UPI’s Success Will Be Replicated Across Asia: NPCI Plans Expansion In Malaysia, UAE, Singapore & More

After the immense success of the Unified Payments Surface, the NPCI is planning to introduce the online transaction platform to other parts of Asia as well.

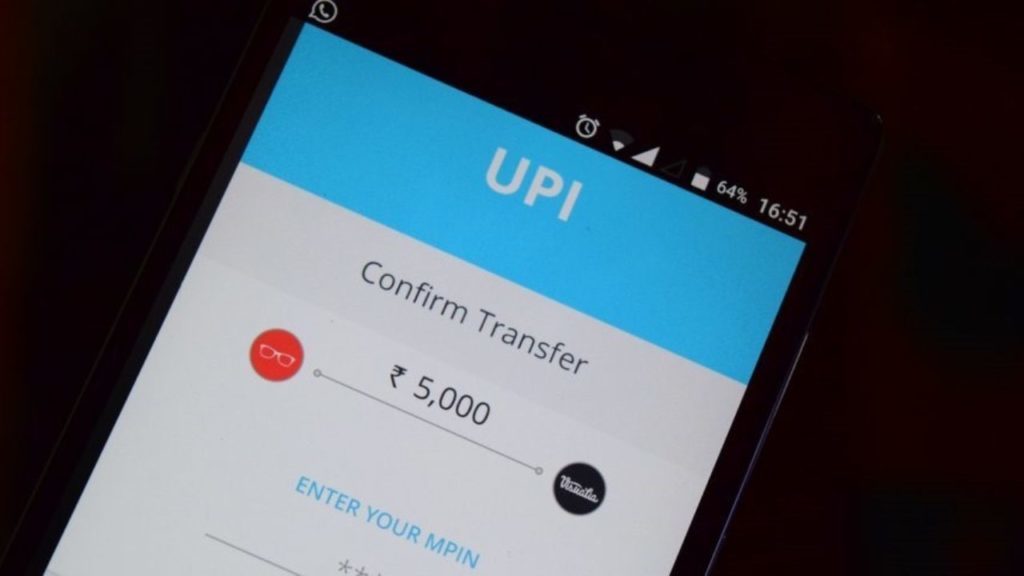

The digital mode of payments have been widely preferred in India, and UPI has been the most popular among all platforms.

NPCI To Export UPI System To Other Asian Countries; Will Start With Myanmar

Considering the rise in the preference for digital payment methods and UPI especially, the National Payments Corporation of India (NPCI) is now looking at exporting opportunities of the payment platform to other Asian countries.

We all know about NPCI International (NIPL), which is the subsidiary recently set up by NPCI.

As per two people who are close to the development, NIPL, along with Euronet, a Kansas based company have together submitted a joint proposal to the Central Bank of Myanmar (CBM). The proposal is about developing Real-Time Retail Payments System and QR-code Generation and Repository System

These sources have revealed that “The CBM project has received grants from the World Bank, and a successful implementation of NPCI’s expertise could give a serious boost to its international aspirations.”

UPI To Face Tough Competition From MasterCard And Visa

However, there is a possibility that this bid might face tough competition from the global payment giants such as MasterCard and Visa who are also interested in the project. However, if the build is successful this will be the first of many international projects that NPCI is aiming for in the Asian market.

There are several economies such as Malaysia UAE and Singapore who are looking forward to mass digitization in the future and are also looking for interoperable networks that are similar to the UPI platform.

In August, we reported that the UPI platform was all set to overtake Visa and Mastercard in the next 1000 days. As per reports given by the Reserve Bank of India, the volume of UPI transactions has increased by 13 times during FY18 and FY20. in the same time span, the value of transactions conducted over UPI has increased by as much as 20 times.

We’ll keep you informed as we get more updates!

Comments are closed, but trackbacks and pingbacks are open.