Whoa! Now Open A Bank Account in Minutes Through Just a Mobile App!

Technology has made the world an easier place. From having cut down queues at various organisations, to bringing your fund transfers at your fingertips, it just doesn’t seem to stop. With a new app to open a bank account, the busy lives of the generation are being put to some more ease.

For the first time in the history of Indian banking, Federal Bank has launched a Mobile App for Bank Account Opening. The App was jointly launched by CA. Nilesh Shivji Vikamsey, Chairman, Federal Bank, and Mr. R Venkataraman, Managing Director, IIFL.

Two years ago when it launched FedBook, its e-Passbook App, it was a hit amongst the users. What a better way to keep a track of your bank transactions just on the go- and just so handy that you did not have to dig in the lockers for your passbook and then again to reach out to the pen to make physical data entries. Federal Bank has consistently pioneered product innovations.

In an upgrade to their older version of FedBook, Federal Bank has launched this facility, which has set the eyeballs rolling. With the new avatar of FedBook, anyone having an Aadhaar Card and PAN Card, be it from rural or urban centres, rich or poor, youth or aged, can now open a Savings Bank Account and get their Account Number instantly using a mobile from anywhere at any time.

Further, the account can also be funded with an initial remittance through online fund transfer up to a maximum amount of Rs. 10000. The App is currently available on Android and iOS phones and will soon be available in windows and blackberry phones.

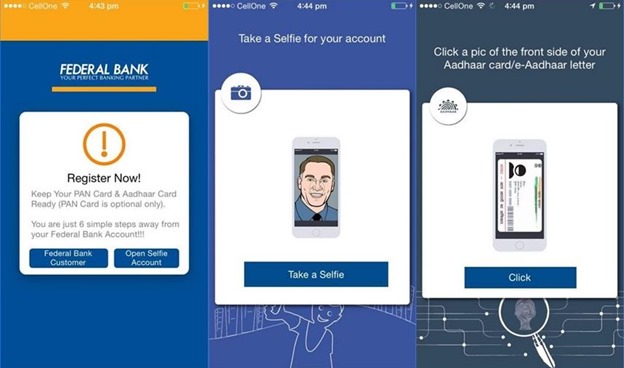

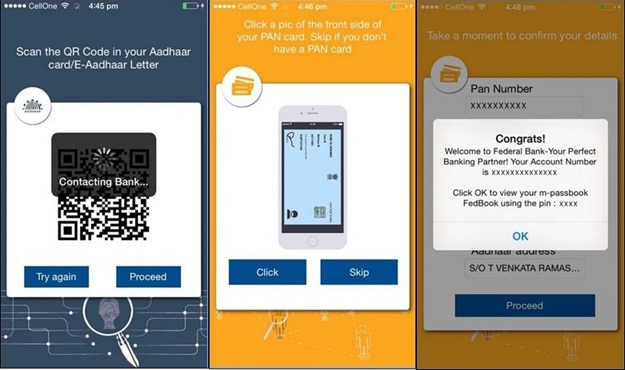

3 easy steps to open an account on the app

- Take a selfie

- Scan your Aadhaar card

- Scan your PAN card

And voila! You’re done!

The app will now do its job of verifying your Aadhar and will open an account for you at the click of a button. Once you open an account, the app will turn into a digital passbook.

To make India a digital place, no stone is being left unturned. Aadhar can be probably looked upon as the need of the hour, in a country, which needed a dozen full of Xeroxed, documents for the smallest of legalities. Not to forget the queues of the populous and the longest of procedures in the country with the longest constitution.

Mr. K A Babu, Head Retail Business, said, “In a country with a fast growing smart phone population, Mobile solutions are going to revolutionize the way India banks. Through this pioneering solution we are aligning ourselves with the nation’s digital ambitions, and by facilitating the opening of a Bank account with ease using a smart phone, the Bank has added a new dimension to digital banking. We are sure that the upgraded Fedbook will take us towards the larger digital audience and change the way Indians open a Bank account”.

Now, given that you don’t need to go to the bank to transfer money-you can transfer funds, fix your deposits or even break them on the app- you can withdraw money from the ATM- and now that you can even open an account at a tap- do you think Mobile Banking will make your local bank a museum very soon?

When was the last time you visited a bank?

Leave your comments below!

Appreciated the growth of the bank in to new generation Digital banking.

I would like to take this opportunity to remind you one of the important service you are standing much behind than other bank is TIME TAKING FOR ADDING BENIFICIERY on ONLINE BANKING.. only your bank required 24hr time for benificiery adding. where as even SBT SBI like govt banks only need 4 hrs maximum .

I hope most of the potential customers are NRI’s. NRI have practical difficulty to visit branch and do transaction or sending a physical cheque leaf to kerala are FACING difficulty due to this 24HR waiting system.

Hi,

Amazing Federal bank app. And i using my NRI account wit app

Yes…its a Zero balance account with lot of additional facilities such as Gold ATM card,nil ledger folio charges etc…

By any chance do you know the minimum balance which should be maintained in the account? or is it a Zero balance account ?

Zero balance account.