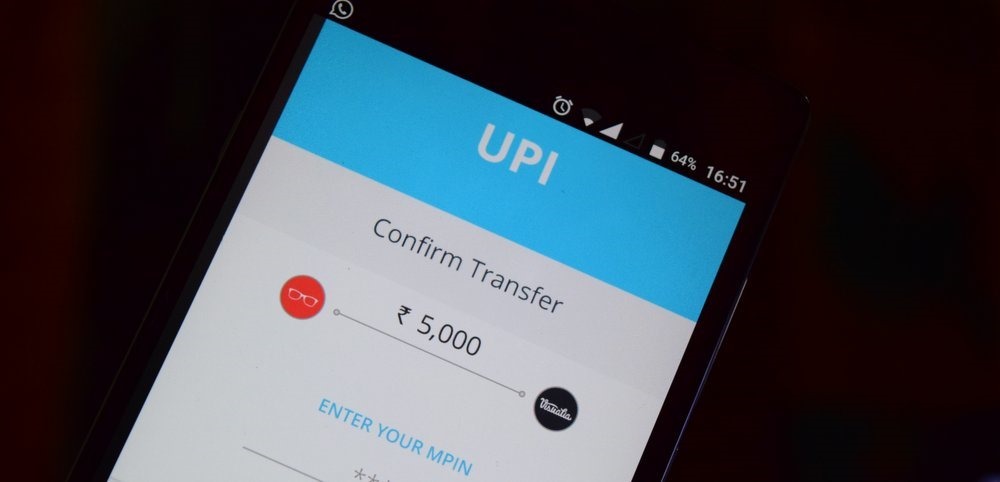

Now Use UPI To Withdraw Cash From Merchants; UPI Witness 442% Growth In Delhi, Google Pay #1 Player With 50% Share!

As per the reports coming in, now you can use the government’s Unified Payments Interface (UPI) to convert money in your account to cash.

Contents

How Did This Happen?

Recently the UPI-based payments platform, PhonePe, has announced a new PhonePe ATM feature, which allows customers to send money to a merchant using PhonePe and take cash from them for the same amount.

Yesterday, the feature went live on the platform.

So far, over 75000 merchants have signed up for the service in Delhi/NCR at the moment, according to PhonePe.

According to the company, the service is live only in the National Capital Region right now, but the company says it plans to scale it up based on customer response from this pilot process.

How Does It Work?

For using these services, any merchant can sign up to be an ATM on PhonePe, using the company’s PhonePe for Business app.

Also, the platform lets users enable or disable the service at will, allowing them to ensure they have enough cash flow.

Although, consumers can only withdraw Rs. 1000 per day using this service.

Moreover, this feature allows only small withdrawals at the moment, using UPI to convert money into cash is not unheard of in India.

Why Is A Need Of This Functionality?

As per the report, many e-commerce platforms use UPI as an accepted mode of payment under their cash on delivery feature, while couriers often tell customers to make payments through apps like Google Pay, PhonePe etc. instead of handing over cash for deliveries.

Another fact is, India lacks a sufficient number of ATMs for banking customers.

India has the fewest ATMs per 100,000 people among BRICS countries, according to the International Monetary Fund.

On top of that, the data from Reserve Bank of India in May last year showed that the number of ATMs in the country fell over the past two years.

How Would This Facility Help?

So, if services like PhonePe ATM are successful, it could spur these apps to increase the withdrawal limits and transactions.

It’s not the first time that a company has tried this approach as Godfrey Phillips-owned convenience store chain, 24Seven, had started advertising a similar ATM service in some of its outlets.

The service would allow customers to swipe their cards at the point of sale (POS) machines and take cash from the stores, according to store personnel at such outlets.

Watching the current bloom, the financial services company, Razorpay, recently found that UPI transactions in India grew by 442% year-on-year in 2019.

While PhonePe itself claims it has approximately 540 million monthly transactions and over 175 million users.

Comments are closed, but trackbacks and pingbacks are open.