Tata Will Spend Rs 12,100 Crore To Acquire 93.7% Stake In This Public Sector Steel Plant (Full Details)

It’s the wave of privatization in the country. Recently we witnessed the homecoming of Air India. Now it’s the same Tata only who are in the news for winning a bid to acquire another drenched PSU.

Tata wins bid to acquire 93.71% in NINL

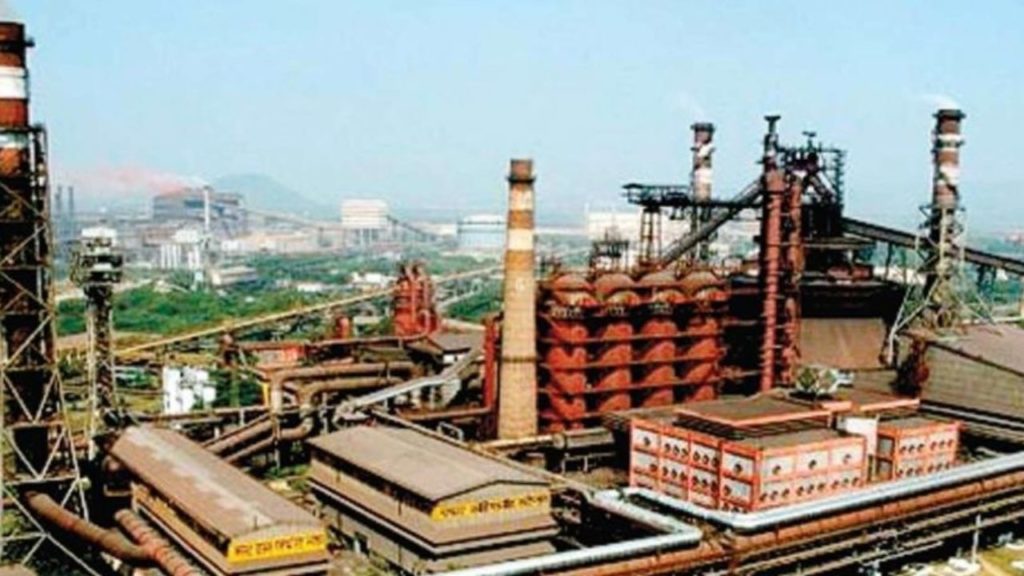

Recently, the government approved the highest bid of Tata Steel Long Products Limited for acquiring 93.71 percent equity in Neelachal Ispat Nigam Ltd (NINL). NINL has an integrated steel plant with a capacity of 1.1 MT, at Kalinganagar, Odisha. The NINL is held by joint venture partners of four CPSEs and two Odisha government companies, at an enterprise value of Rs 12,100 crore.

NINL is a joint venture of 4 CPSEs, — MMTC, NMDC, BHEL, MECON — and 2 Odisha government-owned companies OMC and IPICOL. The company has been running in huge losses and its plant is closed since April 2020.

An alternative mechanism, comprising Transport minister Nitin Gadkari, Finance Minister Nirmala Sitharaman, and Commerce & Industry Minister Piyush Goyal, has approved the bid.

“The company has huge debt and liabilities exceeding Rs. 6,600 crores as of 31.3.2021, including overdue promoters (Rs 4,116 crore), banks (Rs 1,741 crore), other creditors, and employees. The company has a negative net worth of Rs 3,487 crore and accumulated losses of Rs 4,228 crore as of 31.3.2021,” the government said in a statement.

This acquisition will help in reviving the local economy

Tata Steel Long Products won the bid by defeating JSW Steel and a consortium of Jindal Steel & Power Limited and Nalwa Steel and Power Ltd. This is the second large privatization deal post-sale of Air India to Tata Group.

“This is the first instance of privatization of a public sector steel manufacturing enterprise in India. The success of the transaction is a win-win situation for all. The biggest advantage of privatization will be to the local economy of the region as the strategic buyer will be able to revive a closed plant, bring in modern technology, best managerial practices, and make an infusion of fresh capital, which will help in augmenting the capacity of the plant,” the government said.

Now, the government will issue a Letter of Intent to Tata Steel Long Products. After that, a share purchase agreement will be signed. At this stage, 10 percent of the bid amount shall be paid by Tata into the escrow account. It should be noted that the government had provided access to the virtual data room of the company to the bidders for conducting due diligence.

[…] This… Privatization Of Govt Banks: No Jobs Will Be Lost, More Jobs Will Be Created Tata Will Spend Rs 12,100 Crore To Acquire 93.7% Stake In This Public Sector Steel… Tata Group Will Become Official Owners Of Air India On January 27th: India’s… […]