SBI Lost Rs 1.2 Lakh Crore Due To Bad Loans; Recovered Only Rs 8969 Crore In 8 Years!

SBI Lost Rs 1.2 Lakh Crore Due To Bad Loans; Recovered Only Rs 8969 Crore In 8 Years!

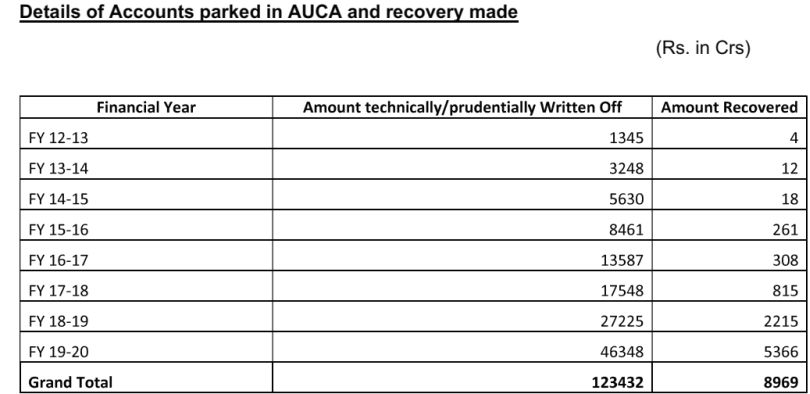

The State Bank of India has written off Rs 1.23 lakh crore, but has recovered just Rs 8,969 crore or just over 7% over the past 8 fiscal years.

Documents procured by Vivek Velankar from the state-run lender reveal a minute recovery of the bad debts, which the Reserve Bank of India (RBI) and Union Government have been clarifying that a bad debt written off does not mean a waiver.

Read on to find out more…

Govt Claims Technical Write Off Doesn’t Stop Recovery Process, Figures Indicate the Opposite!

Mr Vivek Velankar is the President of Pune-based Sajag Nagrik Manch.

He said, “I tried obtaining this information under Right to Information (RTI) Act, but SBI denied it claiming that collating this information would be a waste of its resources. Being a shareholder of SBI, I then asked for this information as a question for the annual general meeting (AGM). I did not get a chance to ask my question during the AGM, but the bank shared this information, which is quite shocking. This also exposes how the bank writes off loans of 100s of crores of rupees of large defaulters while denying waiver of simple interest on loans for common customers.”

The SBI’s response to Mr Velankar indicates that from FY 12-13 to FY 19-20, SBI has ‘technically/prudentially written off’ a whopping sum of Rs 1.23 lakh crore from its books, but only recovered a meagre Rs 8,969 crore in those 8 years.

Here are the figures of the amount recovered against the amount written off over the past 8 years…

Many aggressive and incessant claims have been made by many high profile government spokesperson and economic advisors that a ‘technical’ write-off does not stop the recovery process. However, the findings are completely opposite to what’s been stated.

Former bank chairman told Moneylife, The fact is that once a loan turns bad in India, it is almost impossible to recover anything because it has already been ever-greened for several years.

Breaking Down the Story!

The writing off of the debts, in technical terms, indicates that they are removed as assets from the balance sheet because the bank does not expect to recover payment. As a part of the tax management clean up process banks do this regularly. Although, this practice is disapproved of by experts.

The beneficiaries over all these years have always been some of our biggest industrialist defaulters.

On the other hand, when a bad debt is written down, some of the bad debt value remains as an asset because the bank expects to recover it.

However, as SBI has shown, most of the times, there is meagre recovery for the amounts written off.

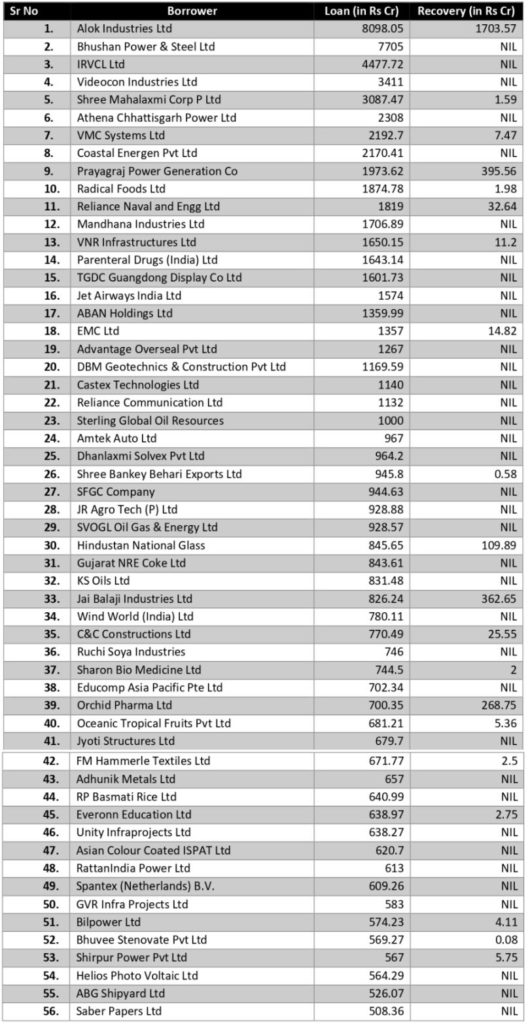

As per the data, Bhushan Power & Steel Ltd, IRVCL Ltd and Videocon Industries Ltd are its biggest defaulters, and have not repaid any recovery amount.

The documents indicate Alok Industries Ltd as the biggest borrower with a written off loan of Rs 8,098.05 but has repaid Rs 1,703.57 crore to the SBI.

Have a look at the list of loan portfolios worth Rs 500 crore and above that were written off by SBI…

Image Source: MoneyLife

The Top Defaulters To Indian Banks!

Earlier in April, RBI had said that Indian banks have technically written off a astounding amount of Rs 68,607 crore due from Top 50 defaulters. RBI said that this amount comprising outstanding and the amounts technically or prudentially written off till 30 September 2019. RBI had revealed this information in reply to an RTI filed by Saket Gokhale.

The lead in the top-50 defaulters to Indian banks, was absconding Mehul Choksi’s scam-hit company, Gitanjali Gems Ltd, which owed Rs 5,492 crore. Choksi is currently a citizen of Antigua & Barbados Isles, whereas his nephew, absconder and a diamond trader Nirav Modi is in London.

Besides other group companies, Gili India Ltd with a loan of Rs 1,447 crore and Nakshatra Brands Ltd with a loan of Rs1,109 crore.

The second in the list is REI Agro Ltd, with an amount of Rs 4,314 crore, and its directors Sandip Jhunjhunwala and Sanjay Jhunjhunwala who are already under scrutiny of the Enforcement Directorate (ED) for over a year.

Following Jhunjhunwala, is absconding Jatin Mehta’s Winsome Diamonds and Jeweleery with a Rs 4,000 crore category, owing Rs 4,076 crore. This absconder is being probed by the Central Bureau of Investigation (CBI) for various bank frands.

In the Rs 2,000 crore bracket, is the Kanpur-based writing instruments giant, Rotomac Global Pvt Ltd, part of the famed Kothari group, which owed Rs 2,850 crore.

Should the bank regulator keep a more close check on the banks and make amends to its policies?

Comments are closed, but trackbacks and pingbacks are open.