Repeat Traffic Offenders Will Pay Higher Motor Insurance; ‘Points’ Based System Coming Soon For Traffic Violations

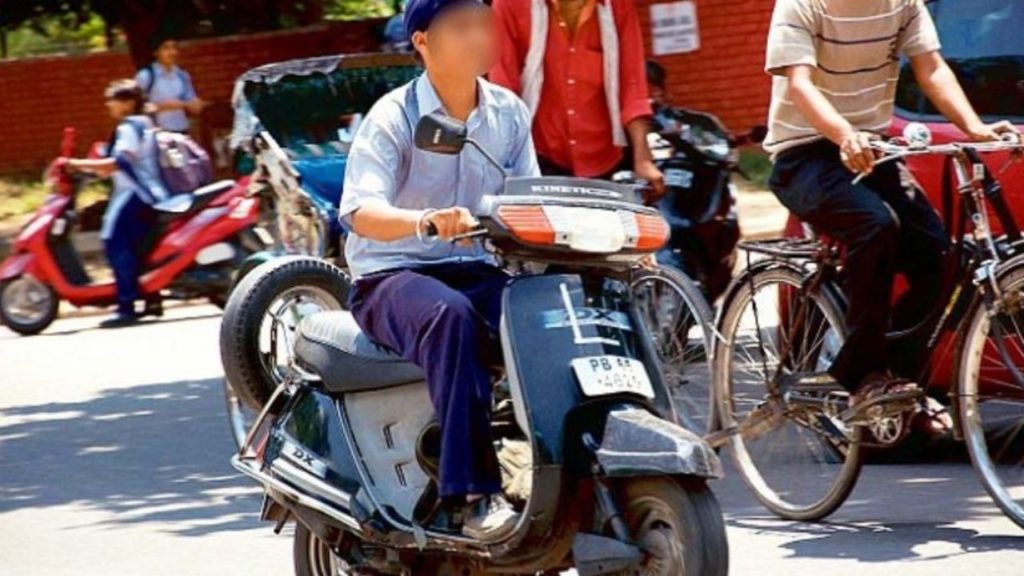

Drivers will now have to compensate for breaching traffic rules through insurance premiums. With the new rules set by Insurance Regulatory and Development Authority of India (IRDAI) harsh drivers will have to pay more insurance premiums on their vehicles.

Under the newly introduced ‘traffic violation premium’ section any driver who offends traffic rules will be penalised according to s point based system.

Contents

This section is applicable to self damage as well as third party segments. So a person is obligated to pay a traffic violation premium on the basis of his behaviour on the road. It won’t depend on the desired motor cover anyhow.

The additional charges will vary from Rs 100 to Rs 750 in case of two wheelers and Rs 300-Rs 1,500 for four-wheelers and heavy commercial vehicles.

The owner of a newly purchased or pre owned vehicle will not be subjected to pay traffic violation premium before buying a motor policy. It is expected to be paid only at the time of renewal.

Point System To Decide The Penalty

The penalty will depend on the severity of the rule that is being violated. For that, a point system has been drafted, the more severe the violation, the more the points and subsequently the more the penalty to be paid in form of insurance.

For starters, parking violations have 10 points whereas a severe violation like drink driving is worth 100 points. The penalty will be applicable to the violation worth 21 and more points. The ones under 21 will not have to pay any extra charges.

First Implementation In Delhi

IRDAI has decided to take a try run of the process in Delhi. However, the vehicles running and violating rules in the capital but belonging to other states will have to pay the insurance in their own state.

Insurance Information Bureau of India (IIB), State Police and National Informatics Centre will come together to maintain the data related to traffic violations. This data will be calculated by the point system and shared among all general insurers who can charge the driver accordingly.

Reaction From Motor Insurance Sector

The motor insurance sector has come in favour of the new rule since it will encourage drivers to follow the traffic rules. Besides, connecting insurance with the behaviour of a driver also makes the insurance process more intelligent.

Sajja Praveen Chowdary, Head-Motor Insurance at Policybazaar.com highlighted that though good drivers are not offered discounts for the good drivers, they will indirectly get benefited over the period of time. After the data is linked to the behaviour of the driver, the insurance company will know if the client is a good driver and provide better offers and discounts to them.

In this way the new traffic violation premium is a win win situation considering both the sides.

Comments are closed, but trackbacks and pingbacks are open.