SBI – Transforming into the Poster Boy of the Digital India Initiative

As a Marketing professional, I must say it was quite surprising to see this front page Ad on today’s newspaper.

It is rather startling to see State Bank of India taking strides in navigating to the digital world in a rather subtle but a sure shot way.

A few days back, the front page carried a full-page Ad on the Buddy App, which was launched in August 2015. A mainstream bank entering the mobile wallet space isn’t new, yet a public sector bank which is assumed to operate in its own pace giving direct competition to conventionally customer-focused Private banks really makes you wonder if the public sector is finally waking up.

Why this move?

To be very honest, with the steep increase in the millennial workforce, the only way to capture mindshare and market share is to tap this app user category. It won’t be surprising to see the under 25 working class of this country not even knowing the physical location of the bank they have their salary accounts in. With this being the case, it is a question of mere survival for any bank that wants to capitalize this huge segment of the market.

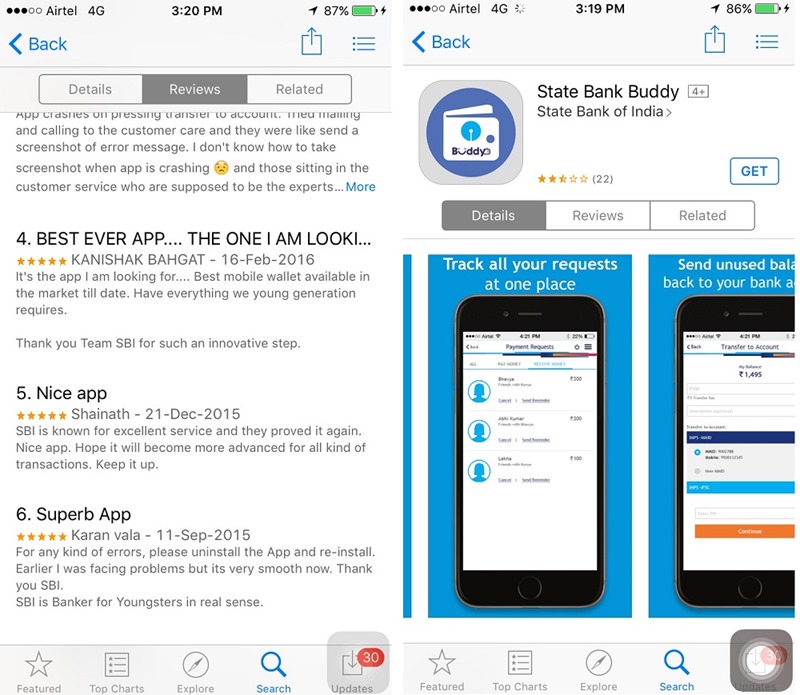

It wasn’t surprising for me to see many user reviews for the Buddy app which could potentially reach a large number of Indians even in far-flung areas who may not have the chance to bank with a HDFC Bank or an Axis Bank. Considering the massive presence of the State Bank of India, the way to reach out to the second and the third generation of families that have been its customers is to go digital.

With that said, it isn’t hard to reason they would focus all guns blazing on capturing the millennial market share and are seeing considerable success due to the following reasons:

- Money transfer between non-SBI account holders is possible

- Transferring money back to the account is possible too

- One can request money to another person through the Ask Money feature

- Transactions such as Recharge, shopping etc. can be done cashless through the Buddy app

What can be better done?

a. Partnerships – Developing partnerships with public sector companies like Electric Board etc. where bills can be paid cashless through the app

b. Discounts – PayTM, PayUMoney etc. are immensely popular due to the discounts that end users get through transacting with them. Buddy needs to be a buddy to the end-user’s pocket too

c. User Interface – All said & done, if one decides to go the app way, they better take the due diligence to ensure a great User Interface. A sucky app UI on an iPhone simply doesn’t strike the right chord

d. Leverage on its strengths – One of the biggest advantages of the app is its already existing huge customer base which other apps do not have. So, to have a referral program with rewards attached can drive adoption rates

The focus is extremely right. If they get their direction right, there’s nothing that can stop them from practically monopolizing the entire millennial banking population.

If they’re so good, how about changing to BITCOIN? THEN I will feel that the “public sector is waking up”……

Haha! I can understand the point between your lines. That’s a decision the Bank has to take. :) I have presented just an opinion.