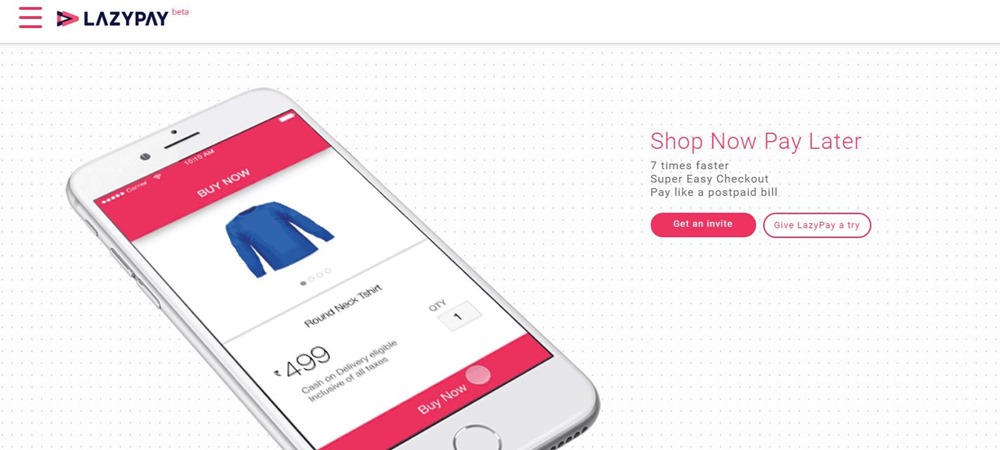

PayU Launches LazyPay; Buy Now, Pay After 15 Days!

Global payment gateway provider, PayU, has launched and interesting service for people in India. LazyPay, developed by PayU, now allows deferred payments by up to 15 days, in the same way, credit cards do.

“The risk associated with the transactions are different but you face the same tedious procedures. Micro transactions see transaction drops due to multiple hops from merchant to aggregator to bank/card gateway and back. At the PayU, we wanted to solve the problem of convenience for small value transactions. That’s why LazyPay was conceptualised and developed,” says PayU.

PayU has invested $50 million into this product and hopes to revolutionise the mobile wallet industry. It was first piloted in March 2017, but the product has now been officially launched in the market.

How does one use LazyPay?

At this point of time, LazyPay is applicable only on select merchants, and the company is expanding its reach. The product can be used only for cumulative transactions between Rs. 500 and Rs. 2,500. However, the credit line can be increased up to Rs. 10,000 depending on the spending behaviour of the customer.

Now, to use LazyPay, you need to either get an invite, from someone who is already using it. However, if you want to experience it, you can see a demo on the website that shows that the checkout time is extremely low so that you can delay your payment.

There is another way to get LazyPay. The risk associated with such payments is being captured by LazyPay’s algorithms at the back, that determine what customer should be allowed to use this service. When you request for an invite on their website, the company will check your online purchase and payment history to see if you’re eligible or not.

Once you have it installed, you can make transactions on the merchant side, and get some time off to make the payments. It is an equivalent to credit cards, but with a smaller due time. This will work extremely well with Indian buyers if modelled very well with Indian purchase behaviours.

How will it help customers?

Let’s say you want to purchase a book or a pair of sunglasses online and you’re out of cash in your mobile wallet. You can simply checkout from your cart using LazyPay and pay the merchant later.

LazyPay has partnered with 5 big merchants and 12 smaller ones including Zomato and Box8. The company has already approved 10 million users and hopes to acquire 5 million more. They also have a real-time debt write-off in place for miscreants.

LazyPay’s idea is similar to that of ‘Ola Credit’ and will attract a lot of customers. However, not everyone will be able to use it, which might, in turn, encourage users to improve their online transaction history. In a way, the ones that get to use it will love the deferred payment facility.

Source: ANI

Worst app, I was wrongly billed and wrongly charged ,

stupid lazypay concept its not much useful. no offers /discounts. unable to use the cash back amount and there is no proper support /response from their customer care.

Don’t use lazy pay, I was wrongly billed and wrongly charged and they have no bloody clue why. And their customer service is so fast my grandma died , reborn as child and started to walk but still no feedback from Lazypay.

its the worst app. do not even try. their payment url or bill desk doesnt work on the day of when outstanding it due. they’ll force you to pay late fee. 10 rs per day is huge interest. 15 days late mean 150 Rs of extra charge. Waste of time and waste of time. Moreover, their customer service is as lazy as their name. they dont bother to respond to your email and neither they receive calls.

Lazypay is the worst that is out there. Simplpay is 100x better. The penalty in case of late payments in lazypay is way to high, as high as 100x your actual bill whereas simplpay imposes only Rs.100 irrespective of your bill. Lazypay also has this annoying customer care who won’t stop calling. You will get at least 6 calls a day. Avoid using lazypay.

Lazypay is the worst that is out there. Simplpay is 100x better. The penalty in case of late payments in lazypay is way to high, as high as 100x your actual bill whereas simplpay imposes only Rs.100 irrespective of your bill. Lazypay also has this annoying customer care who won’t stop calling. You will get at least 6 calls a day. Avoid using lazypay. I’m not here promoting simplpay but comparing the two and I have used both of these services.

This Lazypay service will be very useful for customers with Debit card or Netbanking and who don’t have facilities such as delayed payment offered by Credit card.

But in reality, even for an invite their website asks for “Credit Card” details (it doesn’t have options for debit card or net banking etc). If one is having a credit card, then why he/she is going to use this “lazypay”? He/she will use the credit card and pay later as usual.

When you’re missing the target customers (debit card/netbanking holders) then your business is going to be doomed sooner or later.

If they’re going to offer this service only to credit card holders, what’s the use of this delayed payment service, when credit card is already offering more time for payments??!! I couldn’t understand.