Charges For ICICI Bank Credit Card Users Increase For These Services: Rs 500 Is Minimum Late Fees Now!

Just the other day we had written a story on how PNB is making changes in charges it levies on various services. This time it is the turn of ICICI Bank, to make changes in its fee structure. The bank has made changes in the way credit cardholders will be charged.

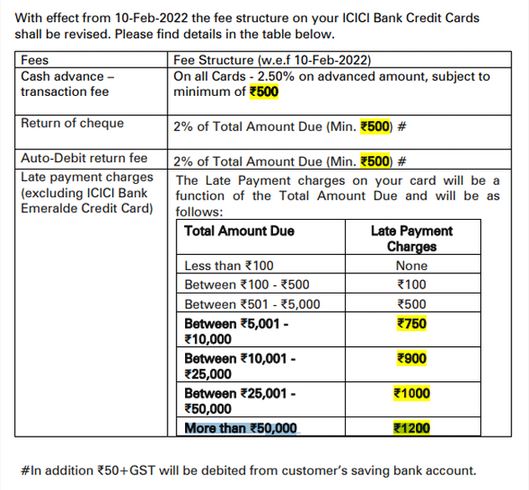

In a message to its credit card customers the bank has stated that it has increased charges of various services related to credit cards, this includes late payment fees. “Dear Customer, effective 10-Feb-22, the fee structure on your ICICI Bank Credit Card shall be revised. For more details on MITC, visit bit.ly/3qPW6wj,” read the message to its ICICI Bank credit card customers.

It should be noted that the latest fee structure on ICICI Bank Credit Cards will be applicable from February 10, 2022.

Transaction charge on Cash Advance has been revised

Starting from February 10, 2022, ICICI Bank credit card customers will have to pay a transaction charge on cash advance has been revised to 2.50% on advanced amounts on all cards, subject to a minimum of Rs 500. In case of cheque return, the bank will now charge 2% of the total amount due with a minimum of Rs 500.

It should be noted that Cash advance is the facility of using your credit card to withdrawal cash. Unlike purchases at merchant establishments, the interest rate meter on cash withdrawals starts from the first day only. During international travel, foreign exchange cash withdrawals could attract an additional transaction fee. As it is a costly option so it is best to avoid cash withdrawals, except in an emergency. Too many small withdrawals can lead to high fixed charges

Late payment fees have also been increased

The ICICI bank has also revised late payment charges for all its credit cards except ICICI Bank Emerald Credit Card. Late payment charges will vary based on the total amount due. It should be noted that if your total amount due is less than Rs 100, then the bank will not charge you. At the same time, for higher amounts, the charges keep increasing with an increase in due amount. The highest amount that the bank will charge is Rs 1200 for amounts over Rs 50,000.

If in case of any unforeseen events, you fail to repay your credit card bill by the due date, it is best to avoid further use of your credit card. At this place, you can convert big-ticket transactions into EMIS (equated monthly installments) for ease of repayment. According to experts, if you are not able to repay the entire outstanding at one go, or not even able to convert transactions into EMIS, then you can also take a personal loan from any lender and pay the entire credit card outstanding amount in one go. This would reduce the burden of heavy interests of pending credit card bills.

Comments are closed, but trackbacks and pingbacks are open.