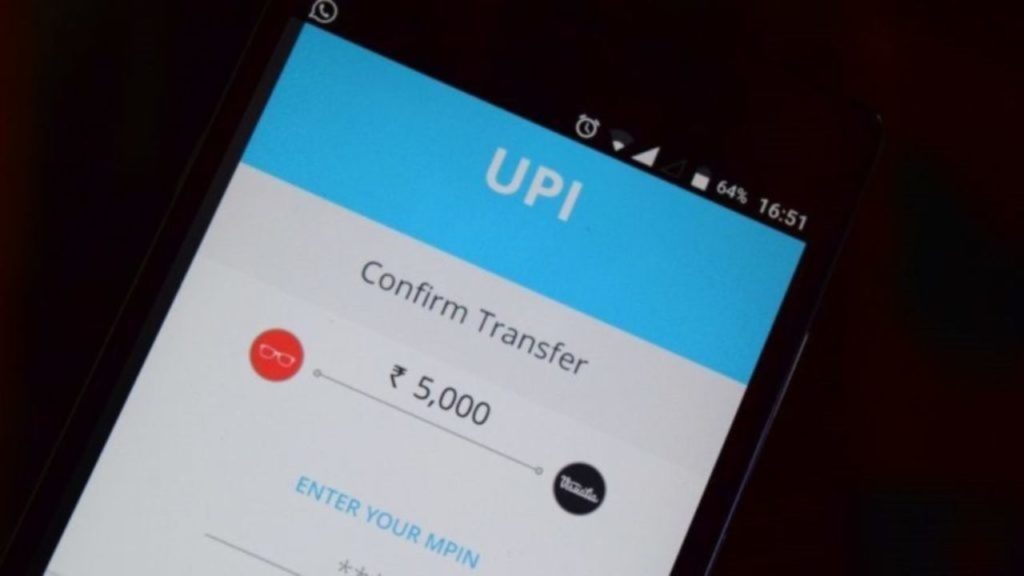

UPI For Feature Phones Launched: Transfer, Receive Money Without Internet!

In order to improve the digital adoption in country, the Reserve Bank of India (RBI) governor Shaktikanta Das rolled out Unified Payments Interface (UPI) for feature phones on 8 March.

According to the RBI, the move will bump up digital adoption, so they launched a 24×7 helpline for digital payments called DigiSaathi.

24×7 helpline And UPI For Feature Phones

Basically this UPI 123Pay helpline will allow customers to use feature phones for almost all transactions except scan and pay.

On top of that it doesn’t even need an internet connection for transactions.

For using this, the customers simply have to link their bank account with feature phones to use this facility.

How Does This Help?

According to Das, this implementation of UPI on feature phones will most likely help the people in rural areas as they cannot afford a smartphone to participate in UPI transactions.

Further adding, “This current decade will witness a transformative shift in the digital payments ecosystem in the country,” as RBI has announced several measures in the last three years to push digital transactions.

Cybersecurity And Cyber Risks

Beside this, Das also stressed on the need to focus on cybersecurity and said systems need to be prepared to face such cyber risks.

Interestingly, the move comes after the central bank in December announced a plan to introduce UPI in feature phones.

But sadly, it remained confined to smartphones as a payment platform ever since rolling out in 2016.

This way, it has limited its use among people in rural areas who have feature phones.

It is noteworthy here that the UPI transactions have grown multifold after the UPI payment platform was introduced in 2016.

With the move of enabling UPI on feature phones will definitely increase digital penetration of financial services.

It would also help a large segment of people without access to smartphones or reliable internet services to transact digitally.

Comments are closed, but trackbacks and pingbacks are open.