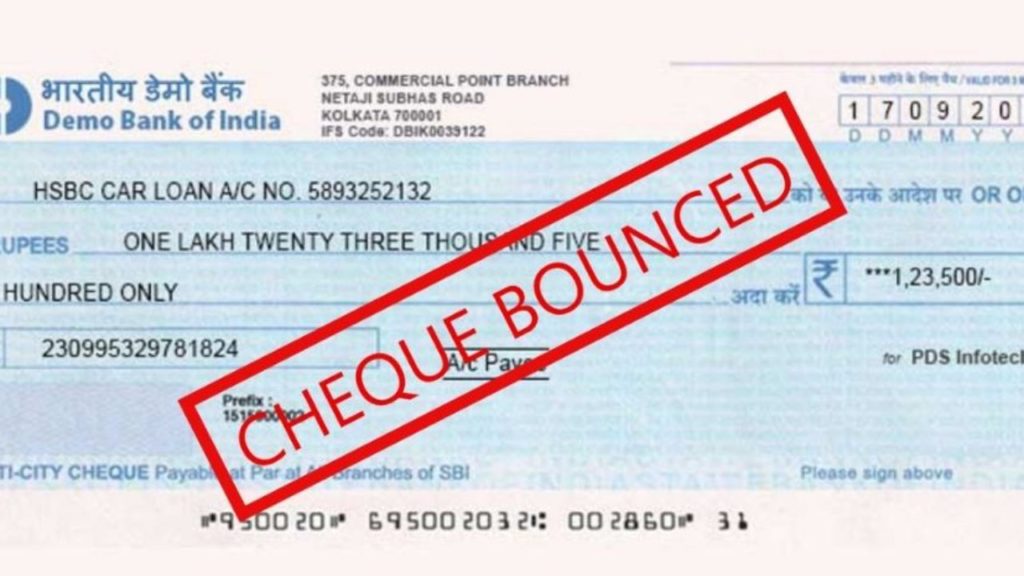

Your Next Cheque Payment Will Bounce Even If You Have Balance: This Needs To Be Done For Every High Value Cheque

Reserve Bank Of India. The central regulatory body lends money to commercial banks, which pass on the benefits to citizens of the country. The RBI also looks after the interest of normal customers by providing guidelines, rules, and regulations to commercial banks. Some of these rules even though well-intended can turn out to be troublesome as well. This, exactly. Might happen if banks start strict enforcement of a rule which was made by the RBI in January 2021.

Make sure you have informed the bank before handing out a high-value cheque

In January 2021, to curb ever-increasing cases of bank fraud in the country, the Reserve Bank of India (RBI) had introduced the Positive Pay System.

Under this Positive Pay System, RBI has mandated that customers should inform banks beforehand. If they fail to do so, the cheque will get bounced. The intention behind the activity was to curb and detect fraudulent activity. This is done by matching cheque-related specific information that is issued by you, the issuer, for clearing.

As per the new rule, customers will have to inform their respective banks about the cheque details via net/mobile banking or a physical visit to the branch. If the issuer fails to inform the bank before the cheque being issued, then the cheque will bounce.

Even though well-intended, this new rule could prove a hurdle for senior citizens or people who are not well versed with online/net banking. The information that needs to be verified includes such things as the cheque number, cheque date, payee name, account number, the amount, amongst other key details.

Banks have started to follow the RBI

Quite a few of the major banking institutions in the country have taken to this rule and made it a mandatory part of their cheque verification process, especially for high-value cheques.

Many of the country’s leading banks including Axis Bank, the State Bank of India (SBI), Kotak Mahindra Bank, ICICI Bank, Bank of Baroda, and HDFC Bank, have implemented this change. Each of these banks has its own procedure for the clearing of the cheques. The RBI had stated that only cheques registered under the Positive Pay System will be accepted under the dispute resolution mechanism.

Comments are closed, but trackbacks and pingbacks are open.