IT Dept. Reminds That Cash Transaction Above Rs 2 Lakh Is Illegal; Asks Public To Report Such Cash Transactions

Income Tax Department has launched a fresh offensive against cash transactions, and illegal money.

In a widely circulated advertisement across almost all mainstream newspapers, Income Tax Dept. has reminded all about illegal cash transactions, and has asked the public at large to report such transactions.

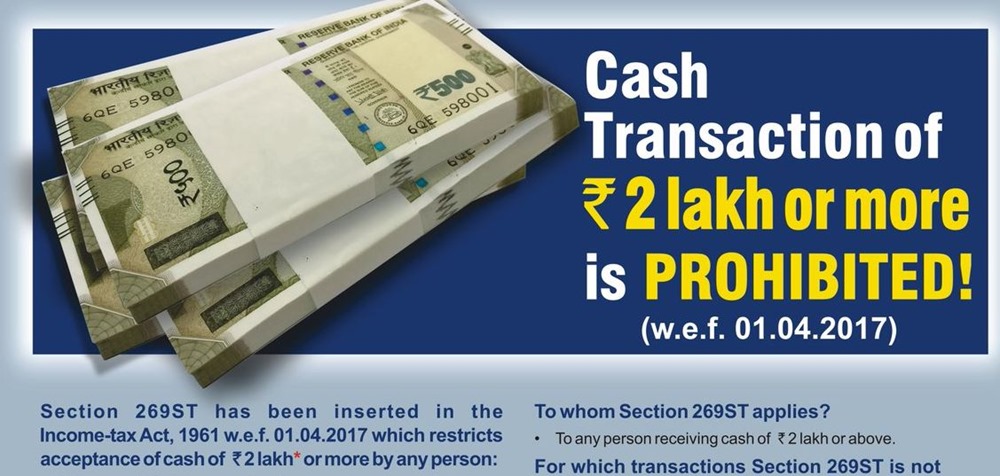

Cash Transactions Above Rs 2 lakh? It’s Illegal!

Income Tax Dept. has once again reminded all and sundry that any cash transaction above Rs 2 lakh is prohibited, and can amount to legal action.

And, they have requested the public to report such cash transactions by emailing at ‘[email protected]’.

The advertisement by IT Dept. across all newspapers mentioned Section 269ST of the Income Tax Act, which has been recently inserted in the Act and focusses on cash transactions above Rs 2 lakh.

Cash transaction of Rs.2 lakh or more is prohibited !

(w.e.f. 01.04.2017) pic.twitter.com/F2UYjNkvj5— Income Tax India (@IncomeTaxIndia) June 2, 2017

IT Dept. has minced no words when they said that a penalty of 100% would be levied, in case anyone is caught dealing with cash transactions above Rs 2 lakh. Hence, if anyone is caught transacting, for example, Rs 3.5 lakh in cash, then a fine of Rs 3.5 lakh would be implied.

The advertisement said, “Contravention of Section 269ST would entail levy of 100 per cent penalty on receiver of the amount,”

Newly created Section 269ST states that cash transaction above Rs 2 lakh is banned, in case the transaction happens on a single day, relating to an event or occasion from an individual.

The Ban On Cash Transactions – How Effective Is That?

Last year, Govt. had proposed a complete ban on all forms of cash transactions above Rs 3 lakh. Another proposal was muted, which makes Rs 15 lakh as maximum cash which any company can possess, at any given time.

Finance Minister had even mentioned this during the Budget presentation this year.

However, later, the limit on cash transactions was dropped to Rs 2 lakh, after considering its misuse by black money hoarders. This limit of Rs 2 lakh was cemented via an amendment in the Finance Bill 2017.

Note here, that this rule of Rs 2 lakh limit on cash transaction doesn’t apply for:

- Receipt by Government, for Govt. related tasks/tenders

- Banking company

- Post office savings

- Co-operative banks (where maximum misuse is reported)

The tax amnesty scheme: PMGKY (Pradhan Mantri Garib Kalyan Yojana) is still active, wherein black money hoarders can deposit their unaccounted cash, and pay 50% as tax and penalty, and come out clean.

Thru this comment I want to inform Income Tax department that Rs 2 crore cash is lying in my stomach.Come catch me.