Cheques Will Become Fraud-Free, Super-Safe With Positive Pay Mechanism: How Will It Work?

For making cheque payments safer, the Reserve Bank of India (RBI) has announced the introduction of ‘Positive Pay’ for all the cheques above Rs 50,000, in its Statement on Development and Regulatory Policies.

How Does Positive Pay Work?

Every year, the cases of cheque frauds are increasing and creating a counterfeit cheque or forging account holder details in order to withdraw funds is not uncommon.

This mechanism will increase safety in cheque payments and will also help in reducing the instances of fraud occurring on account of tampering of cheque leaves.

Currently, the detailed working this mechanism is still awaited, but by using this tool, cheques will be processed for payment by the drawee bank based on information passed on by its customer at the time of issuance of the cheque.

How Does The Use Of Positive Pay Help?

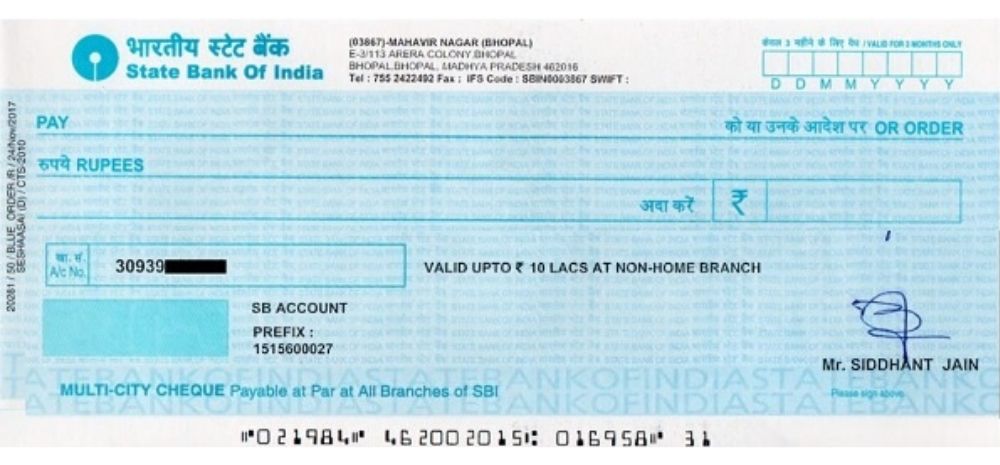

“The introduction of Positive Pay on cheques of Rs 50,000 and above means that an added layer of security has been provided to the instrument. When you issue a high-value cheque, you can upload its details (such as front and back images) to the bank. When the bank receives the cheque from your beneficiary, it will verify the details uploaded by you,” said Adhil Shetty, the CEO, BankBazaar.com.

Further, this will cover approximately 20 percent and 80 percent of total cheques issued by volume and value, respectively.

According to the RBI policy statement, Operational guidelines will be issued separately.

Implementation Of Cheque Truncation System

CTS is basically the process of halting the flow of the physical cheque issued by a drawer at some point by the presenting bank en-route to the paying bank branch.

Instead of that, an electronic image of the cheque is transmitted to the paying branch through the clearinghouse, along with the other required information such as data on the Magnetic Ink Character Recognition

(MICR) band, presenting bank, date of presentation etc.

This way, cheque truncation obviates the need to move the physical instruments across the bank branches, apart from the exceptional circumstances for clearing purposes.

RBI is planning to introduce pan-India CTS by September 2020 to make the cheque clearing process safer and faster as well.

Comments are closed, but trackbacks and pingbacks are open.