WeWork Fiasco: 8 Critical Lessons Which Every Entrepreneur Should Learn & Avoid

After many years of hogging limelights as a tech powered disrupter in the real estate industry, WeWork has done the full circle, and now made news for all the wrong reasons.

The company which leases out workspaces in almost 80 cities and 836 locations across the world had planned its grand IPO in September of 2019. WeWork would have wanted to join the ranks of Facebook, or at least Uber, with a successful IPO. The reality – something else.

In 2018, the company was the second-largest office space provider in the US and rented out 6.5 million sq ft, second only to IWG Plc (previously Regus).

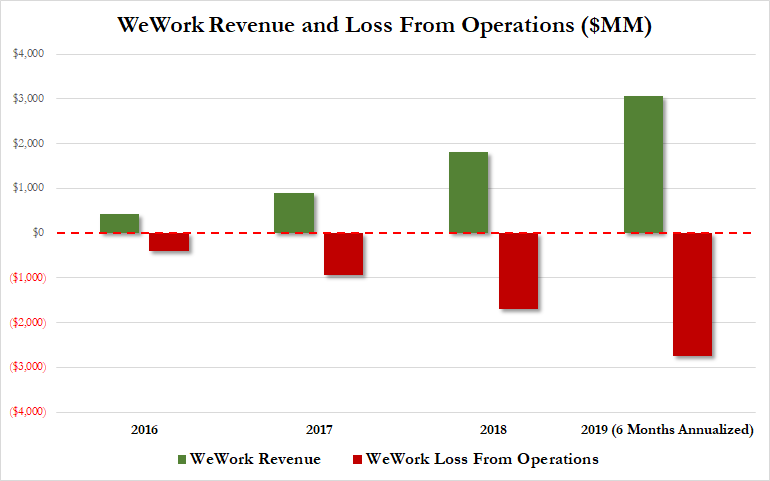

Between 2016 and 2018, WeWork had increased its revenues to about $1.8 billion from $532 million.

In 2018 Morgan Stanley had valued WeWork at almost $100 billion, and in January of 2019, Softbank of Japan had acquired a stake by paying $6 billion that valued it at $47 billion.

Contents

WeWork IPO Fiasco

The We Company, the parent of WeWork, filed paperwork on Sep 30, 2019, to withdraw the IPO.

The company had planned to raise $4 billion from the market and had a $6 billion loan from JP Morgan Chase lined up, but that was contingent on the IPO.

So what went wrong? Why did the founder and CEO Adam Neumann have to resign and hand over reins to the CFO Artie Minson?

You may interpret it as a critical inflection point in the market. The signs have been there since the cab aggregator companies Uber and Lyft were listed earlier this year. There is no longer any appetite in the broader market for grossly overvalued startups.

There is no further scope for listing by new companies that are unable to generate profits and burn through investor cash as if there is no tomorrow to chase the chimera of soaring revenue growth.

There are several lessons offered by the WeWork debacle that startups can learn from.

The Market Hates Multi-class Stock

A large part of WeWork’s problems can be traced back to its multi-class shareholding pattern. At the time of S-1 filing, CEO, Adam Neumann owned shares that had 10 votes each, thus making it impossible for him to be ousted.

This is common among tech companies, with almost forty percent of all IPOs this year showing the same pattern. It is relatively rare in non-tech startups.

Super voting shares are fine as long as the company is private and makes sure that the CEO is not sacked by the investing banks, but the broader public does not like such a hierarchy where they would not have any say over who should be the CEO.

Uber, too, had a similar voting structure, but Travis Kalanick was forced out in spite of it. If your company needs outside money to survive, the number of votes you carry means little.

Sometime later, Uber changed the voting pattern to one share, one vote, and went ahead to become a listed company.

Successful IPO Needs Transparent Corporate Culture

The revenue growth of WeWork was explosive under Neumann.

But he crossed ethical boundaries on several occasions making people question his integrity.

These include renting his self-owned property to WeWork and smoking weed on the company jet while partying with friends.

He even trademarked “We” and sold it back to his own company for $6 million.

Not only did Adam enjoy exceptional control, but that extended to his wife Rebekah, who is the CEO of WeGrow, the educational startup run by The We Company.

Talking Too Much About Scaling Up Does Not Impress

WeWork was growing at an astonishing a hundred and two percent annually, coming into its IPO. It also liked to talk about its total number of members, cities, and locations.

However, a large user base and huge revenues are not a guarantee that an IPO will succeed. The market wants to hear about a sustainable business plan and about how the company plans to address the revenue shortfall.

VCs worry about valuations, and the market about earnings. If the CEO brings the same pitch to the table, then he is in deep trouble indeed. The broader market cares less about excessive valuations. It only finds solace in returns.

The pursuit of a large number of users does benefit companies such as Facebook, but that is only because they have a plan to monetize it and earn a substantial profit successfully.

A Weak Business Model Is Scary

WeWork and Uber have no real answer to how they plan to turn profitable. That is why the WeWork IPO failed, and Uber share prices have dropped by a third since its stock market debut in May.

Neumann was never able entirely to convince others if his company was a real estate or a tech company. If it is a real estate company, then it was really tiny and did not merit the fancy $47 billion valuations.

Blackstone, the largest real estate owner, has a little over one-half percent share of the global property market. WeWork was nowhere as large. Yet it was valued like a tech company using only metrics of revenue and not profitability.

But in a $230 trillion industry, even a $100 billion behemoth can have little significance in the overall scheme of things. There is no way of going by the Silicon Valley maxim – gain market share, and profits will eventually arrive.

That may have been true for Facebook and Amazon because they carved out an entirely new market from scratch, but in the real estate industry that has existed for millennia, there is no way to use that motto.

Iconic CEO Phobia Has Arrived

Uber’s CEO, Dara Khosrowshahi, was mentioned 29 times in the prospectus. Adam Neumann is there 170 times!

Over the past 30 years, startups that have transitioned to being public listed companies have been sort of like a dictatorship where the company uses public money. Still, the ordinary investor has no say in how the company is run.

Larger than life CEOs have begun to grate a little bit on the nerves, mainly since Musk spoke of making Tesla motors private almost as a joke.

Dynamic founders are well and good in the first few years, but the market likes to be assured that its investment is in safe hands, and a mercurial temperament does little to soothe investors.

Overvaluation Cannot Dupe The Market

There was no basis for the fancy $47 billion valuation of WeWork. It was quite literally a number pulled out of thin air.

If we make a peer comparison with IWG, the numbers speak for themselves.

WeWork has 45 million sq ft around the world and about 500,000 members. It is present in nearly 800 locations and has an annual revenue of $1.8 billion.

IWG owns 50 million sq ft globally and has 2.5 million members. Present in over 3,000 locations, it has a profit of $500 million.

Yet it is valued at less than $4 billion compared to the vast $47 billion of WeWork.

When Amazon trades at much lower multiples of revenue, how can an unknown company such as WeWork be valued at 26 times revenue?

If Risk-Reward Is Not Favorable You Are A Pariah –

IWG operates in many more locations. WeWork has most of its offices in some of the most expensive cities in the world – New York, London, Sydney, Los Angeles.

At the time of recession, these iconic cities face the most significant economic hit. Because of the massive cost of operations, more prominent companies retreat away to less priced locations until they recover.

With a potential slowdown in the global economy and just over three percent growth predicted, it is natural that the WeWork story failed to impress.

Also, WeWork needed to invest heavily in its leased spaces to make them swanky and comfortable. This investment in furnishings came at a colossal depreciation cost.

Sunk cost that depreciates fast is not an ideal asset to purchase in a slowing global market.

Watch Out For Cash Flow

It is great to run a business on borrowed money as long as you can borrow the funds. But what happens when you run out of cash, and no one is willing to lend you any more of it?

As Adam Neumann learned the hard way, it means losing your company.

Burning cash may generate massive revenues in the short term but is not going to keep you in the black for very long.

Concluding Thoughts About WeWork

There is doubt if WeWork would be able to return with an IPO in 2020. Even if it can do so, the amount they can value themselves at will be a small fraction of $47 billion.

But the company needs at least $2 billion every year to grow. How will it be able to survive? None knows the answer to these.

Very probably, WeWork will not survive the next year, and that is really sad.

The lesson in it for all entrepreneurs is don’t sell hype, and even if you do, don’t begin to believe your own hype.

Regardless of how highly you value your vision and your company, the market is rarely if ever carried away by such exuberance.

Thus as the CEO, you have to spend time developing a solid business plan and work tirelessly to iron out the kinks. That is how Facebook survived and grew in spite of a less than optimal IPO.

About The Author:

Vishal Vivek is an eminent Indian serial entrepreneur. Despite having to shoulder huge family responsibilities at a tender age, lack of proper training, and a dearth of resources and funding, he started SEO Corporation and scaled it up to a well-known SEO company with sheer will power and integrity of character. In the uncertain world of search engine optimization, he is one of the few experts who gives guarantees and honors them.

The Times Group recognized him as a legendary entrepreneur and published his biography in the book I Did IT (Vol 2) in 2018 when he was just 30!

Comments are closed, but trackbacks and pingbacks are open.