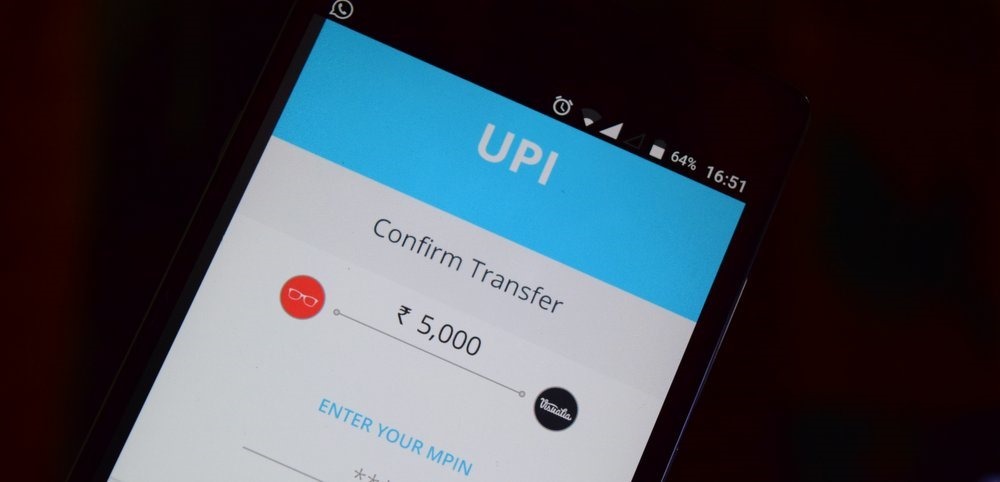

Govt. Aims To Make UPI Transactions Free For All: Can This Impact Google Pay, Paytm?

Remember just some time back we informed you about the government’s decision to not charge any MDR charges on transactions done via UPI and RuPay modes, in order to promote and achieve a ‘less-cash’ economy.

So now, after the abolishment of Merchant Discount Rate (MDR), banks have been looking out desperately for a zero switching fee and payment service provider fee (PSP). The news that’s in is that the National Payments Corporation of India (NPCI) is all set to abolish PSP and interchange fees till April 30.

NCPI to Abolish PSP

As per the MoM of the NPCI working committee released on February 14, the latter shall release a circular to waive-off interchange and PSP fee and it will be effective from Jan 1, 2020.

What this implies is the fact that this waive-off on April 30 will be an interim measure and the move will be implemented with retrospective effect of Jan 1, 2020. The question to be asked here is what happens to the fees already collected, shall this be implemented?

Well in that case, the beneficiary banks shall not make any money on UPI-based transactions, i.e. peer-to-merchant or P2M. As of now, beneficiary banks make Rs 0.25 on transaction up to Rs 1,000, Re 1 on a transaction worth Rs 25,000 and Rs 5 on up to Rs 75,000.

This Will Affect UPI Ecosystem Adversely

Waiver of PSP fee would leave no room for companies like Google Pay, PhonePe, Amazon Pay and Paytm to earn anything on UPI transactions. On average, they make about Rs 0.30-0.35 through PSP fee on every P2M transaction.

If in case the MDR issue isn’t resolved, according to the NCPI, the steering committee meeting will be held in April to discuss and decide the future course of action.

Like we’d informed you previously, the government had already abolished the MDR fees on the transactions done via UPI and RuPay modes from December 30, 2019.

Now since the banks aren’t charging MDR on RuPay and UPI transactions, they have no funds to pay to any other stakeholder, hence to make money.

Not just those, the UPI portals like PhonePe, Google Pay, Bharatpe and Amazon Pay who have been spending several million dollars every year to capture a high market share in the UPI ecosystem, shall not be able to make a single rupee out of it.

Theoretically speaking, after removal of the PSP fees, there will be no future revenue model that exists for these third-party apps in the merchant-based UPI ecosystem.

Comments are closed, but trackbacks and pingbacks are open.