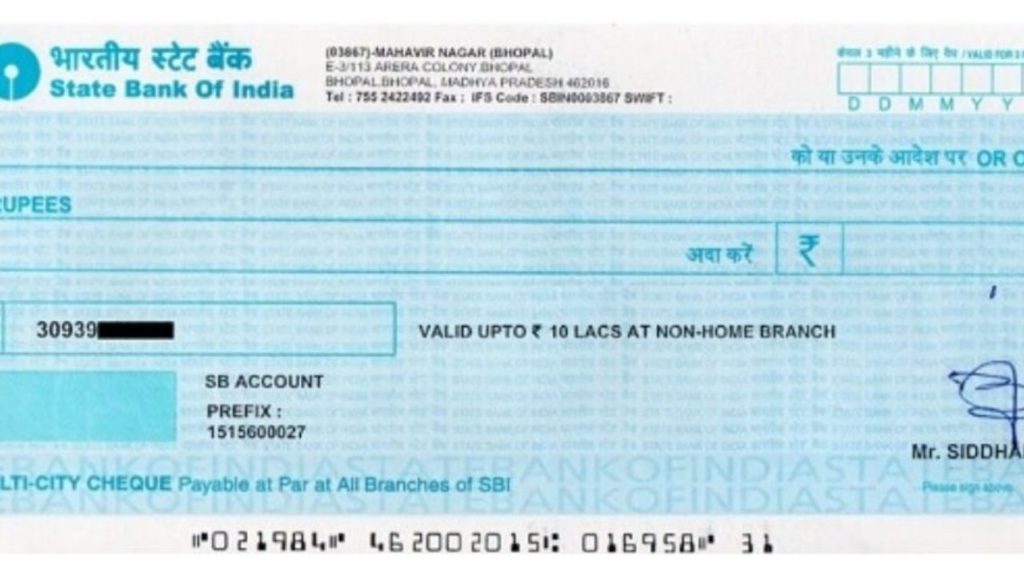

New Rules For Cheque Payments From January 1: Re-Verification Of All Cheques Above Rs 50,000

Some time back, the Reserve Bank of India (RBI) decided to introduce the ‘positive pay system’ for cheque payments which will come into effect from 1 January 2021.

Contents

New Cheque Payment Rule

According to this new cheque payment rule, the re-confirmation of key details may be needed for payments beyond Rs 50,000.

The announcement came in focus to keep consumer safety and to lower the cases of fraud and abuse with respect to cheque payment.

Here Positive Pay is simply an automated fraud detection tool.

This process involves the matching of the specific information related to the cheque presented for clearing, including the cheque number, cheque date, payee name, account number, amount, and other details against a list of cheques previously authorized and issued by the issuer.

The process of Positive Pay of reconfirming key details will be useful for large value cheques.

How Does A Positive Pay Process Work?

According to this process, the issuer of the cheque submits electronically, through channels like SMS, mobile app, internet banking, ATM, etc., certain minimum details of that cheque (like date, name of the beneficiary/payee, amount, etc.) to the drawee bank, details of which are cross-checked with the presented cheque by CTS.

In case of any discrepancy, it is flagged by CTS to the drawee bank and presenting bank, which would take redressal measures.

Moving ahead, only cheques that are compliant with the above instructions will be accepted under the dispute resolution mechanism at the CTS grids.

Positive Pay Process Implementation

As per the plan, the National Payments Corporation of India (NPCI) will develop the facility of Positive Pay in CTS.

Further, they will make it available to participant banks.

So that, banks can enable it for all account holders issuing cheques for amounts of ?50,000 and above.

When Positive Pay Process Will Be Applicable?

So far, the availing of this facility is at the discretion of the account holder.

However, banks may consider making it mandatory in case of cheques for amounts of ?5,00,000 and above.

Apart from this, the member banks can also implement similar kinds of arrangements for cheques cleared/collected outside CTS as well.

As part of the implementation, the banks are suggested to create adequate awareness among their customers on features of the Positive Pay System.

They are supposed to provide all this information through SMS alerts, display in branches, ATMs as well as through their website and internet banking.

Comments are closed, but trackbacks and pingbacks are open.