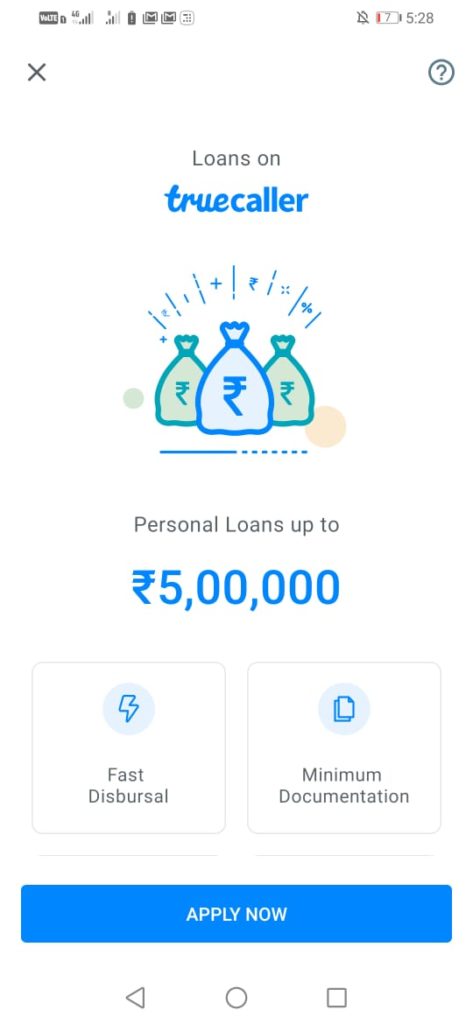

Truecaller Offers Instant Loan Upto Rs 5 Lakh With 16% P.A. Interest, 36 Months Tenure: How It Works?

Truecaller, a platform that is widely used for caller identification, has now rolled out personal loans upto Rs 5 lakh for their Indian users.

The app has also set eligibility criteria, interest rates, tenures and much more.

Read on to find out!

Contents

Truecaller Launches Loans For Customers: Eligibility, Process, All You Need To Know!

Truecaller is a platform that engages in caller-identification, call-blocking, flash-messaging, call-recording, Chat & Voice. And now, the app will also be providing loans to its customers. These loans will be term loans, wherein the amount can be repaid in regular installments over a fixed period of time.

Who Will be Eligible For Truecaller Loans?

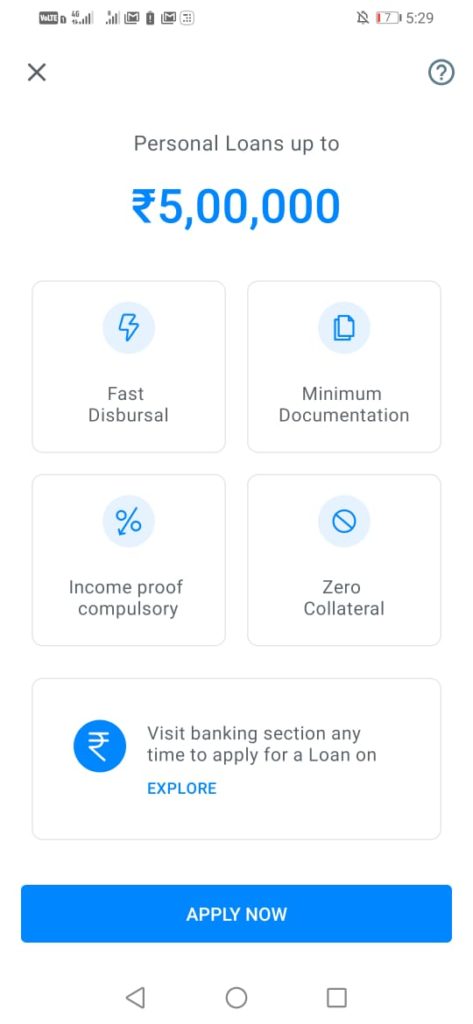

As of now, the platform provides loans to only salaried customers. The monthly in-hand salary should not be less than Rs. 13,500. For self-employed customers, the monthly income should be at least Rs. 25000.

The other criteria include Truecaller’s proprietary credit scoring process, the customers’ Credit Bureau score, which shouldn’t be less than 650.

Applicable Rate Of Interest: The rate of interest starts from 16% per annum, and will be based on the app’s assessment of your spending patterns.

What Documents Will You Need?

Identity Proof – Aadhaar/PAN Card

Current Address Proof – If Aadhaar Card doesn’t feature your current address

Bank Statement (Salary A/C) – Last 3 months’ statement with salary credits

How To Get A Loan From Truecaller?

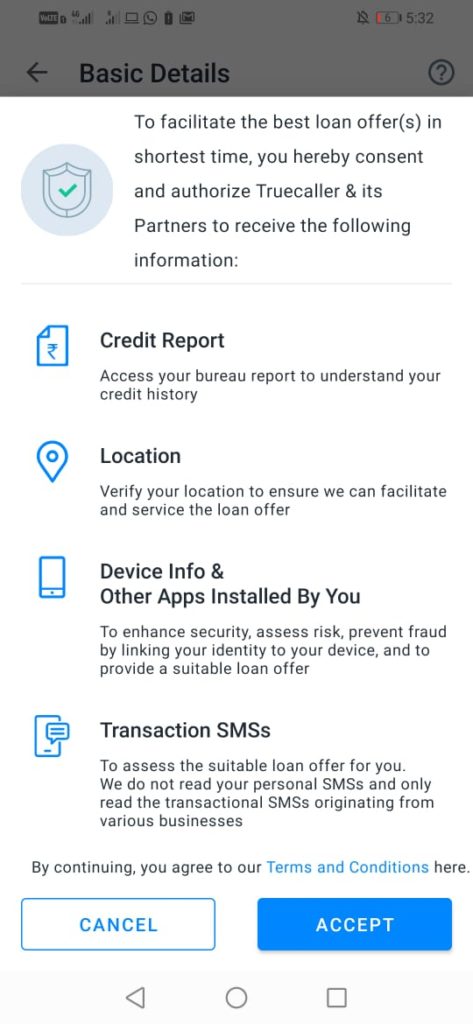

Here is a step by step procedure to get an instant loan from Truecaller without any paperwork:

- Submit the completed loan application on the app.

- Once the application is submitted, Truecaller will verify your documents and analyze your creditworthiness and other important details on your application.

- Once the verification process is complete, Truecaller will send you a NACH form. You will need to print this form, sign it, scan it and send it back to the app. The NACH form will enable the auto-debit feature for your bank account so that you can pay your EMIs regularly and automatically.

- Once the NACH form reaches Truecaller, a loan agreement will be sent to you, which you will be required to review and submit. After this, your loan amount will be credited into your bank account within a few hours.

By entering into the personal loan segment, Truecaller has opened up a new front for expanding their presence in India. It would be interesting to observe how this development impacts the micro-finance industry in India.

Will you be applying for a loan from Truecaller? Do let us know by commenting right here!

Comments are closed, but trackbacks and pingbacks are open.