UPI Volume, Value Of Transactions Decrease, 1st Time In 10 Months; UPI Failures Are The Reason?

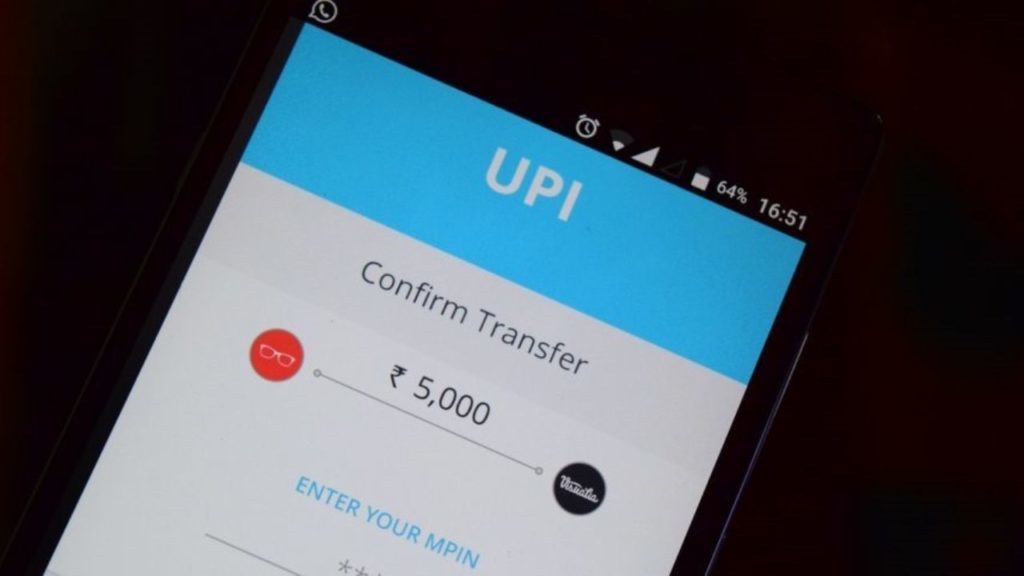

Since February 2021, Unified Payments Interface (UPI) transaction volume and value have witnessed a contraction.

From 2302.73 million transactions involving Rs 4,31,181.89 crore processed in January 2021, the number of transactions declined to 2,292.90 million worth Rs 4,25,062.76 crore in February 2021, according to the data from the National Payments Corporation of India (NPCI).

UPI transactions in April last year had declined to 999.57 million amounting to Rs 1,51,140.66 crore from 1,246.84 million transactions worth Rs 2,06,462.31 crore in the preceding month.

The Rise Of Digitalization

Several digital payment startups encouraged by the government such as Paytm, MobiKwik picked up rapidly in 2016 just after the demonetization.

“Demonetization brought about a springboard effect in terms of growth for Fintech in India. In a primarily cash-dependent country, the pre-demonetization period witnessed slow adoption of digital payments” said Sampad Swain, chief executive officer and co-founder of payment gateway firm Instamojo.

Again during the covid 19 pandemics when the nation was on a complete or partial lockdown, there was huge growth seen in UPI transaction.

The pandemic forced traditional banks to depend upon digitalization and thus made us comfortable with easy transactions. It wasn’t hard to believe that physical cash handling was no more in the picture. As in the Covid-19 outbreak, forward-thinking retailers thrived immensely and embraced digitalization.

UPI transaction failures due to technical reasons

In January the public sector lender Union Bank of India had faced the biggest failure so far. The failure rate jumped to 12.89 per cent in January for Union Bank of India during technical decline such as unavailability and network issues at the bank or with NPCI. Bank like Andhra Bank and Indian Bank recorded the second and third highest TD rate of 10.40 per cent and 9.83 per cent respectively in January. As per the data, the State Bank of India has improved its performance. It has also improved its total debit reversal success rate.

PhonePe’s volume was over 100 million transactions On the other hand, Paytm Payments Bank securing the 3rd position with a volume of 332.69 million worth Rs 37,845.76 crore. The combined transaction volume of the three leading UPI apps stood at 93.5 per cent share of the total January volume of 2,302.73 million while the value share stood at 94.5 per cent of Rs 4.31 lakh crore.

Comments are closed, but trackbacks and pingbacks are open.