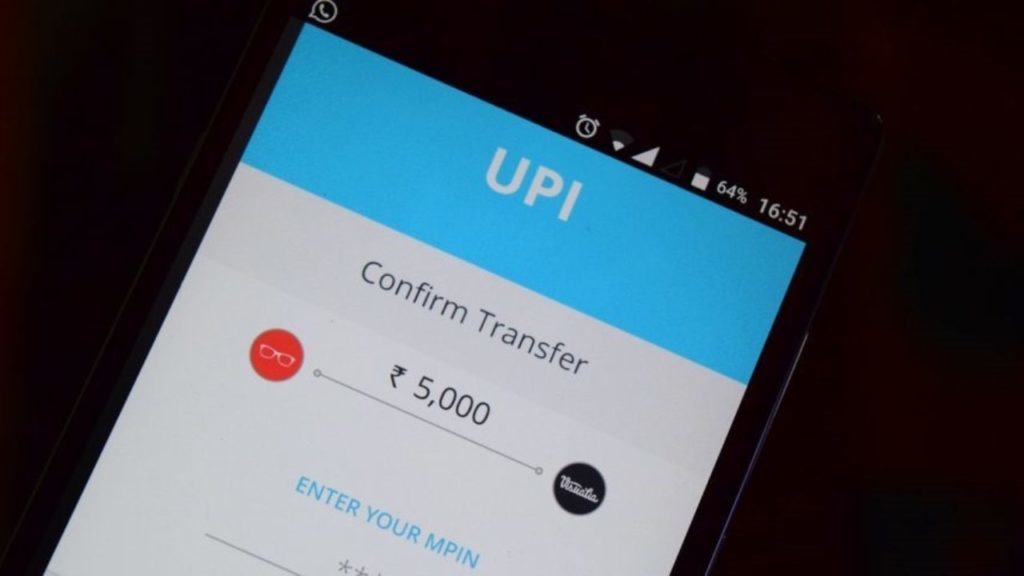

What Is 30% Cap For UPI Transactions On Google Pay, PhonePe, Paytm? How Will It Impact You?

In a major blow to leading UPI payment apps in India, NPCI or National Payments Corporation of India has imposed a cap of 30% on every app.

What does this mean? How will it impact you?

Keep reading to find out more!

Contents

What Is 30% Cap For UPI Transactions On PhonePe, Paytm, Google Pay?

Since NPCI has now placed a cap of 30% on all UPI transactions done on any payment app, this means that no single app can do more than 30% of the transactions via UPI.

Hence, for any digital payment app, 30% will be the maximum transactions they can do now. Be it Paytm, PhonePe, Google Pay, BHIM or MobiKwik, every app can only have 30% market share now.

How Will This Work Out?

The mathematics of 30% cap will work based on the last three months UPI transactions, on a rolling basis.

Hence, for the month of December, NPCI will check how many UPI transactions say PhonePe has done, and if it’s more than 30% of the overall UPI transactions, then the app wont be allowed to process any more UPI transactions.

Same with Google Pay or Paytm or any other UPI payment app.

Big Blow For Google Pay, PhonePe?

At this point of time, PhonePe and Google Pay are the leading UPI payment apps in India, with 40% market share for each app.

Rest 20% market share is controlled by Paytm, MobiKwik, and BHIM App, which has the least market share.

With 30% cap rule, PhonePe and Google Pay will lose market share, and from 40%, their share will 30% maximum. Hence, this is a loss for them.

Whereas Paytm and other UPI payment apps can have a chance to increase their usage, and market share.

How Will This Impact The Users?

It’s still not clear, what will happen, once an app crosses the 30% share.

It may happen, we are speculating here, that the user won’t be able to make any UPI payment from PhonePe or Google Pay, once these apps have crossed 30% share.

In that case, the user will have to use ay other app, and thus, all the players will have similar number of transactions.

Since there is no incentive for the apps to attract new users, and to conduct more transactions, we can see drop in offers and cashbacks as well.

This is a developing story. We will keep you updated, as more details come in.

Comments are closed, but trackbacks and pingbacks are open.