Google, Facebook, Amazon Can Launch UPI-Alternative To Fight NPCI’s 30% Cap Rule

In a twist of events, digital and Internet’s global biggies are planning to launch an alternative to UPI, and fighting the dominance of NPCI in the digital payments industry.

While Google and Facebook are in talks with Reliance to garner their support, Amazon is thinking on similar lines.

What exactly is happening here?

Google, Facebook, Amazon Working On NPCI-Alternative

As per an exclusive report by Economic Times, Internet behemoths Google, Facebook and Amazon are working to launch a strong UPI-alternative in India.

This can be done by launching a strong competitor to NPCI or National Payments Commission of India, which right now manages and controls UPI platform in India.

As per the report, while Facebook and Google are in talks with Reliance Jio for the same, Amazon is planning their own version of a new payment system.

Both Amazon and Google are now stakeholders in Jio, while Amazon already has their own payment app: Amazon Pay, which also works with UPI.

A unnamed source informed ET: “India is an exciting market for Google, Facebook and Amazon and they are seriously exploring joint venture partners. Reliance Jio has emerged as the clear favourite. A lot of domestic applicants have also reached out to these global giants for a JV and it’s too early to say which way they will go,”

What Is The Reason For UPI Alternative?

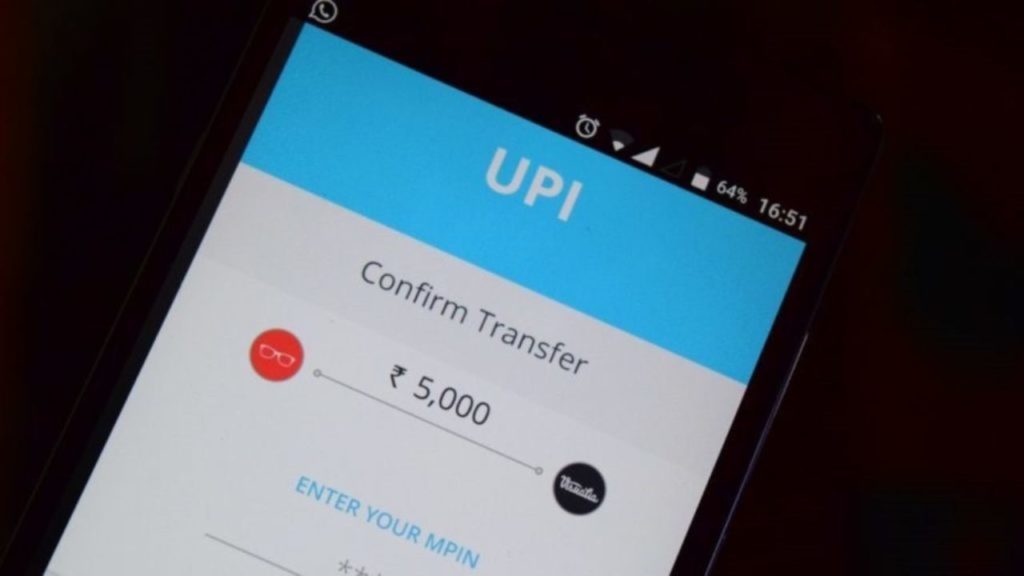

Recently, UPI made it a rule that no third party UPI app can have more than 30% market share in the overall UPI market.

This comes as a big blow to existing market leaders in UPI: PhonePe and Google Pay, since they both control roughly 40% of the market.

Although they still have 2 years to implement this new rule, new entrants such as Whatsapp Pay will need to follow this rule immediately.

The 30% cap for UPI apps hinders them from expanding their existing services, and stops them from rolling out loyalty programs and features, since they cannot go beyond 30% share.

Besides these internet giants, there are other parties as well, who are interested to develop a UPI-alternative.

This includes HDFC Bank, TCS, and more.

We will keep you updated, as more details come in.

Comments are closed, but trackbacks and pingbacks are open.