Paytm Payments Bank Will Now Offer Higher Return on Fixed Deposits, Credit Loans, Instant Withdrawals, ATMs & More!

Paytm is introducing many new features including Instant Withdrawals, Better return for Senior citizens, Paytm's own ATM kiosks and many others

After being officially launched less than a year back, Paytm has already committed to invest Rs. 3000 crore in the entity in next three years, where India’s largest financial service platform targets create a network of more than 10,000 offline consumer banking touch points.

Paytm Payments Bank has now partnered with IndusInd Bank where the company will introduce a facility that will create a fixed deposit when customer balance exceeds the limit of Rs, 1,00,000 at the end of day.

A first-of-its-kind feature ever introduced in the Indian banking history to create a fixed deposit when the balance of a customer’s account exceeds the threshold limit of Rs. 1 Lakh.

Contents

Instant Withdrawal

The primary aspect of the new feature is that it will allow the Paytm Payments Bank customers’ to instantly withdraw their deposits whenever they want and at anytime. Users do not need to pay any pre-closure or any other miscellaneous charges to withdraw their deposit.

Apart from the easy withdrawal feature, users will be able to earn up to 6.85 per cent annual interest on their fixed deposits. The fixed deposits will be auto generated, whenever the balance exceeds the Rs. 1 Lakh limit.

More Returns For Senior Citizens

If any customer becomes a senior citizen before the maturity period, or is a senior citizen, the deposit will be auto-renewed under the senior citizen scheme. Senior Citizens are enrolled to get at least 8 percent interest on fixed deposits, and if any customer turns sixty before maturity, or is a senior citizen, will earn higher interest.

Zero Paperwork, Instant Redemption & No Charges

According to Paytm Payments Bank, Indians prefer safer investment options that higher earning potential. Paytm Bank will offer the convenience of zero paperwork, instant redemption and no charges for one of most preferred investment options in the country.

Unlike other conventional banks, you don’t need to go through all the hassle, and can easily fix your money to earn an internet upto 6.85 percent.

Paytm Ka ATM

Paytm Payments Bank also recently unveiled the ‘Paytm Ka ATM‘ outlets, where customers can now open savings accounts as well as deposit or withdraw money.

The outlets from Paytm will play a vital role in bringing offline banking access to the smaller cities and towns by ensuring that customers find it convenient to locate an access point near them. The ‘Paytm Ka ATM’ service will be enabled by another business correspondent network.

Offline Expansion

The Paytm Payments Bank is planning to add over 1 lakh ‘Paytm ka ATM’ banking outlets across the country to expand their services and reach of their banking to the entire nation.

With Paytm’s commitment of Rs. 3,000 crore over the period of next three years, the payments bank will work to expand their offline presence and enlarge their distribution network by allowing more trusted local partners to act as their potential cash-in and cash-out points.

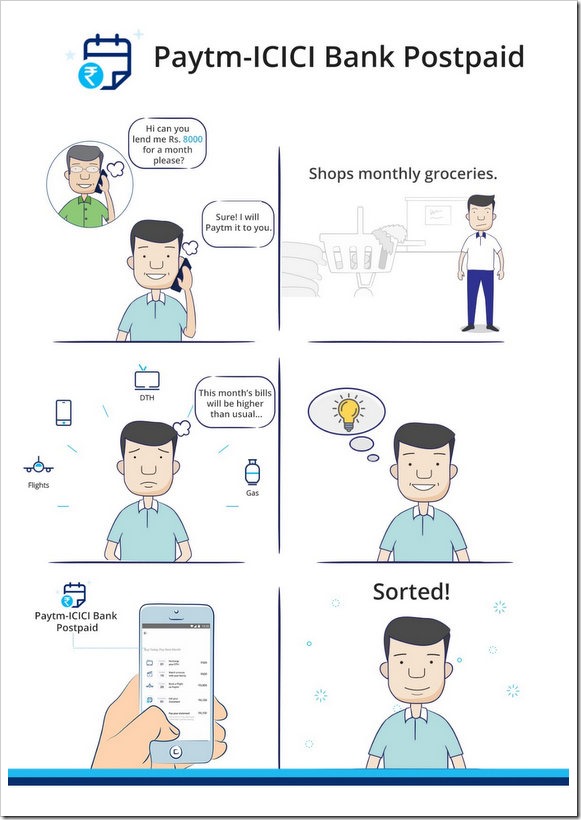

Paytm Postpaid

Paytm has started offering short term instant credit loans in association in ICICI Bank. ICICI Bank users can get an interest-free short-term digital credit loan and use it for to pay for movies, bill payments to flights to physical goods. Paytm-ICICI Bank Postpaid does not require any documentation or to visit any bank branch. Plus, there are no transaction or joining or hidden administration charges

Partnering with the conventional banks like IndusInd Bank and ICICI Bank, Paytm Payment Bank is further strengthening their digital payment space, with a hyperlocal model of banking. It will play a major role in enabling hundreds of millions of customers around the country to gain access to Paytm Payments Bank and its services.